This form is a sample letter in Word format covering the subject matter of the title of the form.

Debt Settlement Letter Sample With Credit Card In Utah

Description

Form popularity

FAQ

In Utah, for most debts, a creditor has six years to take legal action on that unpaid debt. After the statute of limitations expires, a creditor or debt collector can no longer sue you for the debt.

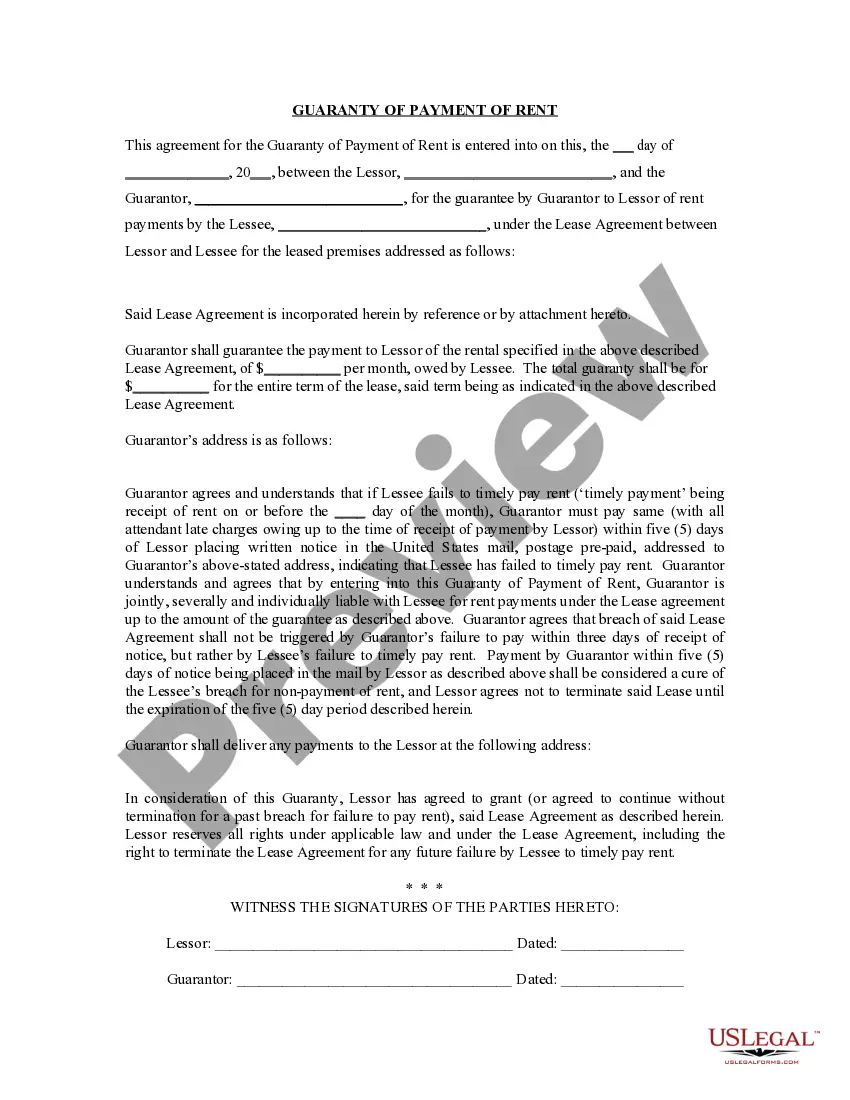

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

The 7-in-7 rule, established by the Consumer Financial Protection Bureau (CFPB) in 2021, limits how often debt collectors can contact you by phone. Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt.

In Utah, for most debts, a creditor has six years to take legal action on that unpaid debt. After the statute of limitations expires, a creditor or debt collector can no longer sue you for the debt.

An unsecured debt might be statute barred if any of the following has not occurred in the past 6 years (or 3 years for the Northern Territory): You have not made a payment. You have not acknowledged the debt in writing. No court judgment has been entered against you.

Credit Card settlement is an agreement with your Credit Card issuer to resolve your debt by paying a reduced amount. The process involves negotiating a lump sum payment less than the total balance, either on your own or with a debt settlement company.

Keep in mind that making a partial payment or acknowledging you owe an old debt, even after the statute of limitations expired, may restart the time period.

This is a type of offer where you ask the creditor to accept part of the amount you owe and write off the rest. You can find information about how to use this letter in our guide Full and final settlement offers. You can choose to send a letter in your own name or in joint names.

Tip for Drafting an Effective Settlement Letter Be concise. Your letter might be 20-30 pages long if your claim is complex. Be organized. Reread your letter to make sure you haven't said anything that the opposing party can twist around to use against you. Be polite and professional.

What things should be included in the Full and Final Settlement Letter? Settlement Amount: Clearly state the finalized amount to be settled. Settlement Cheque: Provide details regarding the issuance of the settlement cheque. Resignation/Termination Date: Specify the date on which the employee resigned or was terminated.