Publication 783 With Scope For Sale In Bexar

Category:

State:

Multi-State

County:

Bexar

Control #:

US-00110

Format:

Word;

Rich Text

Instant download

Description

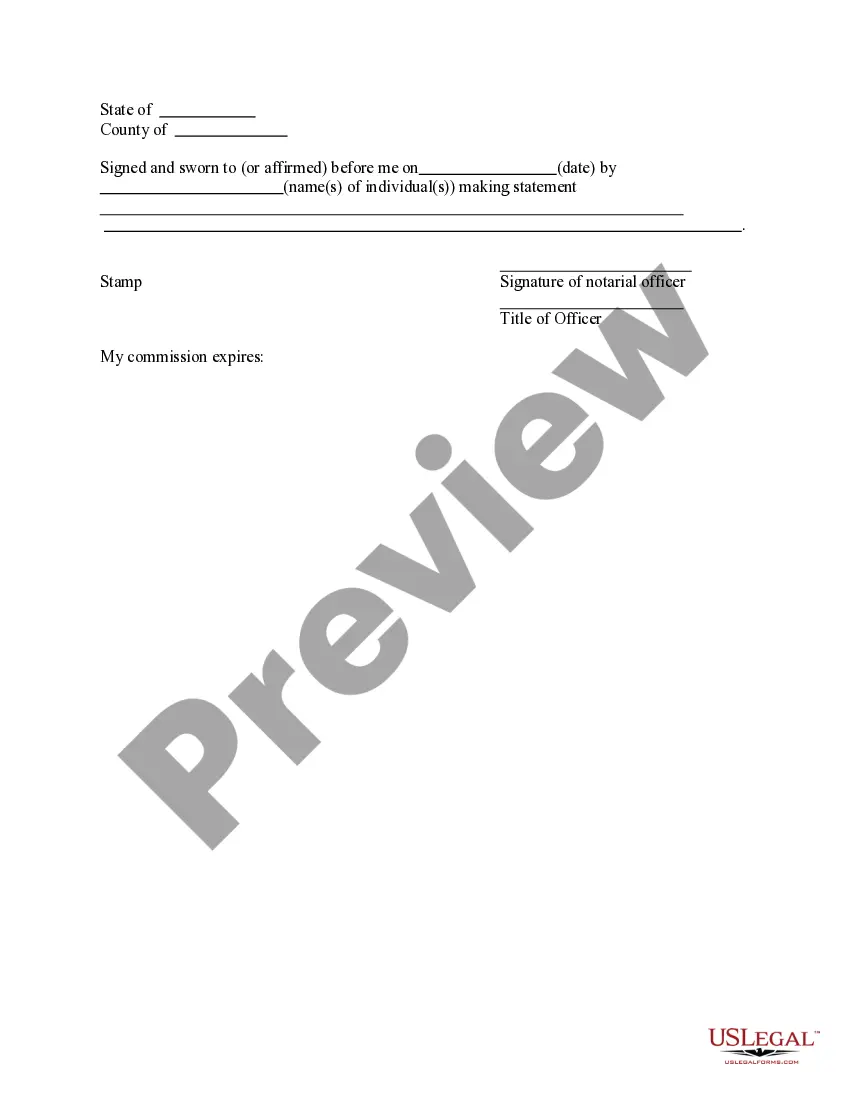

Publication 783 with scope for sale in Bexar is a crucial document that facilitates the application for a certificate of discharge from a federal tax lien. This form helps individuals, particularly attorneys, partners, owners, associates, paralegals, and legal assistants, navigate the process of mitigating tax liens on property. Key features include requirements for detailed property descriptions, the tax payer's relevant information, encumbrance listings, and appraisals to establish property value. Users must provide specific details about the property, including its location, existing liens, and costs associated with sales or transfers. When filling out the form, it's essential to attach various documents such as notices of federal tax lien and evidence from appraisers if private sales are involved. Legal professionals can utilize this form in cases of property sales, ensuring that lien-related issues are addressed and resolving potential legal complications. Additionally, clear instructions on payment and condition for release of liens make it user-friendly, aiding those unfamiliar with legal terminology. Overall, Publication 783 serves as a vital resource in Bexar for managing federal tax lien discharges.

Free preview

Form popularity

FAQ

Proper handling of the notice of lien is extremely important. Generally the IRS can pursue collection of a tax liability up to 10 years from the date it was assessed. A Notice of Federal Tax Lien may be filed any time within that 10-year period.

How Can a Taxpayer Request a Discharge of an IRS Tax Lien? You need to submit form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien at least 45 days before the sale or settlement meeting. Publication 783 provides the instructions for completing form 14135.