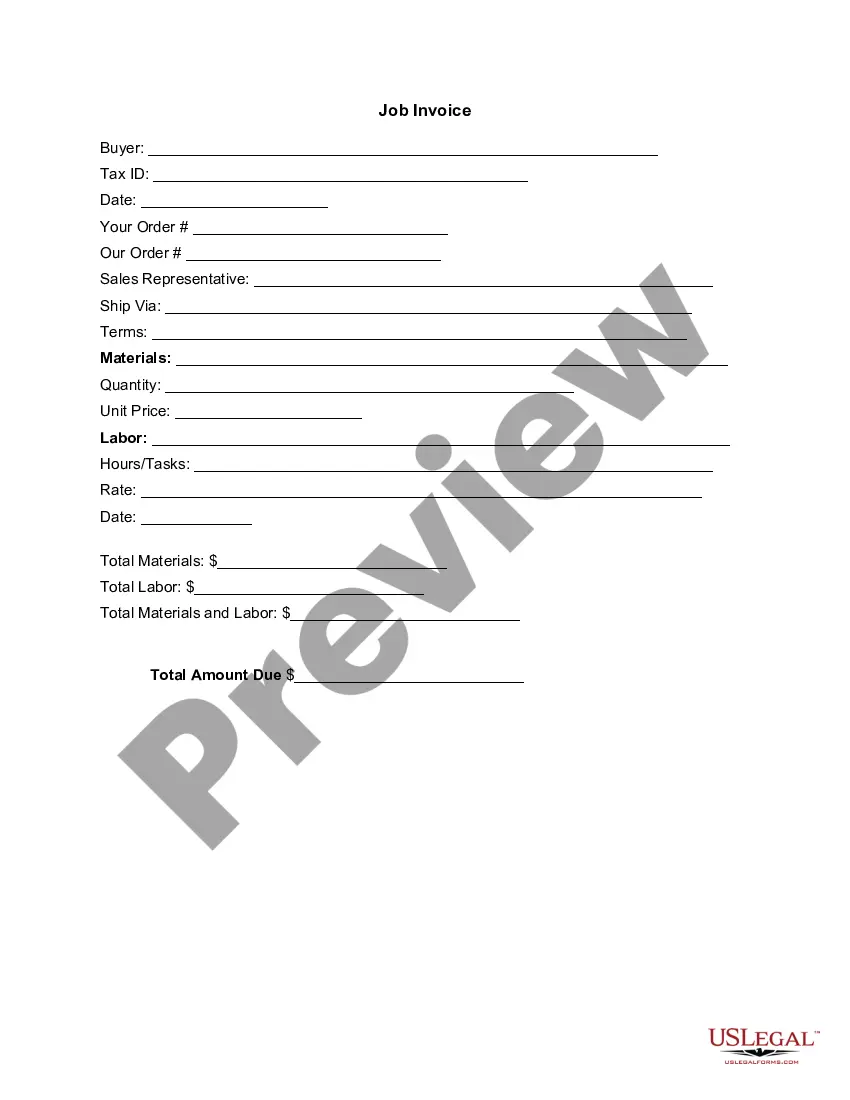

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sell Out With Me In California

Description

Form popularity

FAQ

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

Yes, ing to the Board of Equalization. As long as either the primary residence is sold or the replacement primary residence is purchased on or after April 1, 2021, the base year value of the primary residence can be transferred to the replacement primary residence under Proposition 19.

Seller/Transferor and Buyer/Transferee must complete the perjury statement, sign and date on Side 3 of Form 593 when the initial sale occurs. For the remaining installment payments, the Buyer/Transferee must sign all subsequent Form 593s.

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.

Partition actions are usually simple lawsuits since there typically are no important facts in dispute, and it is just a matter of getting the court to order a sale of the property. The court then issues an order, after hearing evidence on the issue, as to how to distribute the proceeds.

You're not required to hire a real estate agent to sell your home in California. But selling without one involves a lot of work and a big time commitment. While selling by owner spares you from paying the commission of a seller's agent, you'll still be responsible for the buyer's agent's commission.

You're not required to hire a real estate agent to sell your home in California. But selling without one involves a lot of work and a big time commitment. While selling by owner spares you from paying the commission of a seller's agent, you'll still be responsible for the buyer's agent's commission.

You will have to hire an attorney and file an unlawful detainer to begin the eviction process. The courts in California are extremely slow right now but your attorney may be able to speed up the eviction since you have a stipulation in the contract the seller was to move out in 7 days after the close.

If you want to sell a rental property in California, it's essential to know about the 120-day notice to sell. This is a key legal requirement that serves as a formal declaration of your intent to sell. What is the 120-Day Notice to Sell? This notice is mandatory for landlords selling tenant-occupied properties.