This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sold Our With Tenant In Cook

Description

Form popularity

FAQ

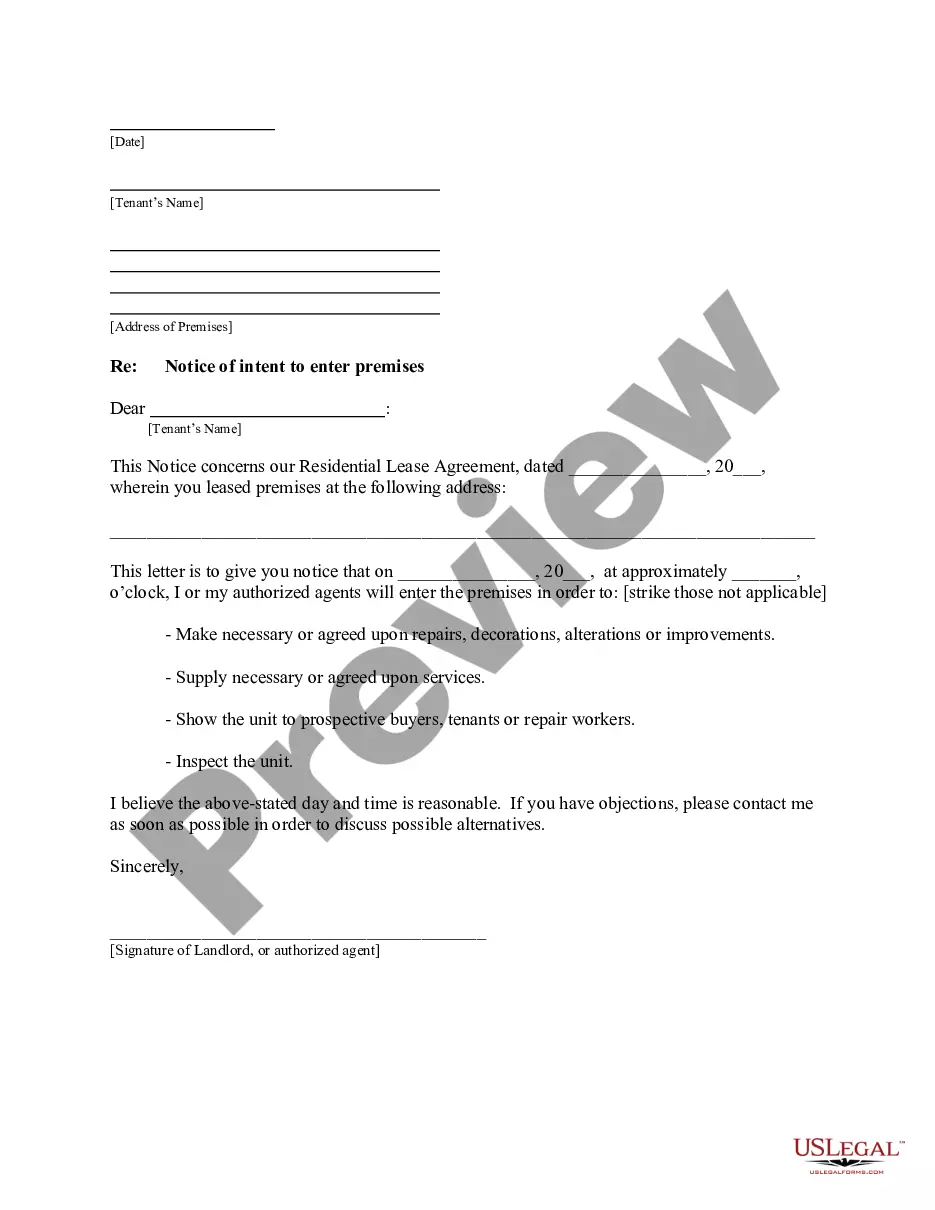

Your landlord must notify you in writing that he/she intends to terminate the lease. If you are renting month-to-month, you are entitled to a 30-day written notice. Leases running year-to-year require a 60-day written notice. YOUR LANDLORD DOES NOT HAVE TO GIVE YOU ANY REASON FOR TERMINATING THE LEASE.

The letter to notify a tenant of the sale of the property should be short and concise and include information such as: Identifying information including the date, owner name, tenant name, and property address. Notice that property is being sold and that the lease and deposit will transfer to the new owner.

In California, a property owner can sell a property even if it is currently leased. The lease remains in effect, and the new owner must honor the terms of the existing lease. The tenant has the right to continue living in the property under the same conditions agreed upon with the original owner.

No less than 30 days prior to listing or otherwise offering a rental property for sale, the owner shall provide notice to the tenant association, or if no tenant association exists, to each tenant, and to the Department, of the owner's intent to sell.

The answer is yes but with some limitations. If there is a written agreement between the previousMoreThe answer is yes but with some limitations. If there is a written agreement between the previous tenants. And the previous landlord. Then the new owner can collect the back rent.

The letter to notify a tenant of the sale of the property should be short and concise and include information such as: Identifying information including the date, owner name, tenant name, and property address. Notice that property is being sold and that the lease and deposit will transfer to the new owner.

How to Write an LOI in Commercial Real Estate Structure it like a letter. Write the opening paragraph. State the parties involved. Draft a property description. Outline the terms of the offer. Include disclaimers. Conclude with a closing statement.

Details about the sale Inform the tenant that the property is being sold. Be transparent about the process, including whether the lease and deposit will transfer to the new owner. Let them know that the property will go on the market, and they may need to cooperate with showings.