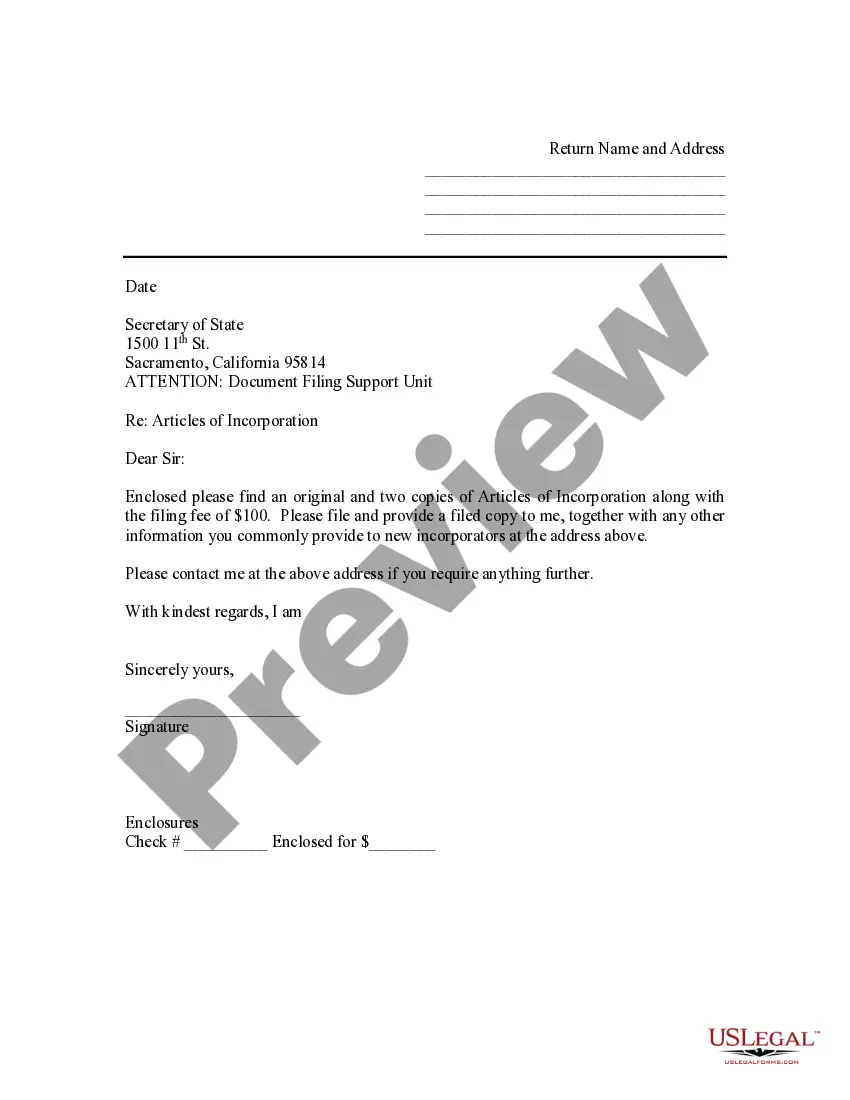

Form with which the secretary of a corporation notifies all necessary parties of the date, time, and place of the first stockholder's meeting.

First Stockholders Meeting For Friends In Philadelphia

Description

Form popularity

FAQ

The first shareholder meeting is an organizational meeting where shareholders ratify and approve the actions of the incorporators. Shareholders also approve shares values, appoint directors and officers if needed, and wrap up other initial tasks.

Prepare copies of the meeting agenda and any relevant reports (financial statements, proxy statements, etc.) for attendees, either in physical form or through a secure online portal. Determine the voting method (electronic voting platform, paper ballots, etc.) and ensure everyone understands the process.

A shareholders' meeting is a meeting held by the shareholders of a company to discuss the arrangements of the company or to vote in the election of board members.

Prepare copies of the meeting agenda and any relevant reports (financial statements, proxy statements, etc.) for attendees, either in physical form or through a secure online portal. Determine the voting method (electronic voting platform, paper ballots, etc.) and ensure everyone understands the process.

In order to have a legal meeting you must have a quorum of shareholders present. Typically, a quorum is defined as a representative of more than half of all shares outstanding. There are many other items that can be included on the agenda for an annual shareholder meeting.

Notification of the meeting's date and time will include a copy of the meeting's agenda, which is often centered around the election of members to the board of directors, approval of an accounting firm to review the company's financial records, and an opportunity to vote on any proposals that are put before the board, ...

Be familiar with your financials, including revenue, expenses, and projections. Be prepared to discuss key metrics relevant to your business. Be prepared to listen and respond thoughtfully to the investor's questions and feedback. This can foster a more engaging conversation. Have a plan for follow-up after the call.

The Quakers, though few in numbers, have been influential in the history of reform. The colony of Pennsylvania was founded by William Penn in 1682, as a safe place for Quakers to live and practice their faith.

Pennsylvania, while predominantly Quaker, soon became a haven for minority religious sects from across Europe, as well as the most culturally diverse of the thirteen original colonies.

This new sect called themselves the Society of Friends, or Quakers, whose faith and practices were so radical that persecution fell upon them. Ultimately, this persecution and their desire for spiritual freedom led them to flee England and establish a religious haven in Pennsylvania.