Property Personal Selling With Example In Allegheny

Description

Form popularity

FAQ

Property Assessment Allegheny County uses base year methodology to set assessed values. Base year methodology allows similar homes to have similar assessments by eliminating the effect of changing market conditions.

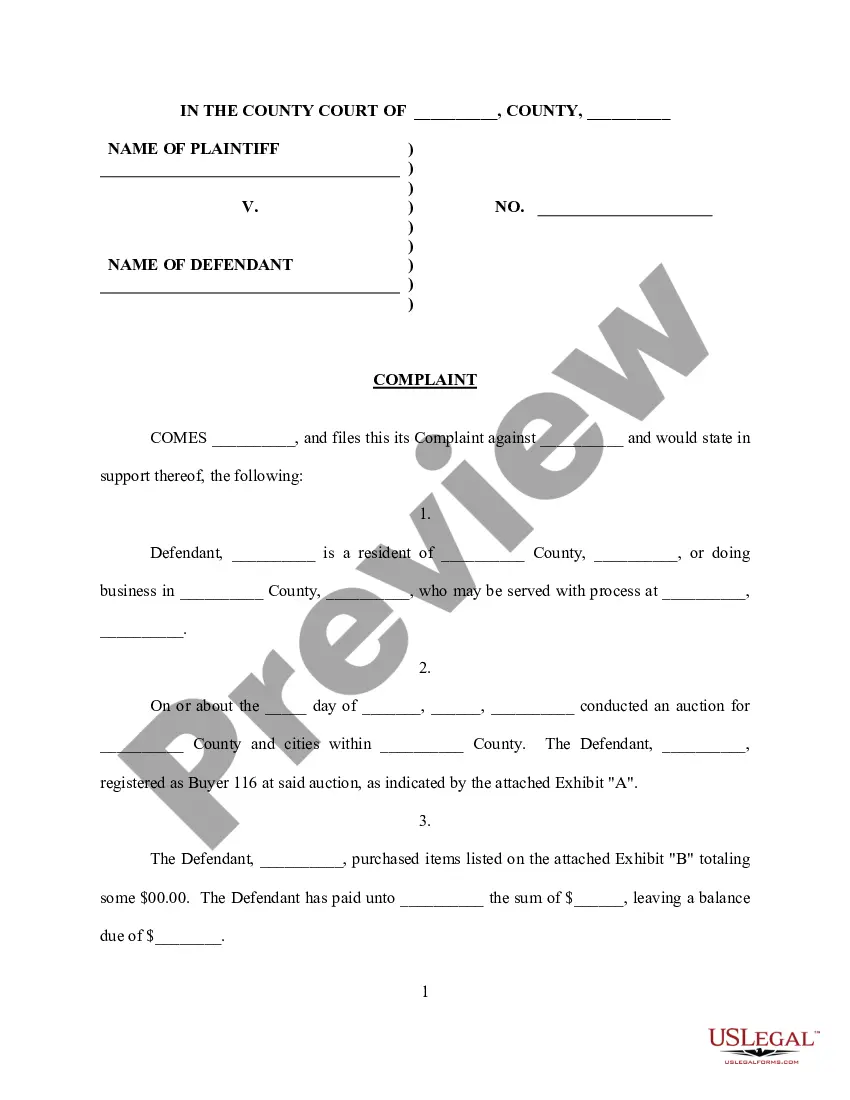

Once the thirty days has elapsed and the occupant is still in the property, you must prepare a Complaint in Ejectment with a 20 Day Notice to Defend and a legal description of the property and/or the deed.

Can a Sheriff Sale be postponed? Yes, sales can be postponed twice within 130 days of the original sale date. The property usually will not be re-advertised in the newspaper. Announcements are made at the beginning of each Sale indicating those properties that have been continued or stayed.

The Plaintiff in the case may cancel or adjourn a Sheriff's Sale. Typical reasons for doing so include settlement or bankruptcy.

The average effective property tax rate in Allegheny County is 2.00%, more than double the rate in Philadelphia County.

Act 77 (Senior Citizen Tax Relief) At least 60 years old.

Examples of personal selling might include a car salesperson meeting with a potential customer to show them different car models and features, a real estate agent giving a tour of a property to a prospective buyer, or a financial advisor meeting with a client to discuss investment options.

Allegheny County Property taxes are calculated by multiplying the county property assessment by the current millage rate for each specific taxing entity and then adding all three tax bills. The County millage rate for 2024 is 4.73.

Monroe County (4.73%) had the highest property tax burden in the state, 0.92 percentage points higher than the second highest, Pike County (3.81%).