This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form Forsyth County In Fulton

Description

Form popularity

FAQ

How you file your business taxes with the IRS depends on your business's structure. Some structures, like corporations, must file their business taxes separately from their personal taxes. Other structures, like sole proprietorships, must report their business income on their personal taxes.

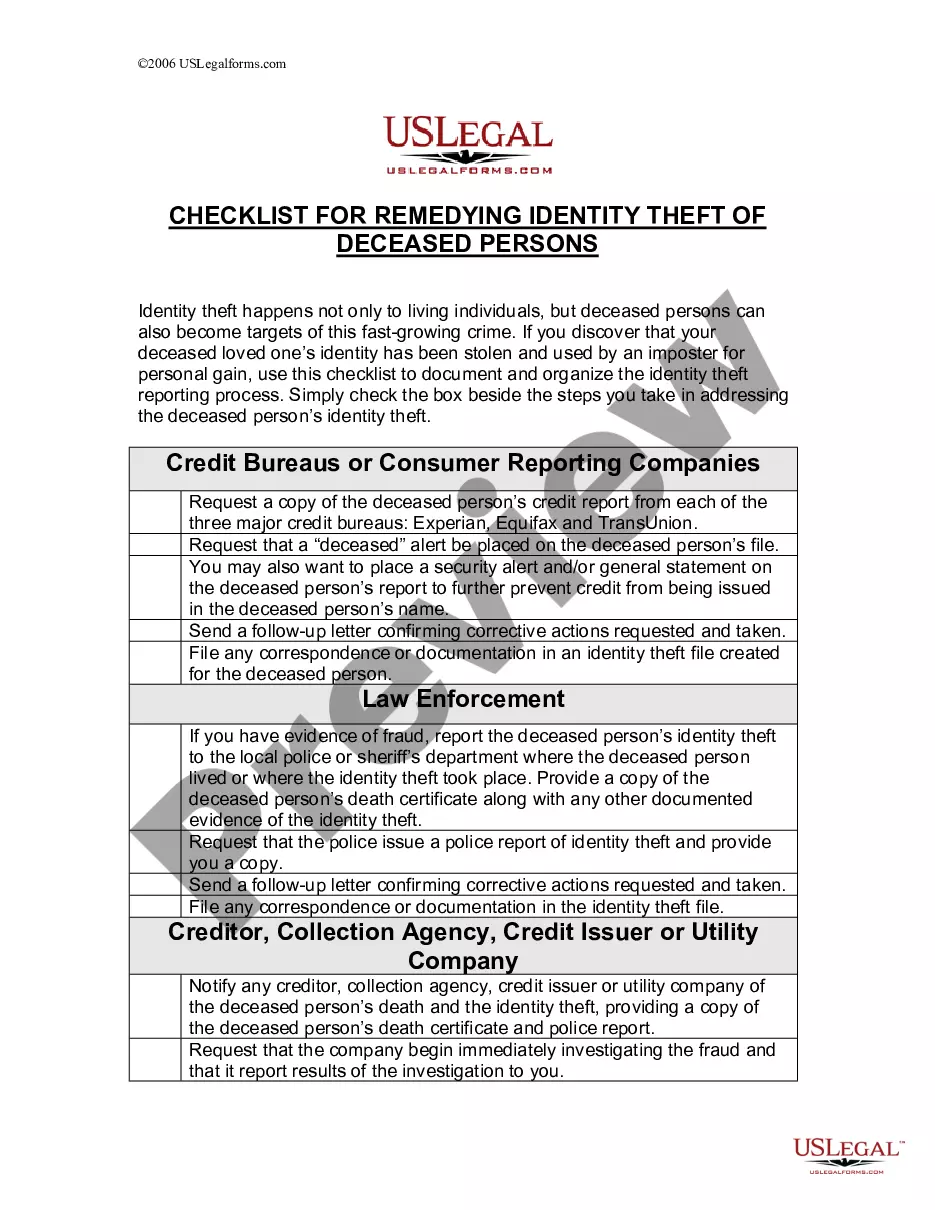

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

• All businesses are required by law to file the Business Personal Property. • Tax Return (PT-50P) to the Tax Assessor's Office by April 1st of each year. • Personal property includes machinery, equipment, furniture, fixtures, inventory, supplies, and construction in progress.

The state of Georgia provides the following exemptions: All personal clothing and effects, household furniture, furnishings, equipment, appliances, and other personal property used within the home, if not held for sale, rental or other commercial use, shall be exempt from all ad valorem taxation.

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property.

Georgia exempts a property owner from paying property tax on: Items of personal property used in the home if not held for sale, rental, or other commercial use. All tools and implements of trade of manual laborers in an amount not to exceed $2,500 in actual value.