Personal Property Business Form With Two Points In Hennepin

Description

Form popularity

FAQ

Line 2 is the prior year qualifying amount. The qualifying amount is limited to 10 acres on a residential homestead, or the house/garage/site portion of an agricultural homestead. Relative homesteads do not qualify for property tax refund.

What are the maximums? For refund claims filed in 2024, based on property taxes payable in 2024 and 2023 household income, the maximum refund is $3,310. Homeowners whose income exceeds $135,410 are not eligible for a refund.

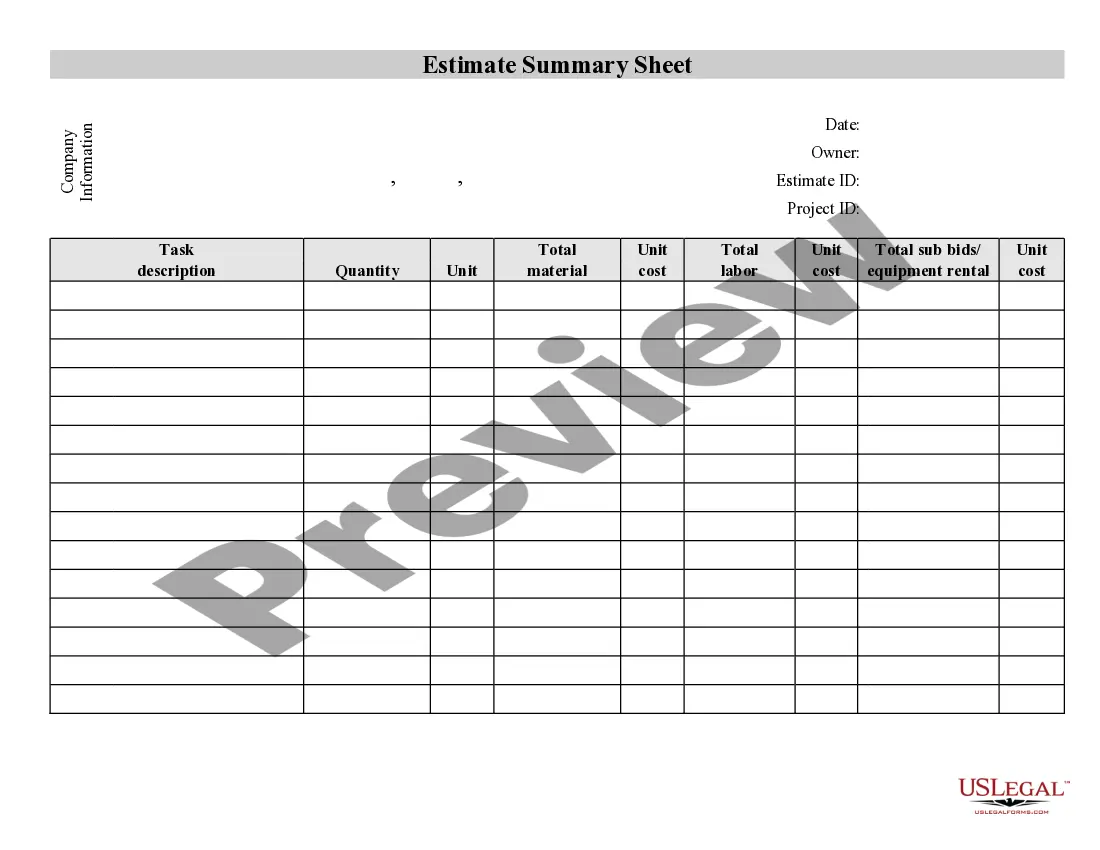

Personal property is movable property that is not attached to land. Tangible - movable equipment and machinery, furniture, cars, trade fixtures, etc. Intangible – goodwill, non-compete clauses, patents, copyrights, etc.

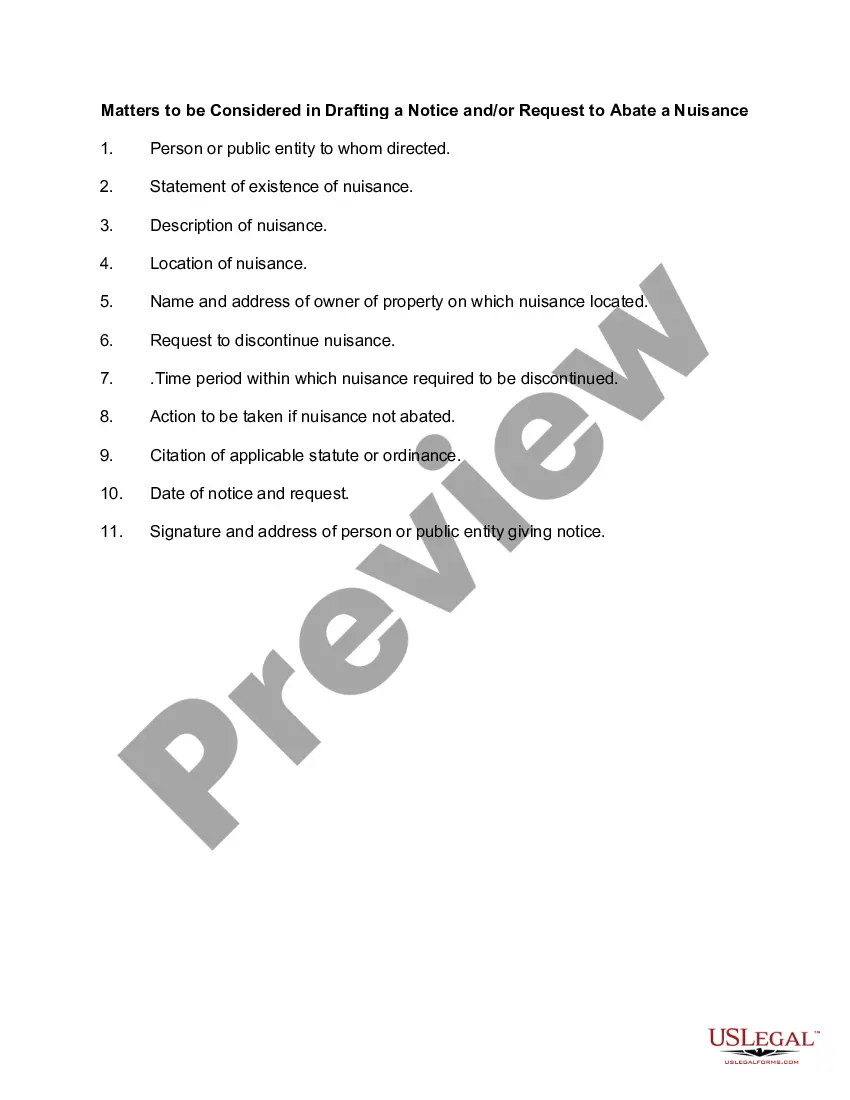

A personal property rendition is a report that lists all business assets (personal property) that are subject to personal property tax, which is typically all tangible personal property unless a specific exemption applies.

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income. The State of Texas has jurisdiction to tax personal property if the property is: Located in the state for longer than a temporary period.

A rendition is a form that provides information about property that you own. The appraisal district uses the information you provide to appraise your property for taxation.

Understanding Tax Rates State Average: The average property tax rate in Minnesota is around 1.11% of a home's assessed value. County Differences: Rates vary widely. For example, Hennepin County (urban) has an average rate of 1.32%, while Becker County (rural) might be as low as 0.80%.

The average effective tax rate in Hennepin County is 1.32%, highest in Minnesota. If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Minneapolis can help you out.

Minneapolis' residential property tax increase from 2019 to 2024 lies in the middle of the pack, at 26th out of the 50 largest cities. Minneapolis' median property tax bill went up 28%, bringing the monthly tax bill to $321.

Business personal property is all property owned or leased by a business except real property.