This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property For Sale In Sacramento

Description

Form popularity

FAQ

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

California's property tax rate is 1% of assessed value (also applies to real property) plus any bonded indebtedness voted in by the taxpayers.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings. These are considered to be real property.

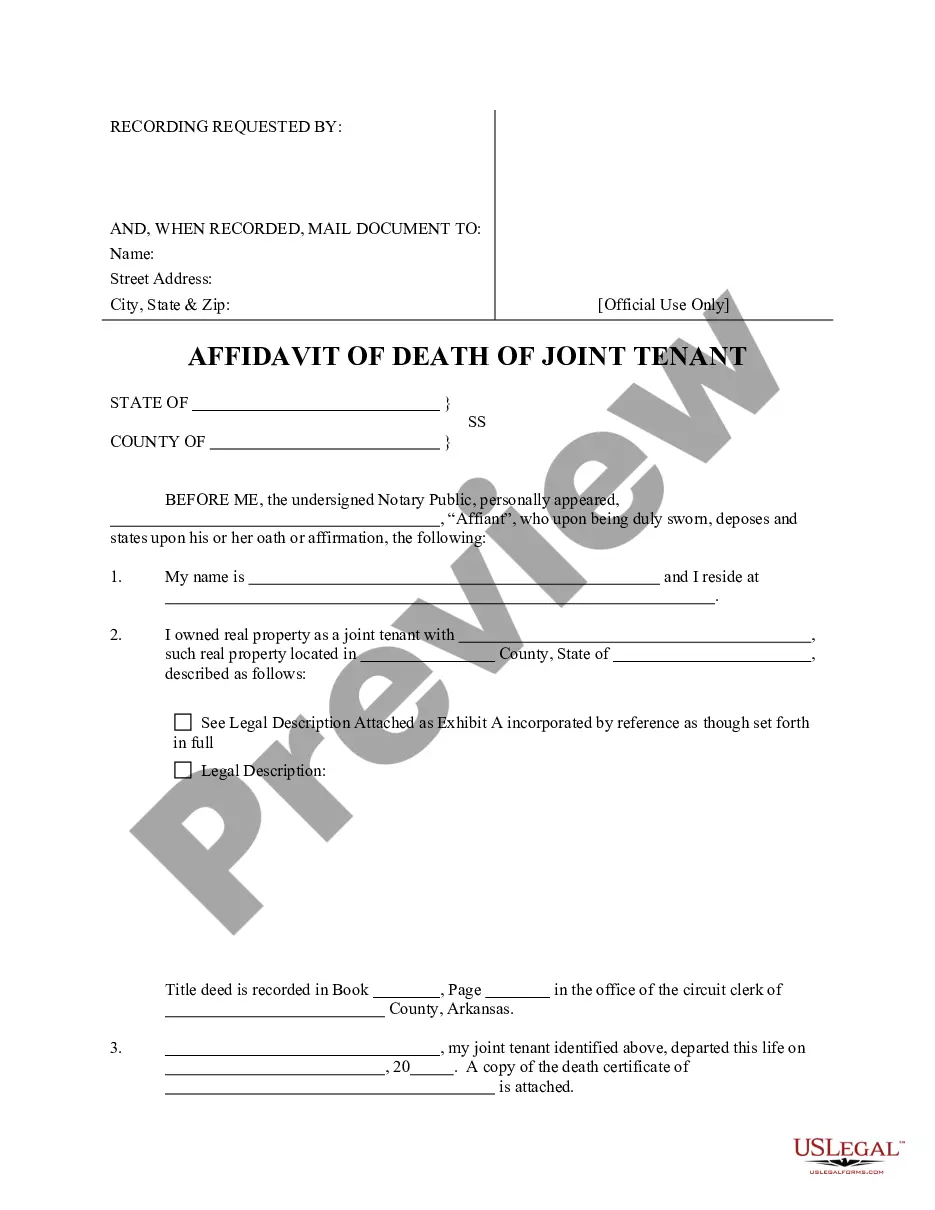

What's Included in an Affidavit for Collection of Personal Property? The name of the person who died. The date and location of the death. That 40 days have passed since the death. That probate has not been initiated. That the estate value does not exceed $166,250. A description of assets to transfer. Names of other successors.

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.

Yes, in addition to Title 40 of the U.S. Code the sale of Federal personal property is governed by other statutory requirements, such as the Debt Collection Improvement Act of 1996 (Public Law 104-134, sec. 31001, 110 Stat. 1321-358) and antitrust requirements that are discussed in §102-38.325.