Meeting Annual Consider For S Corp In Nevada

Description

Form popularity

FAQ

A corporation or LLC must file an S-Corp election within two months and 15 days (~75 days total) of the date of formation for the election to take effect in the first tax year. Example: Your articles of formation was filed on August 21st. Two months later is counted to the numerically corresponding day of October 21st.

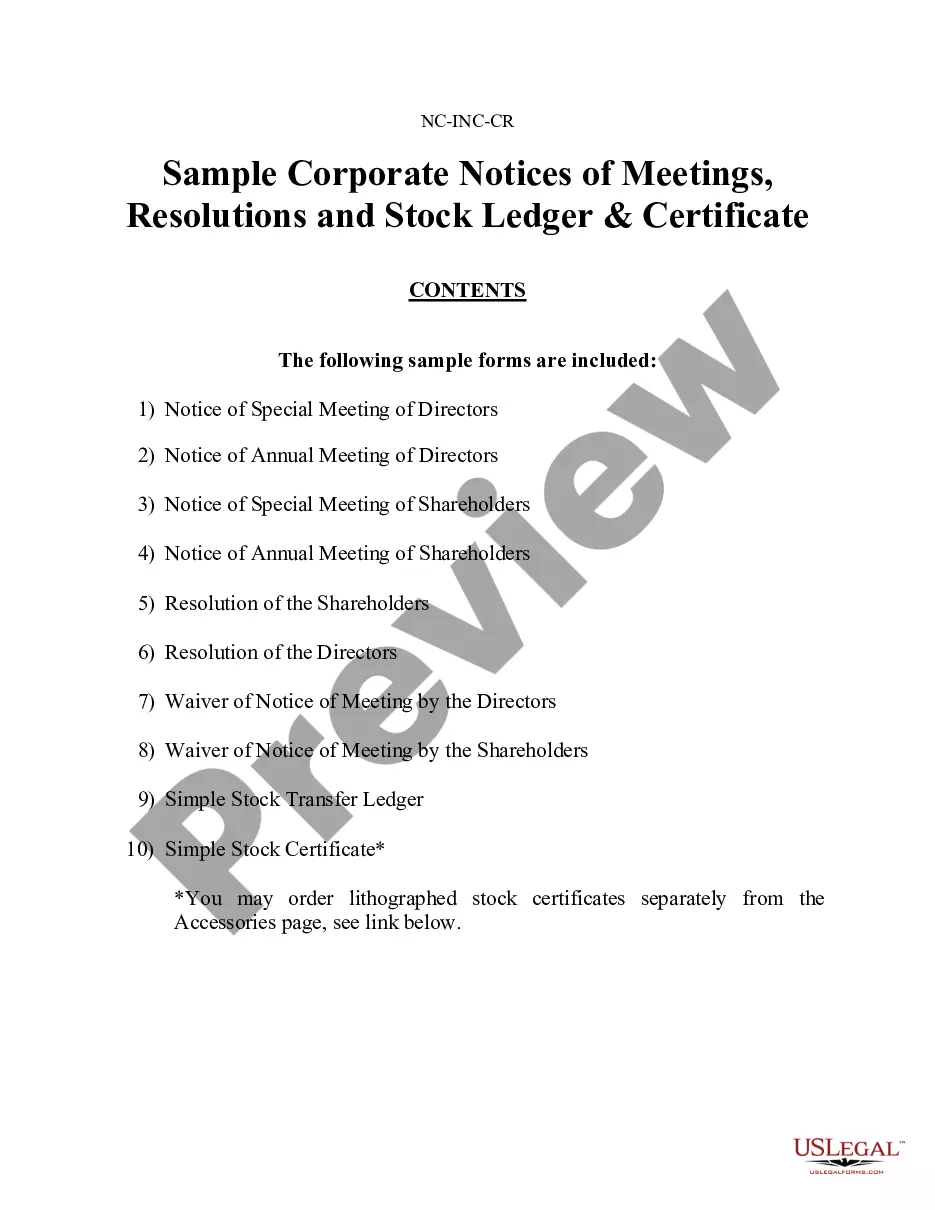

S Corps are legally required to keep accurate and up-to-date meeting minutes to document their business activities. This is a legal requirement for all C corporations and S corporations in California. Several states don't require meeting minutes for corporations.

Both California Corporations and California S-Corps are required to hold an annual meeting for shareholders. These meetings are pivotal for fostering transparency, discussing business strategy, and making essential corporate decisions.

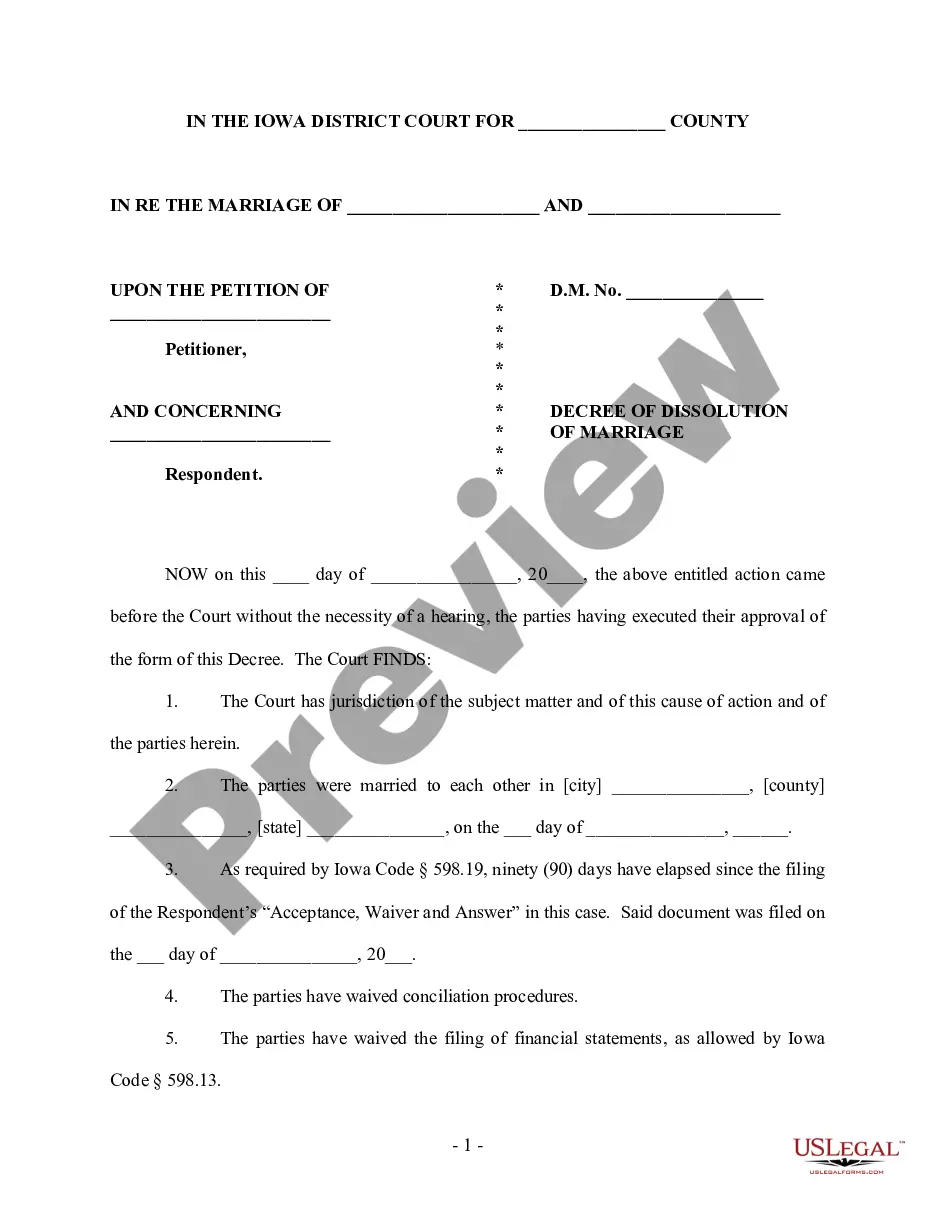

An S-corp annual report details an S-corporation's activities during the previous year. S-corporations and other companies must file an annual report each year on the state level, typically through the Secretary of State's office in their state.

Both California Corporations and California S-Corps are required to hold an annual meeting for shareholders. These meetings are pivotal for fostering transparency, discussing business strategy, and making essential corporate decisions.

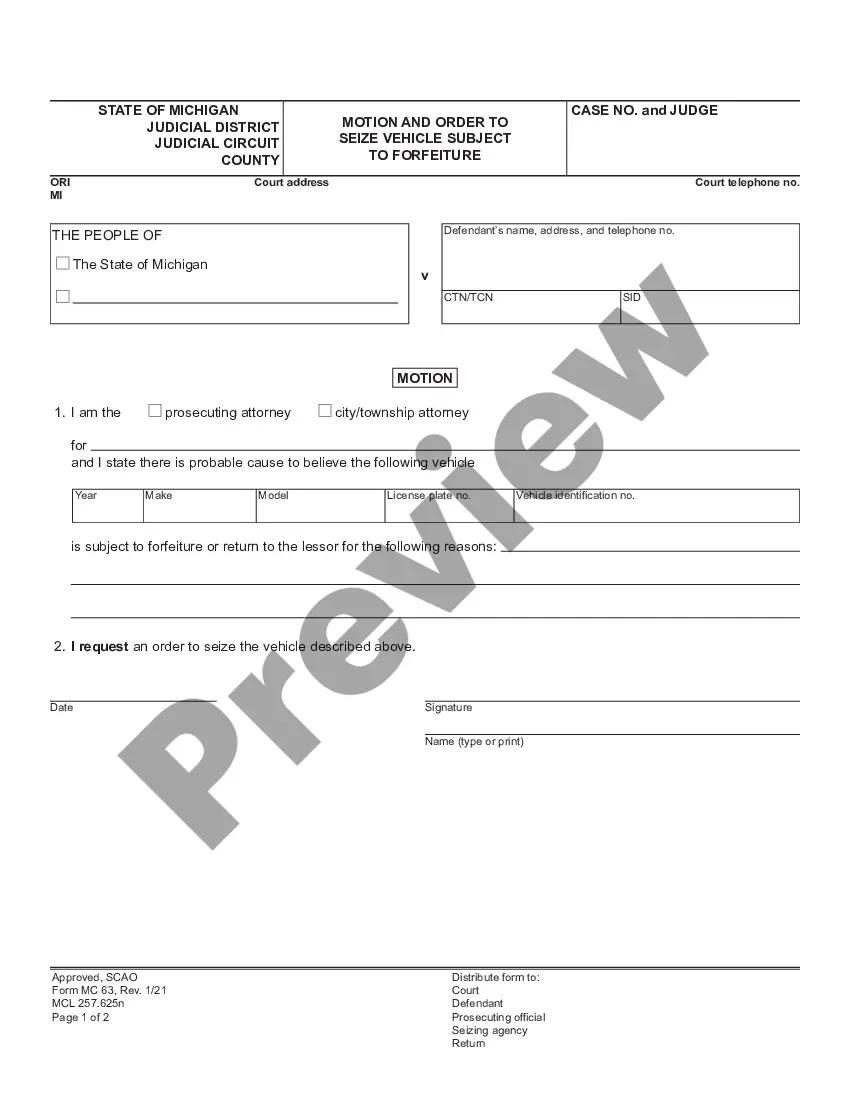

What information do I need to file my Nevada annual report? Your entity number or Nevada business identification number (NVID). Your business's name. Your entity type (LLC, corporation) Your business's mailing address. The names, titles, and addresses of corporate officers, managers, or members.

S Corps that lose their “S” status must typically wait five years before being able to re-elect it.

An S-corp annual report details an S-corporation's activities during the previous year. S-corporations and other companies must file an annual report each year on the state level, typically through the Secretary of State's office in their state.