Form with which the secretary of a corporation notifies all necessary parties of the date, time, and place of the first stockholder's meeting.

Stockholders Corporate Resolutions Withdrawal In Philadelphia

Description

Form popularity

FAQ

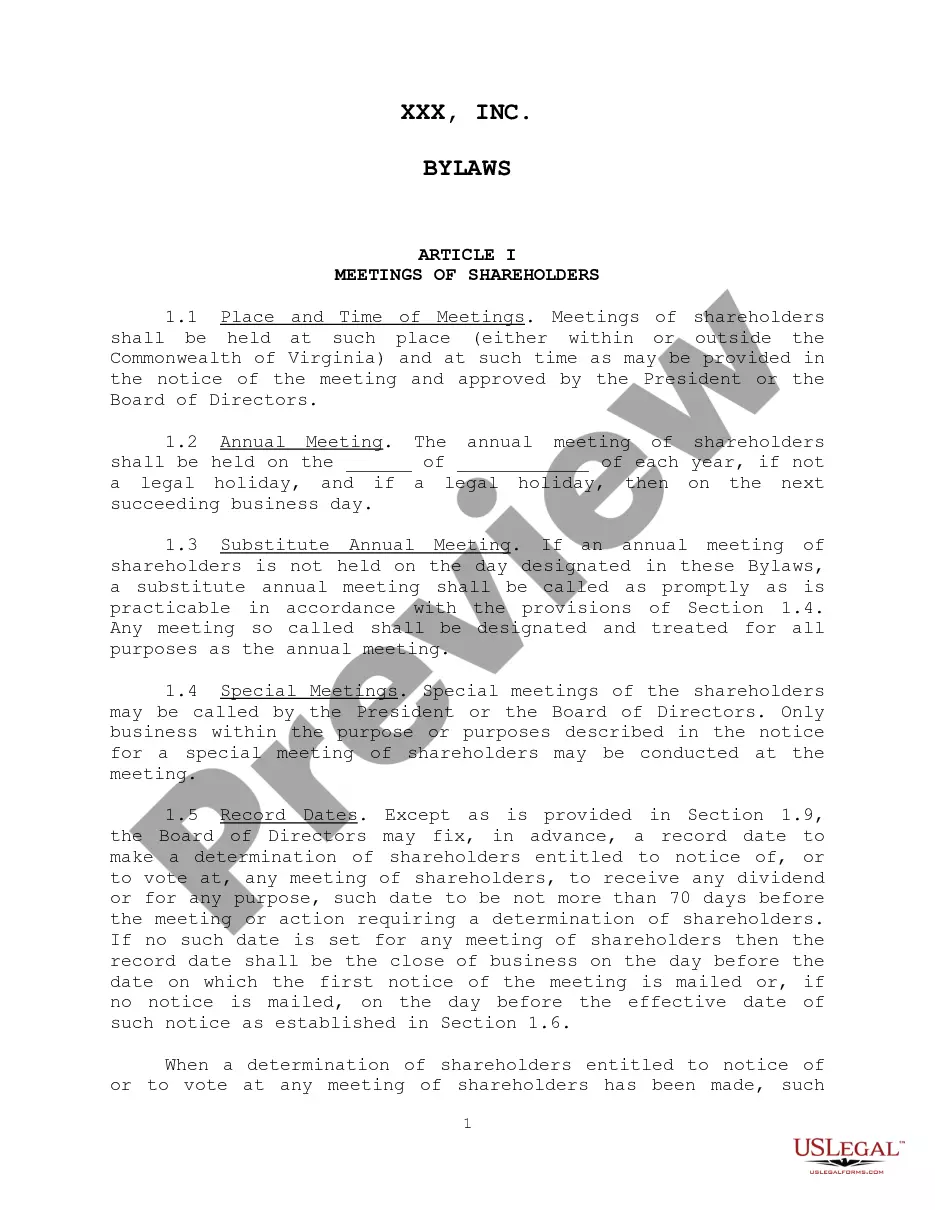

(b) Action by consent. --Unless otherwise restricted in the bylaws, any action required or permitted to be approved at a meeting of the directors may be approved without a meeting by a consent or consents to the action in record form.

--Unless otherwise restricted in the bylaws, any action required or permitted to be approved at a meeting of the directors may be approved without a meeting by a consent or consents to the action in record form.

Section 1766(b) of the BCL (relating to consent of shareholders in lieu of meeting) authorizes the articles of incorporation of a business corporation or a bylaw adopted by the shareholders of a nonregistered corporation to provide that action by the shareholders without a meeting may be taken by the written consent of ...

In Pennsylvania, a corporation need not adopt bylaws at its formation, but bylaws are sometimes adopted by the incorporator or board of directors at formation or a later time.

Anti-takeover Statutes in Pennsylvania, among Other Provisions, Give Target Shareholders a Put, Impose a Moratorium on Mergers with Interested Shareholders, and Prohibit Voting of Control Shares.

What is a Unanimous Consent Agreement? A Unanimous Consent Agreement allows you to record official actions of the directors and/or shareholders of a corporation that were taken by unanimous consent, rather than as part of a formal meeting.

Without an agreement or a violation of it, you'll need at least a 75 percent majority to remove a shareholder, and said shareholder must have less than a 25 percent majority. The removal is accomplished through votes, and the shareholder is then compensated upon elimination, ing to Masterson.

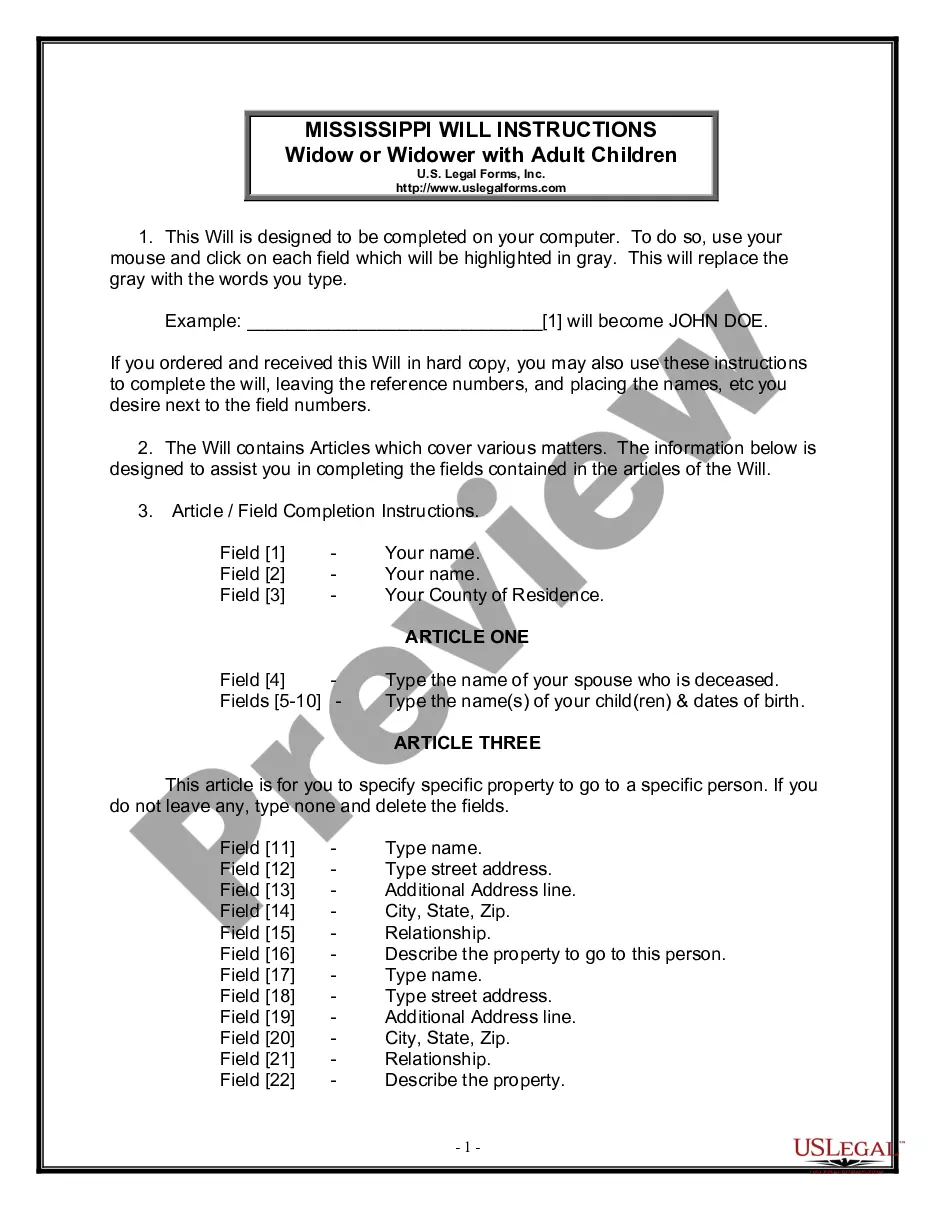

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

To cancel a foreign LLC, just submit form L-109, Certificate of Cancellation to the New Jersey Division of Revenue. To withdraw a foreign corporation, file form C-124P, Certificate of Withdrawal with the Division of Revenue.