Debt Settlement Letter Sample With Bank In Clark

Description

Form popularity

FAQ

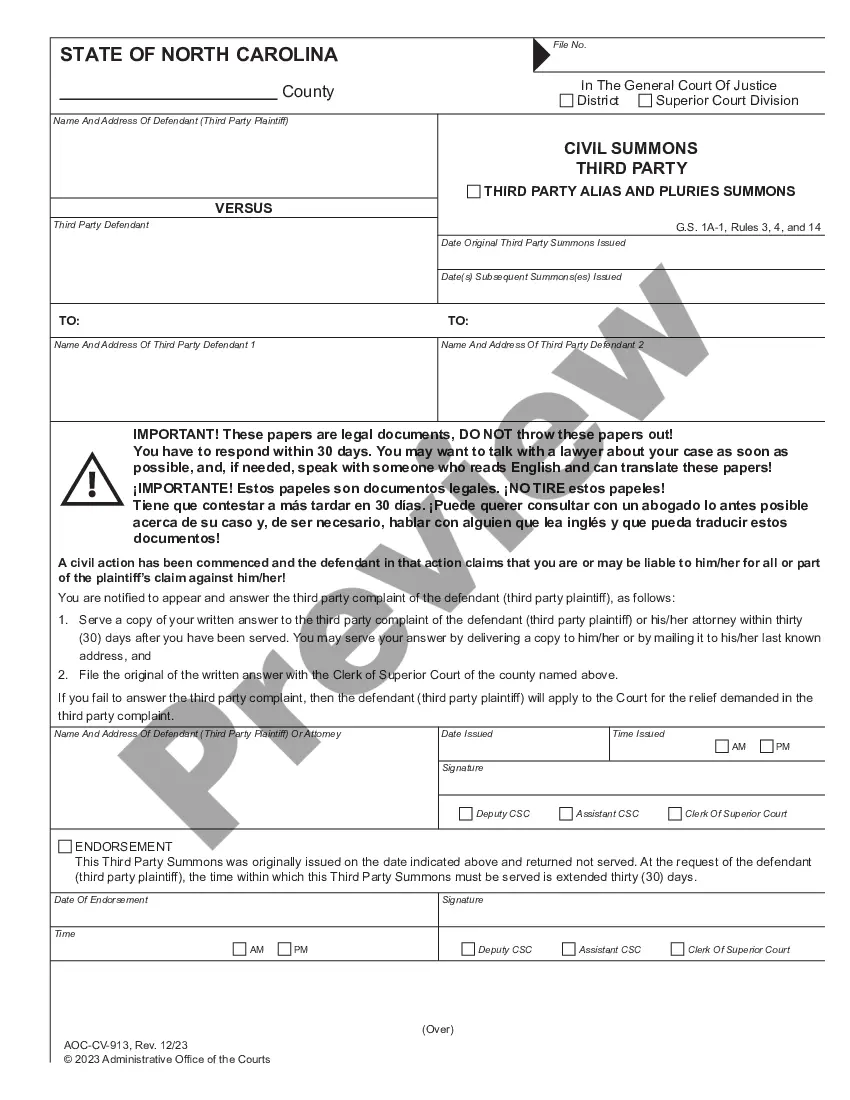

It's important to respond to (or answer) the lawsuit. You do this by filing official paperwork with the court. Be sure to address every point in the complaint, raise any defenses you have, and file the paperwork within the time frame provided.

Settlement Letter - Confirms the amount to settle debt up to a specified date. Letter of Indebtedness - Confirms the amount owed to date as of the letter's date. Letter of Non-Indebtedness - Confirms no outstanding debt.

In some instances of serious financial hardship, your lender or credit card provider may be willing to settle your outstanding balance for less than what you owe — provided you can offer them a large lump-sum payment.

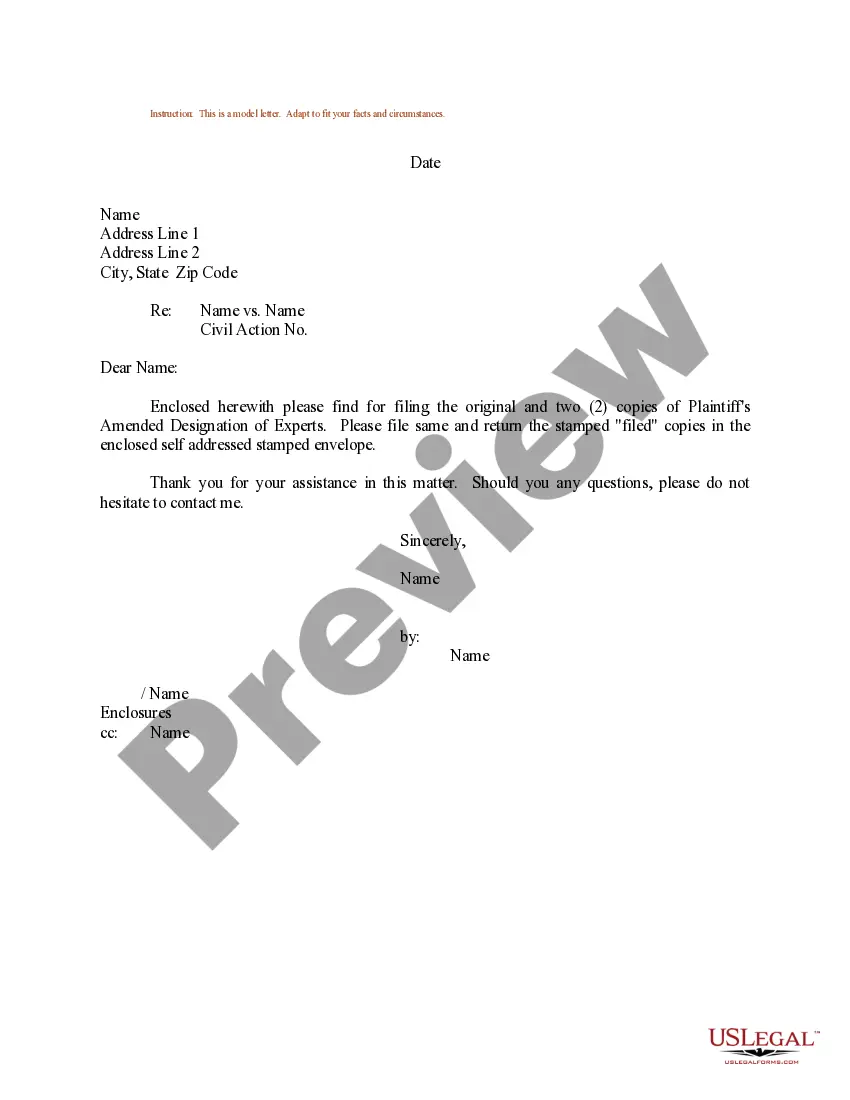

Explain your circumstances and propose a settlement amount. The lender might counteroffer, and the goal is to reach a mutually agreeable amount. 4. Get It in Writing: Once a settlement amount is agreed upon, ensure you receive a written agreement from the lender.

Tip for Drafting an Effective Settlement Letter Be concise. Your letter might be 20-30 pages long if your claim is complex. Be organized. Reread your letter to make sure you haven't said anything that the opposing party can twist around to use against you. Be polite and professional.

No, there's no way you can get the bank to forgive the debt.

In some instances of serious financial hardship, your lender or credit card provider may be willing to settle your outstanding balance for less than what you owe — provided you can offer them a large lump-sum payment.

Talk to your bank to find out what your options are if you have debts with them. They may be able to: Separate any overdrafts from your existing account. Set up a new 'clean' basic bank account for you.