Private Property In Business In Cook

Description

Form popularity

FAQ

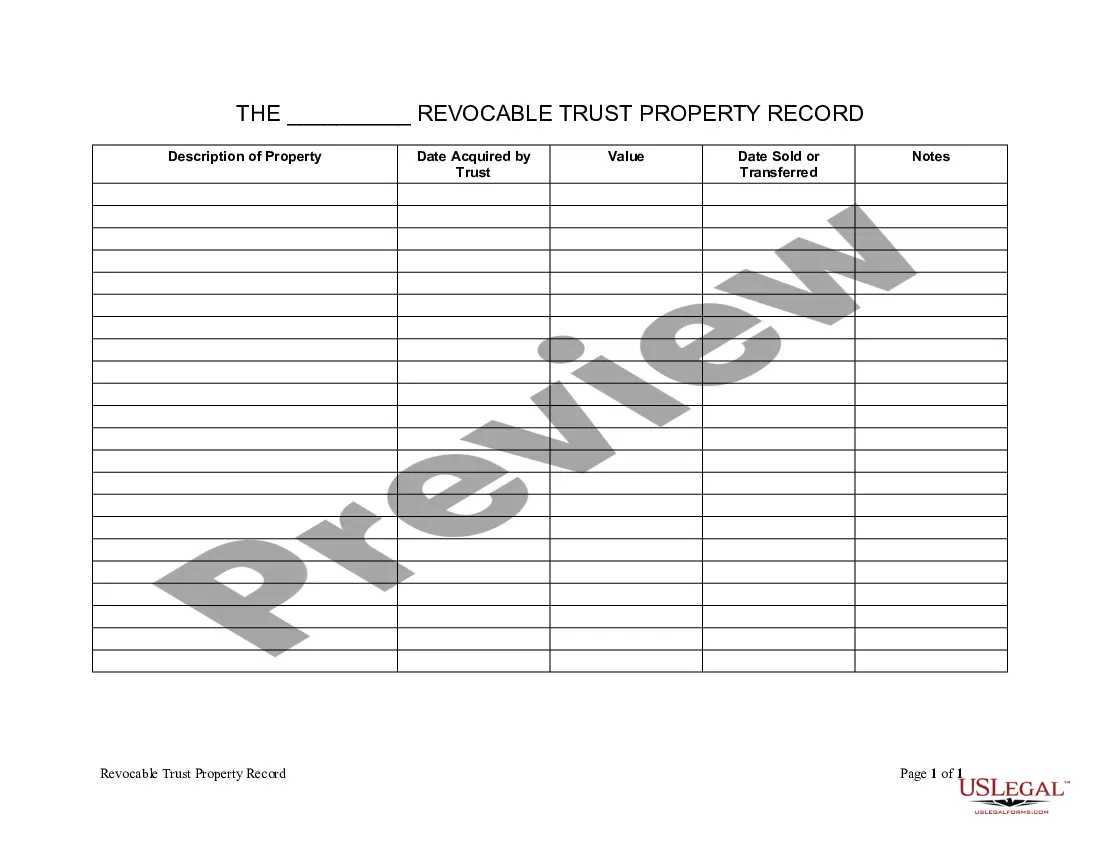

Private property refers to things that belong to people or businesses, not the government. This can include land, buildings, things like cars or furniture, and ideas that people come up with.

Benefits of Forming an LLC to Hold Real Estate Asset Protection. Protection Against Creditors through a California Real Estate LLC. Tax Advantages of holding investment properties in a California real estate LLC. Flexible Management Structure. Enhanced Credibility and Privacy.

Disadvantages of forming a real estate LLC Despite the advantages, there are some drawbacks to forming an LLC for real estate investment, including formation and ongoing costs, mortgage difficulties, and limited liability protection.

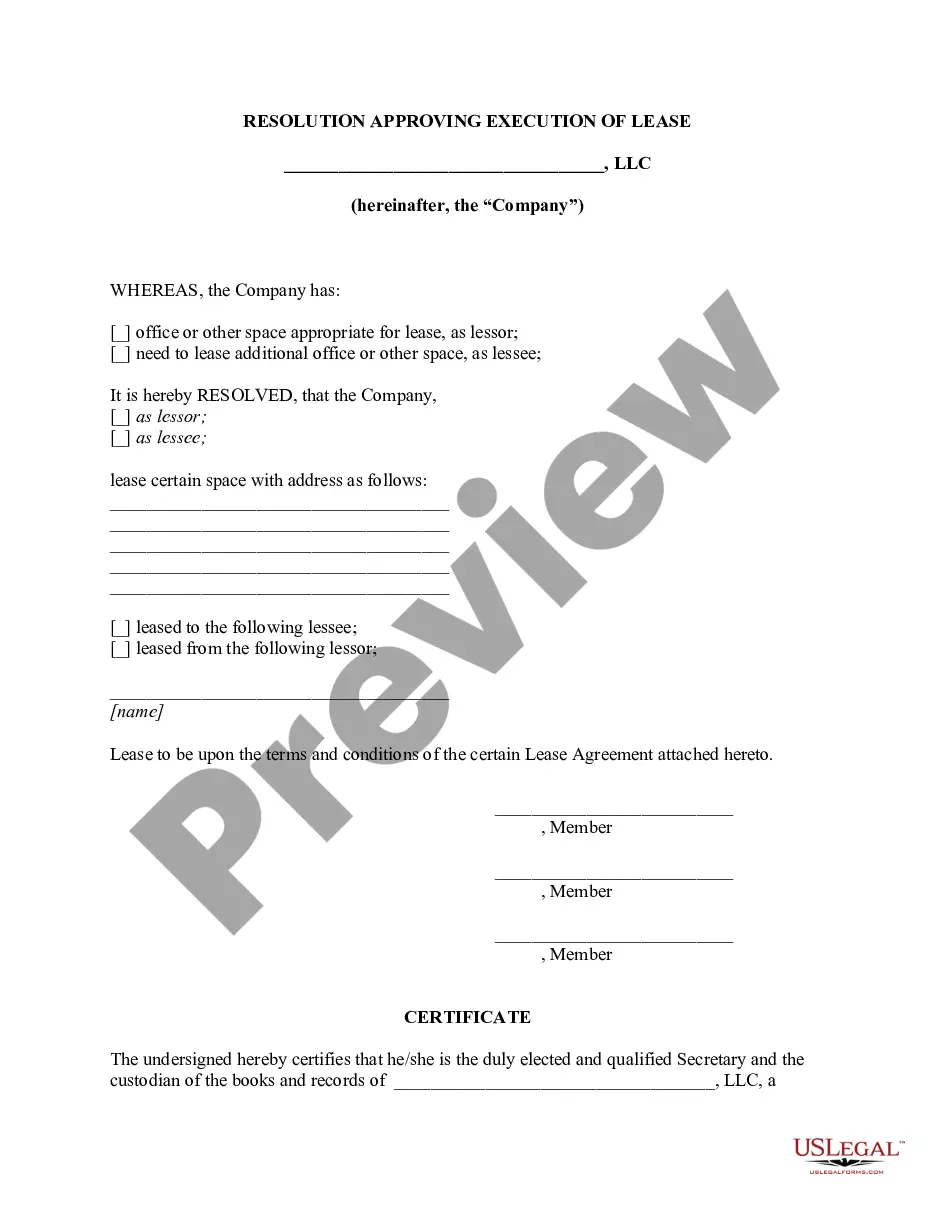

Follow these steps to transfer property to LLC business structures. Make sure your LLC is registered. Review the property title and LLC operating agreement. Draft a deed of transfer. Notarize and file the deed. Notify your mortgage company. Update tax records. Transfer utilities and insurance. Plan for tax complications.

The main purpose of an LLC is to limit the owner's personal liabilities for (and protect personal assets like your home from) the LLC's business, and most real estate investors will hold each property in a separate LLC so that any liability that arises on one property will not affect any other property.

In order for an individual to run a business from their home in New York State, it must be owned and operated by the individual living in the residence. Only one individual who is not residing in the home may be employed there.

You can download or request a permit application. It includes forms and information about requirements. Visit the DOHMH permits and licenses page. Call 311 or 212-NEW-YORK (212-639-9675) to request a copy.

Yes, a permit is required for all food vendors offering food for sale to the public.

Permits and licenses: You'll likely need various permits, including a business license, food service permit, and possibly a special use permit for operating on residential property. Health regulations: Food trucks must meet strict health and safety standards, regardless of location.

New York cottage food producers may sell their products from home or online with in-state shipping or home delivery. New York also permits wholesale and retail cottage food sales at restaurants, cafes, grocery stores, farmers' markets, craft fairs and flea markets. Cottage food may not be sold across state lines.