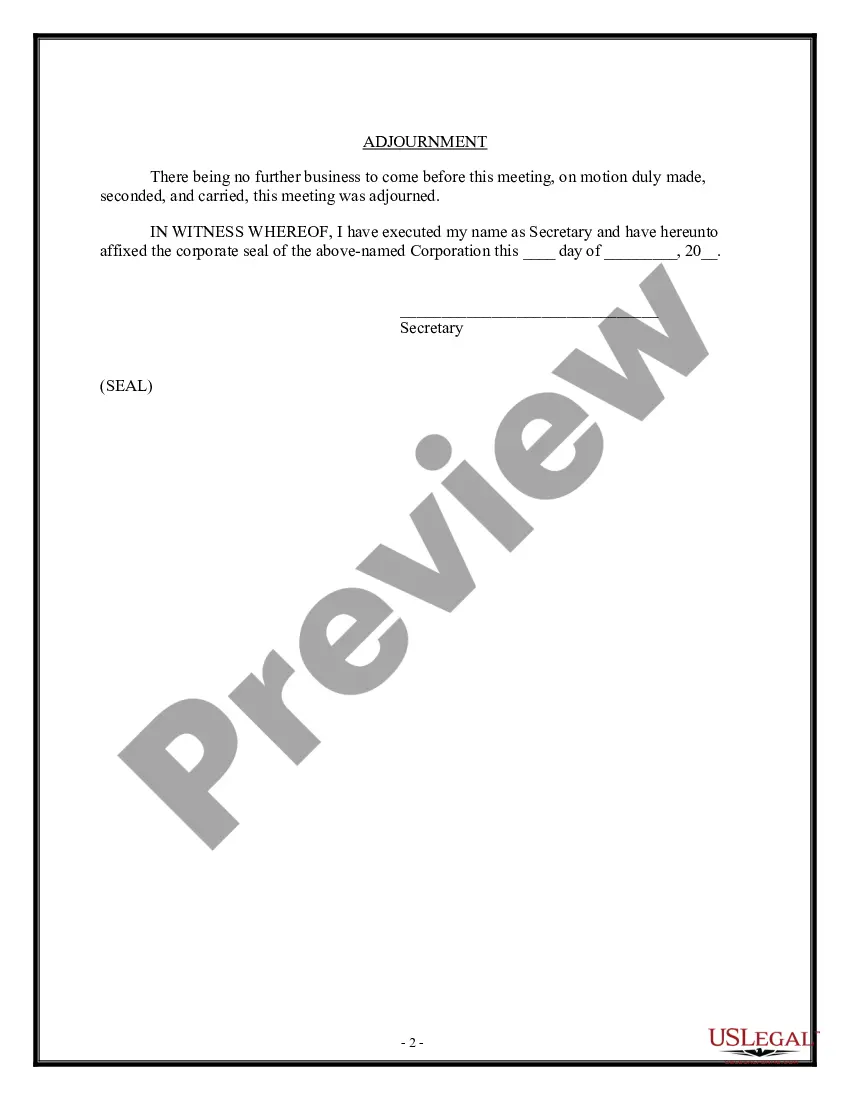

Form with which the stockholders of a corporation record the contents of a special meeting.

Asamblea Acta Withouta In New York

Description

Form popularity

FAQ

The notice must run once a week for six weeks and include a number of facts concerning the company and its formation. If an LLC doesn't fulfill the publication requirements, the company's authority to do business in New York can be suspended.

New York doesn't administratively dissolve LLCs. Even if you stop doing business in New York, your LLC will remain active and in existence until you take steps to dissolve it. If you voluntarily dissolved your LLC but want to get it back into business, you'll have to start over and form a new New York LLC.

A corporation or LLC that fails to file its Biennial Statement will be reflected in the New York Department of State's records as past due in the filing of its Biennial Statement.

New York Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

As a foreign corporation, you are required to register with the Department of State if you are "doing business" in the State of New York. Note: Foreign corporations are not required to have a physical office or a registered agent located within the jurisdiction of New York.

Domestic and foreign business corporations are required by Section 408 of the Business Corporation Law to file a Biennial Statement every two years with the New York Department of State.

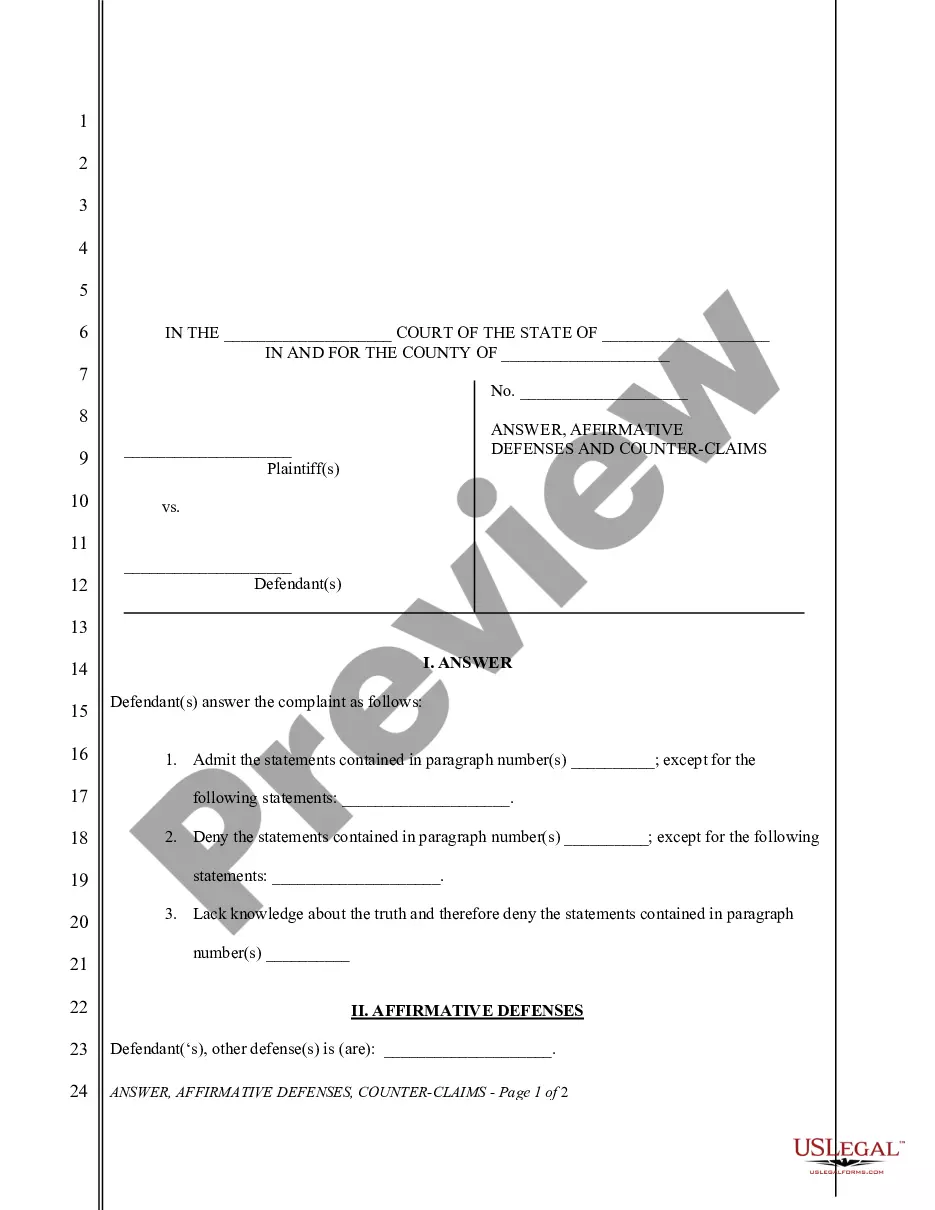

Effective January 1, 2024, notarized affidavits are no longer required for most sworn statements submitted in New York state court. No longer limited to lawyers and doctors, court-filed affirmations are now permissible from any witness.

How to Start a Nonprofit in New York Name Your Organization. Choose a New York nonprofit corporation structure. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records.

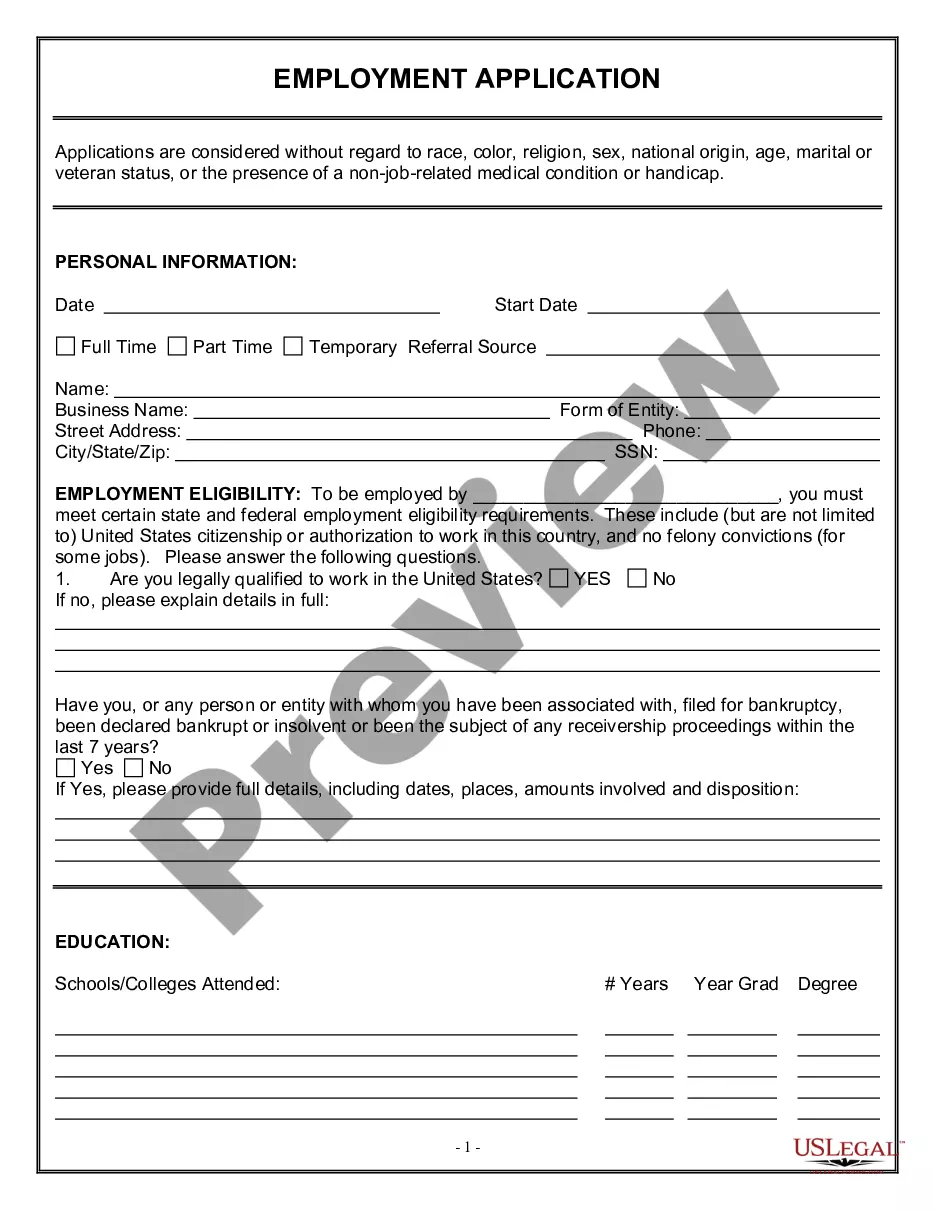

In New York, the new hire paperwork collection looks similar to that of other states: I-9 employment eligibility verification form (not required for volunteers, independent contractors, or unpaid interns) W-4 federal tax collection form. IT-2104 New York state tax withholding form.

Documents required for new employee: Proof of Identity: Typically, this involves a government-issued ID such as a passport or a national identity card. Proof of Eligibility to Work: Depending on the country, this could be a work permit, visa, or a document like the Social Security card in the USA.