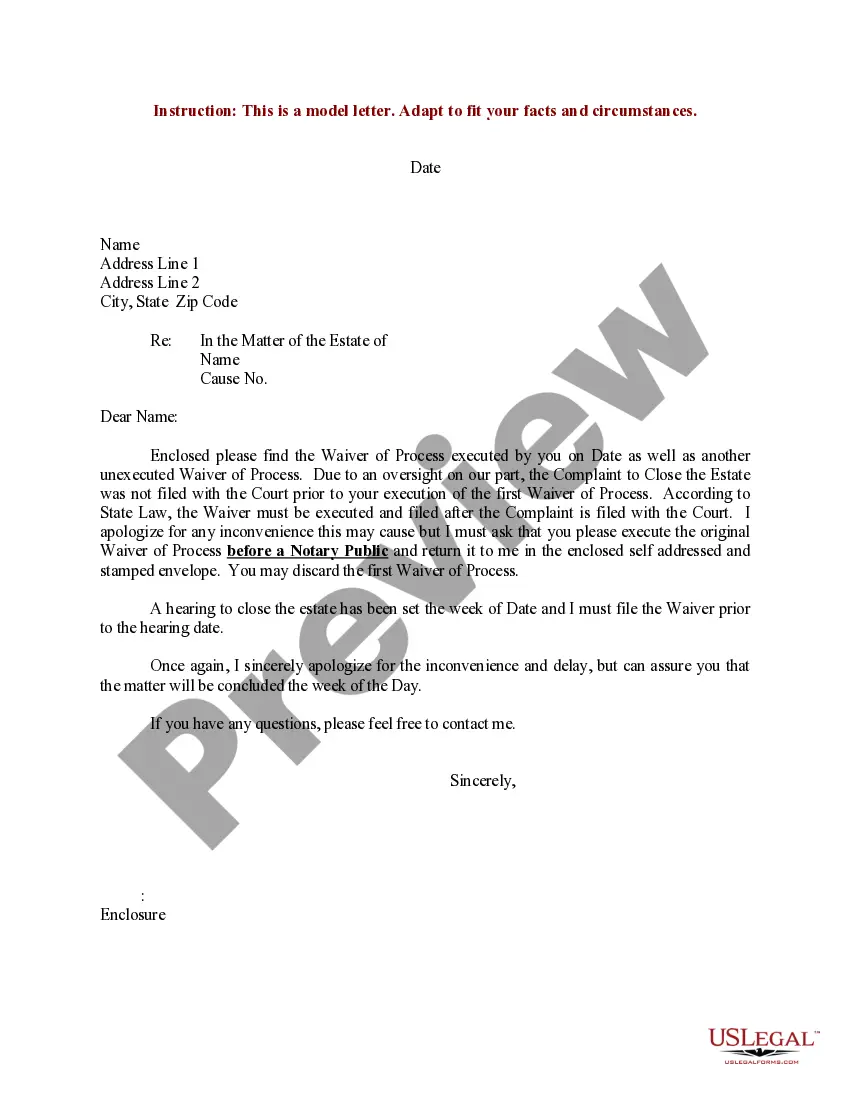

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Business Personal Property Form 103 In Chicago

Description

Form popularity

FAQ

These taxes resulted when the new Illinois Constitution directed the legislature to abolish business personal property taxes and replace the revenue lost by local government units and school districts.

Personal Property - Any property other than real estate. The distinguishing factor between personal property and real property is that personal property is movable and not fixed permanently to one location, such as land or buildings.

Zip RegardingAddressCity Form ST-103 P.O. Box 7218 Indianapolis, IN Form ST-103DR P.O. Box 6114 Indianapolis, IN Form ST-103MP P.O. Box 6114 Indianapolis, IN Form ST-103NC P.O. Box 7230 Indianapolis, IN4 more rows

“Tangible personal property” exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

Where to Report Personal Property on Your Taxes. Claim the itemized deduction on Schedule A – State and local personal property taxes (Line 5c). Taxes you deduct elsewhere on your return — like for a home office or rental — don't qualify for this deduction.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

It's also worth noting that many states, but not Illinois, tax “personal property” like cars, boats and business equipment. The 1970 Illinois constitution banned personal property taxes.

These taxes resulted when the new Illinois Constitution directed the legislature to abolish business personal property taxes and replace the revenue lost by local government units and school districts. In 1979, a law was enacted to provide for statewide taxes to replace the monies lost to local governments.