This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Publication 783 For 2023 In Clark

Description

Form popularity

FAQ

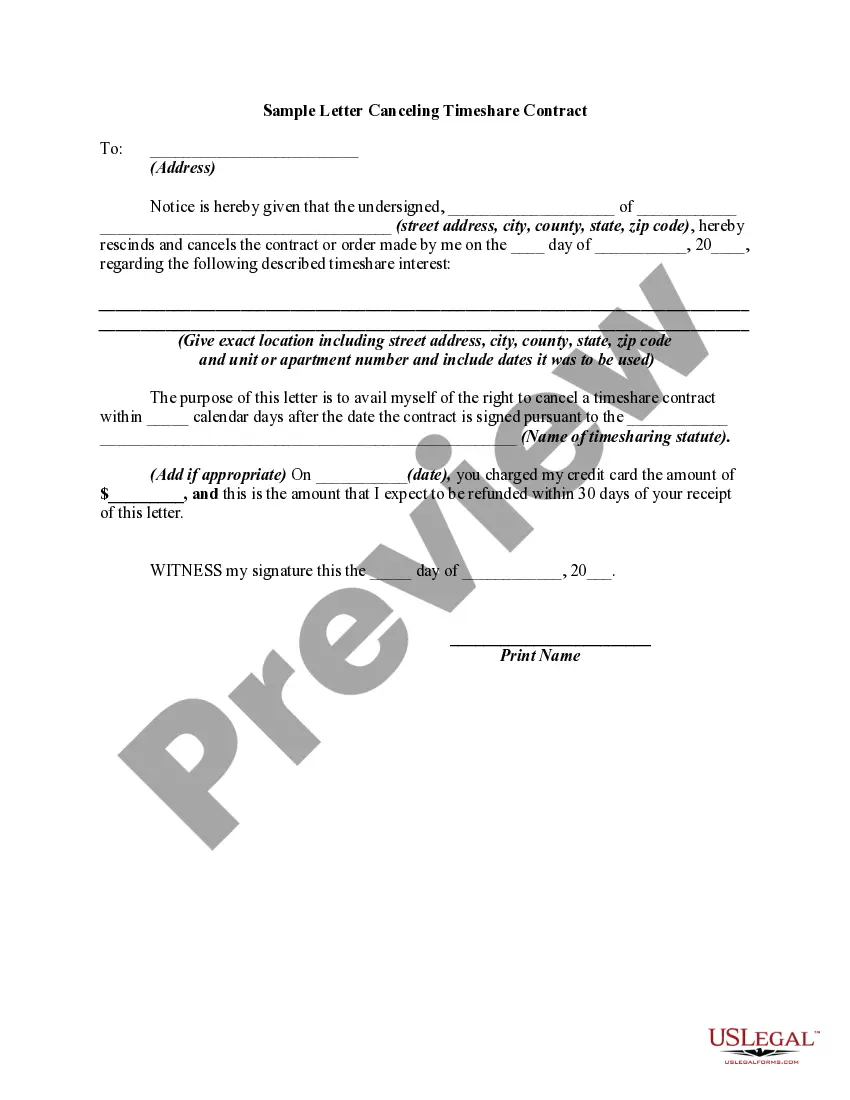

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.

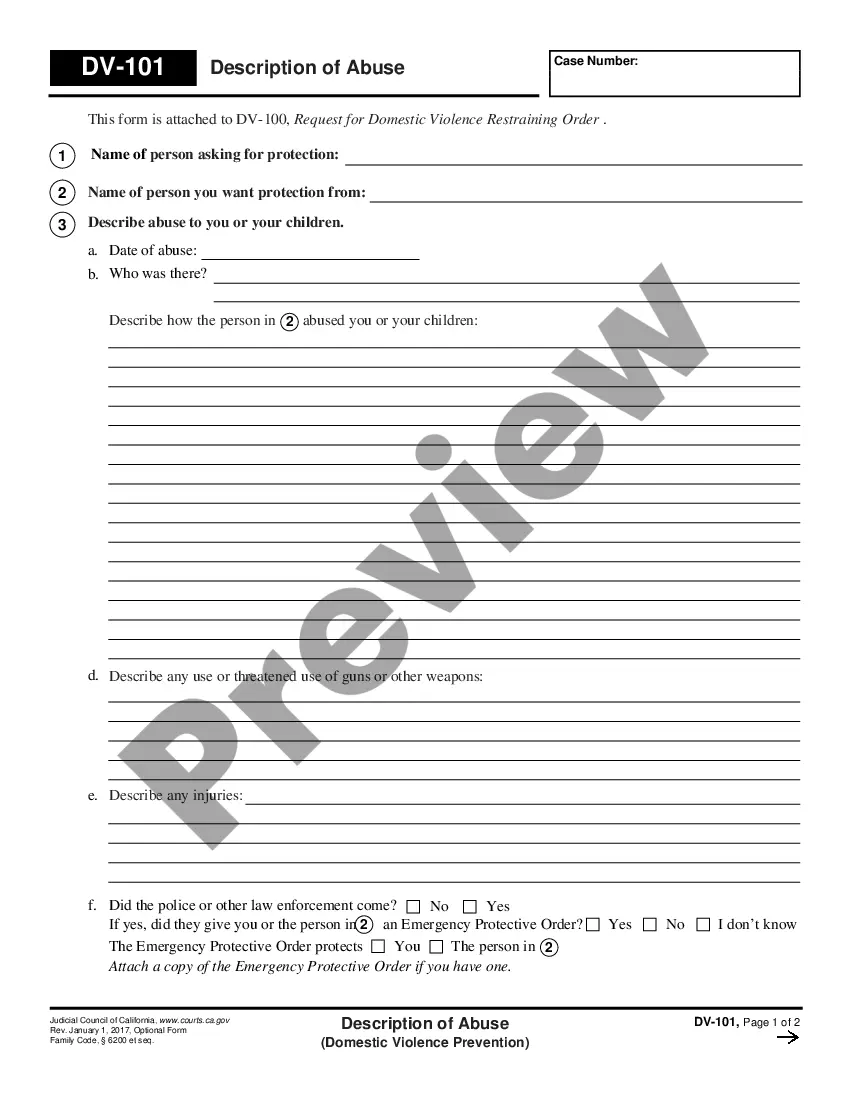

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

IRS & State Tax Attorney Resolving Tax Debt… You're absolutely able to sell property that is subject to an IRS lien.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

To get a copy, visit the IRS web site at .irs under the “Forms and Pubs” section. It can be accessed directly at ftp.fedworld/pub/irs- pdf/p17. pdf. Or it can be ordered by calling 1-800-829-3676.

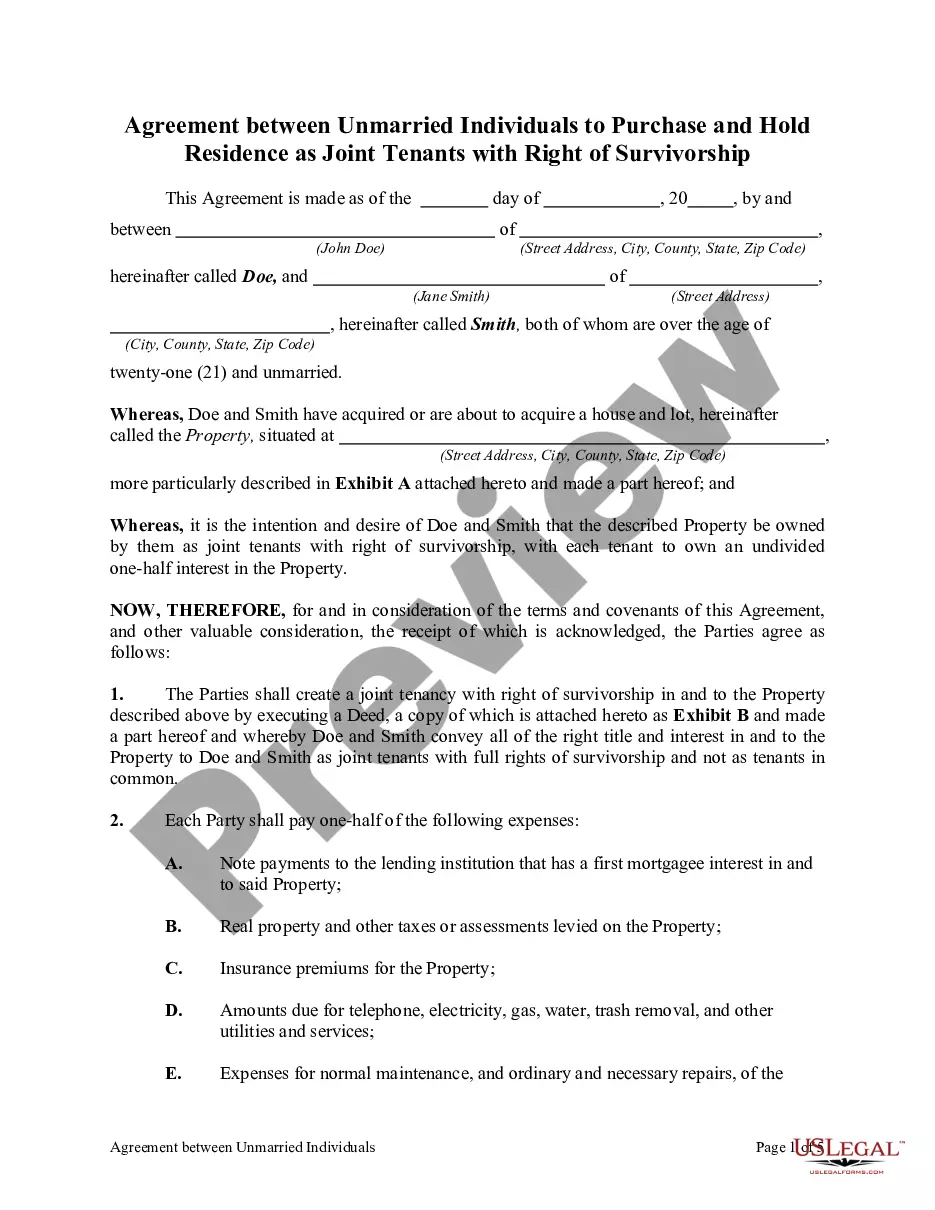

Complete Form 14135, Application for Certificate of Discharge of Federal Tax Lien attached with this publication.

4 ways to search for UCC and federal or state tax liens Use a dedicated lien search tool. Search business records at a state Secretary of State office. Look for liens on a state or county recorder's office website. Get a list from the IRS via a Freedom of Information Act request.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.