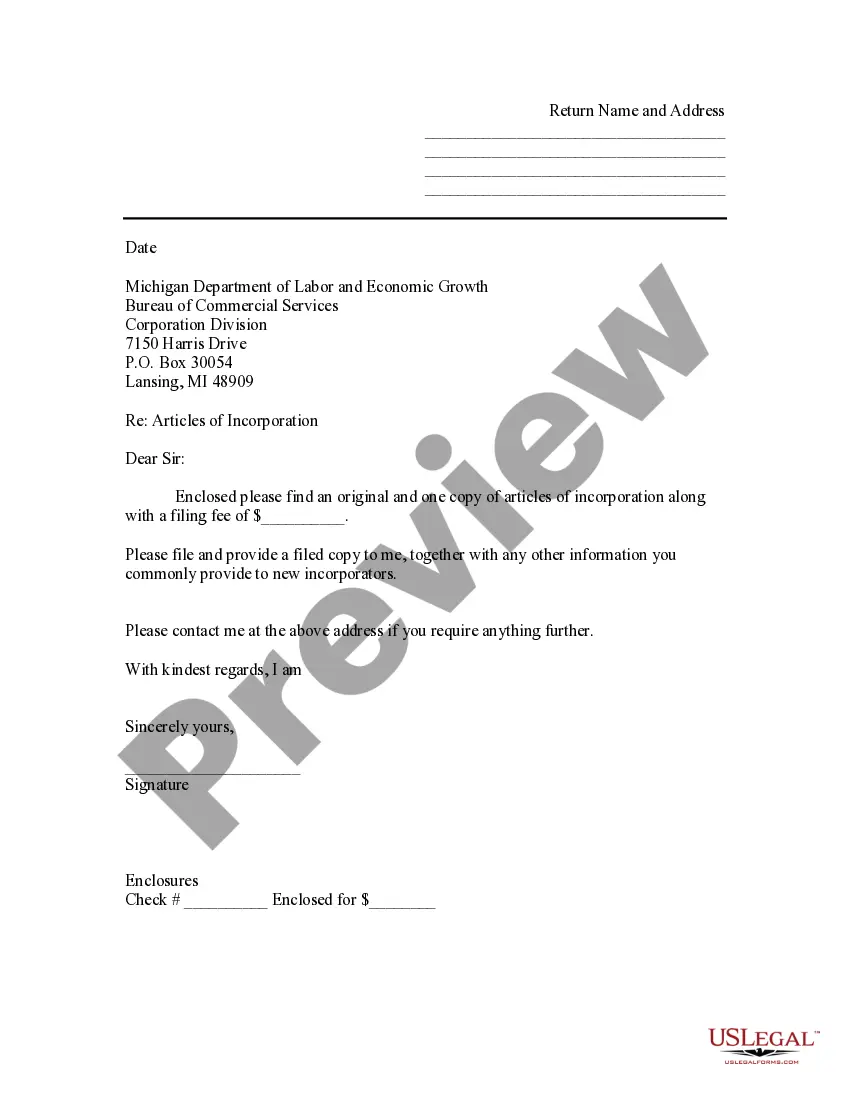

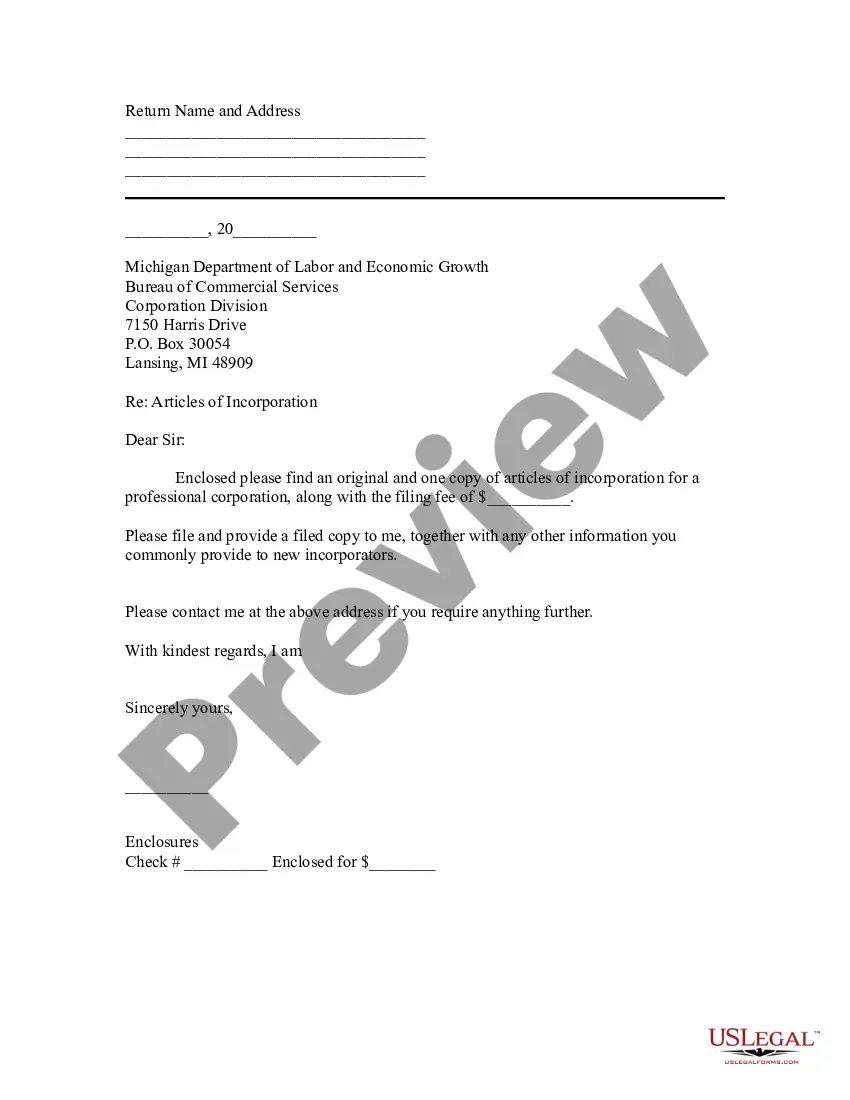

This form is a sample letter in Word format covering the subject matter of the title of the form.

Removal Request Letter With Tax Id Number In Arizona

Description

Form popularity

FAQ

A request for the abatement of a penalty, or penalties, can be requested to the Penalty Review Unit with the Arizona Form 290 – Request for Penalty Abatement. The account must be in compliance and provide clear and concise information to allow for a prompt reply by the Department.

Through AZTaxes for the fastest results by logging in to the AZTaxes account, select the business by clicking the “View” link in the “Actions” column. Then click “Account Update” and choose the “close account” tab. Submit your last TPT return with “FINAL RETURN (Cancel License)” box checked.

Determining Filing Status for Nonresidents and Part-Year Residents. Individuals who move to Arizona or live in the state temporarily also have tax filing requirements. Nonresident individuals must file income tax returns in both Arizona and their home state.

Nonresident Personal Income Tax Form -- Fillable Form is used by non-residents to report income derived from Arizona sources and related expenses, allowable deductions and credits. For tax year 2018 - 2022, see Form 140 - X & Y Tables. For tax year 2017 and prior, see Form 140NR X & Y Tables.

We send Notices to help protect taxpayers and to verify information to process the return and refund. If you receive a notice, you'll need to respond to the correspondence before we can issue your refund.

With notably low taxes on working and retirement income, and no estate or inheritance tax, Arizona is one of the more tax-friendly states for older workers and retirees. Last filing season, Arizona adopted a flat income tax rate of 2.5 percent.

File a Form 140NR if you were not an Arizona resident but earned income from an Arizona source in 2021. This Booklet Contains: • Form 140NR – Nonresident Personal Income Tax. Return.

No, an EIN does not expire. Once the IRS issues an EIN to your business, it's permanent and remains associated with your business for its lifetime.

To cancel your EIN and close your IRS business account, you need to send us a letter that includes: The complete legal name of the business. The business EIN. The business address. The reason you wish to close the account.

Regardless of whether or not an EIN was ever used, the number is PERMANENT. The IRS cannot cancel EIN numbers; however, the business account associated with the EIN may be closed. If the EIN is needed in the future, it will still belong to the business entity even after the account is closed.