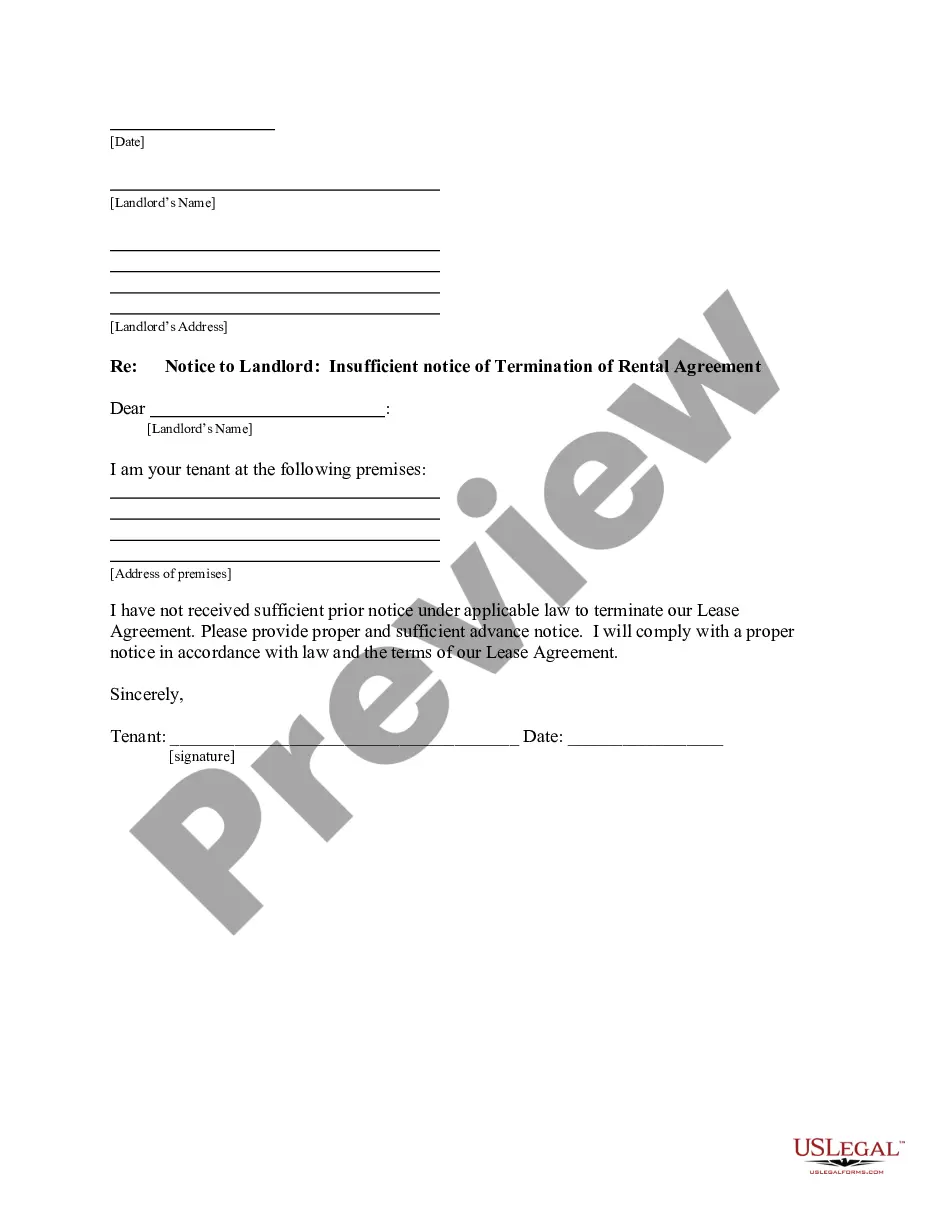

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Refund Of Overpayment In Philadelphia

Description

Form popularity

FAQ

If you wish to request a refund or appeal an assessment or determination, a petition must be filed with the Board of Appeals. You can file a petition electronically at the Online Petition Center.

If you disagree with the IRS letter, gather whatever evidence you have to support your argument. Either call the phone number on the letter or prepare a response letter. If you reply in writing, attach copies of whatever proof you have.

The letter you received is most likely a Notice of Assessment, which is a document that the DOR sends to taxpayers when they determine that there is a deficiency or an overpayment of tax. A Notice of Assessment may be issued for various reasons, such as:

Wage Tax refund requests can be submitted through the Philadelphia Tax Center, including for salaried or commissioned employees. If you requested a refund on your return, you do not need to fill out these forms. To request a refund, once in the Philadelphia Tax Center, you need to know your FEIN, SSN, or PHTIN.

You do not need a Philadelphia Tax Center login to respond to most letters. On the website's homepage, find the "Submissions" panel, and select "Respond to a Letter." Next, enter the Letter ID, which can be found on the top right corner of your letter.

In case of refund failure, taxpayer can raise the service request in e-Filing portal upon receiving communication from CPC. Go to Services ' menu and click on 'Refund reissue'. Create Refund Reissue request. You will get the details of Assessment Year for which refund got failed.

Mailed documents take longer to process than information sent electronically. Processing can take about six weeks to enter into the system. Then, it takes an additional three to four weeks for review. After review, it takes an additional three to four weeks for you to receive a refund check.