Private Property With Examples In Cuyahoga

Description

Form popularity

FAQ

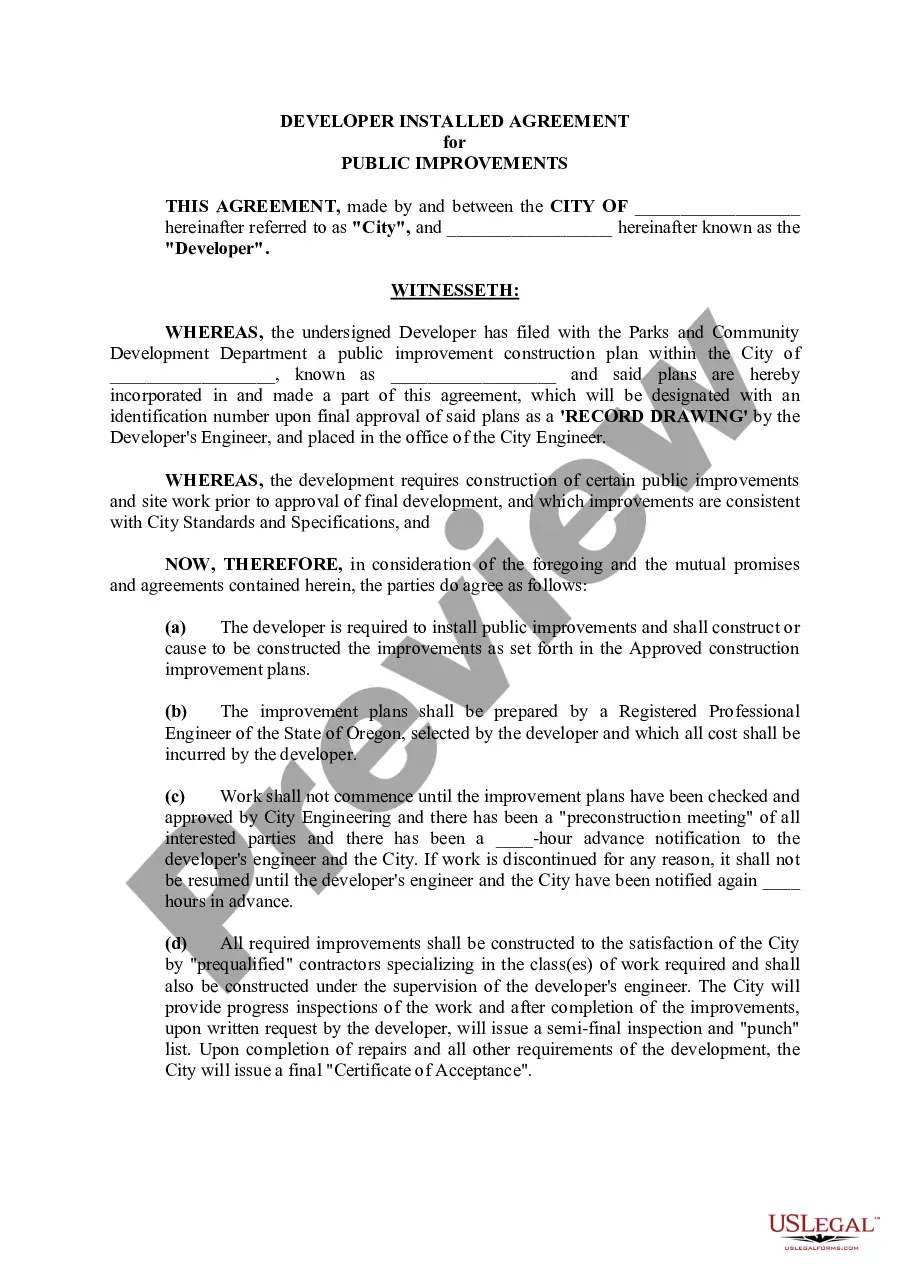

Document Formatting Requirements (9) A one and one-half-inch margin of blank space across the top of each of the remaining pages of the instrument or document to accommodate any certification or endorsement of the county engineer, county auditor, or county recorder, as may be required by law.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own. Find a copy of your deed. Complete the TOD for real estate form. Take the form to a notary. Submit the form at your County Recorder's Office.

(A) The transfer of a deceased owner's real property or interest in real property as designated in a transfer on death designation affidavit provided in section 5302.22 of the Revised Code shall be recorded by presenting to the county auditor of the county in which the real property is located and filing with the ...

Unless you have a complex situation or have specific concerns, you likely won't need a lawyer to create a TOD deed. But you will need to make sure that the TOD deed you make is valid in your state, since each state's rules are a little different.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own. Find a copy of your deed. Complete the TOD for real estate form. Take the form to a notary. Submit the form at your County Recorder's Office.

Deeds and additional ownership documentation (circa 1810 to present) is available online or in person at the Recorder's Office, located on the 4th floor of the Cuyahoga County Administration Building. Circa 1860-1945, available at the Cuyahoga County Archives.

The mission of the Cuyahoga Land Bank is to strategically acquire properties, return them to productive use, reduce blight, increase property values, support community goals and improve the quality of life for county residents.

The average effective property tax rate in Ohio is 1.41%. However, tax rates vary significantly between Ohio counties and cities. The highest rates are in Cuyahoga County, where the average effective rate is 2.51%. The county with the lowest rate is Lawrence County, which has an average effective rate of 0.86%.

Private property refers to the ownership of property by private parties - essentially anyone or anything other than the government. Private property may consist of real estate, buildings, objects, intellectual property (copyright, patent, trademark, and trade secrets).

Private property is a legal designation for the ownership of property by non-governmental legal entities. Private property is distinguishable from public property, which is owned by a state entity, and from collective or cooperative property, which is owned by one or more non-governmental entities.