This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Publication 783 For 2023 In Contra Costa

Description

Form popularity

FAQ

City: LocationRateType Contra Costa County 8.750% County Corcoran 8.250% City Corning 7.750% City Corona 8.750% City104 more rows

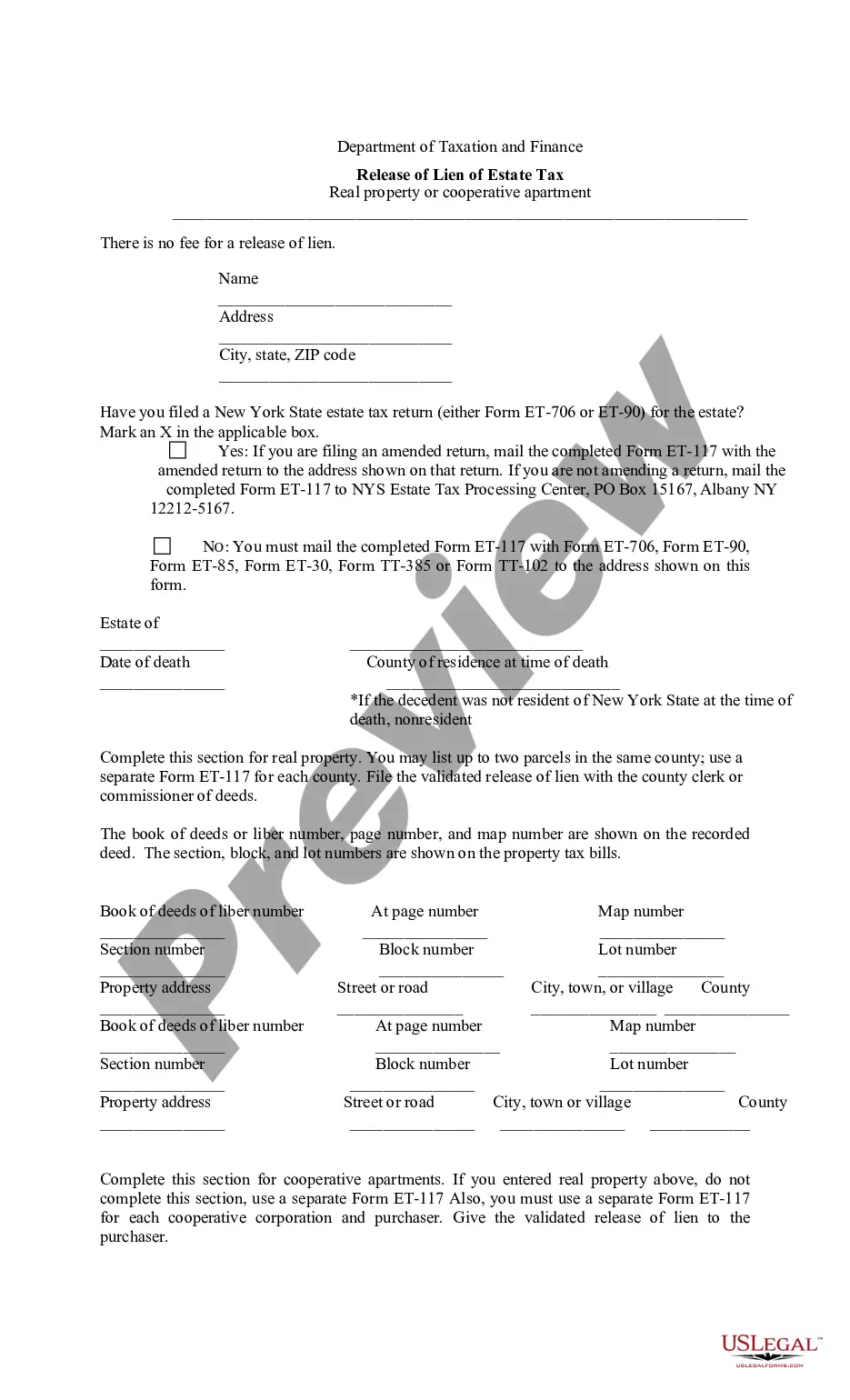

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

The IRS withholding lock-in letter cannot be removed once issued and can only be modified when the employee has shown compliance with the lock-in letter for three years.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

Five Steps to Removing an IRS Tax Lien From Your Credit Report Step 1: Complete IRS Form 12277. Step 2: Send Form 122277 to the IRS. Step 3: Wait for response from IRS. Step 4: Dispute the lien with the Credit Reporting Agencies. Step 5: Final confirmation.

The state tax lien attaches to all property and rights to property, belonging to the taxpayer and located in the State of California (Gov. Code section 7170(a)). A state tax lien continues in effect for ten years from the date of its creation unless it is released or discharged.

You might also remove a judgment lien from your property by filing for bankruptcy. Bankruptcy may allow you to avoid or discharge the judgment debt and thereby remove the lien from your property. Finally, you may have the option to remove the lien by seeking a court ruling that invalidates the lien.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

Visit the Forms, instructions & publications page to download products or call 800-829-3676 to place your order.