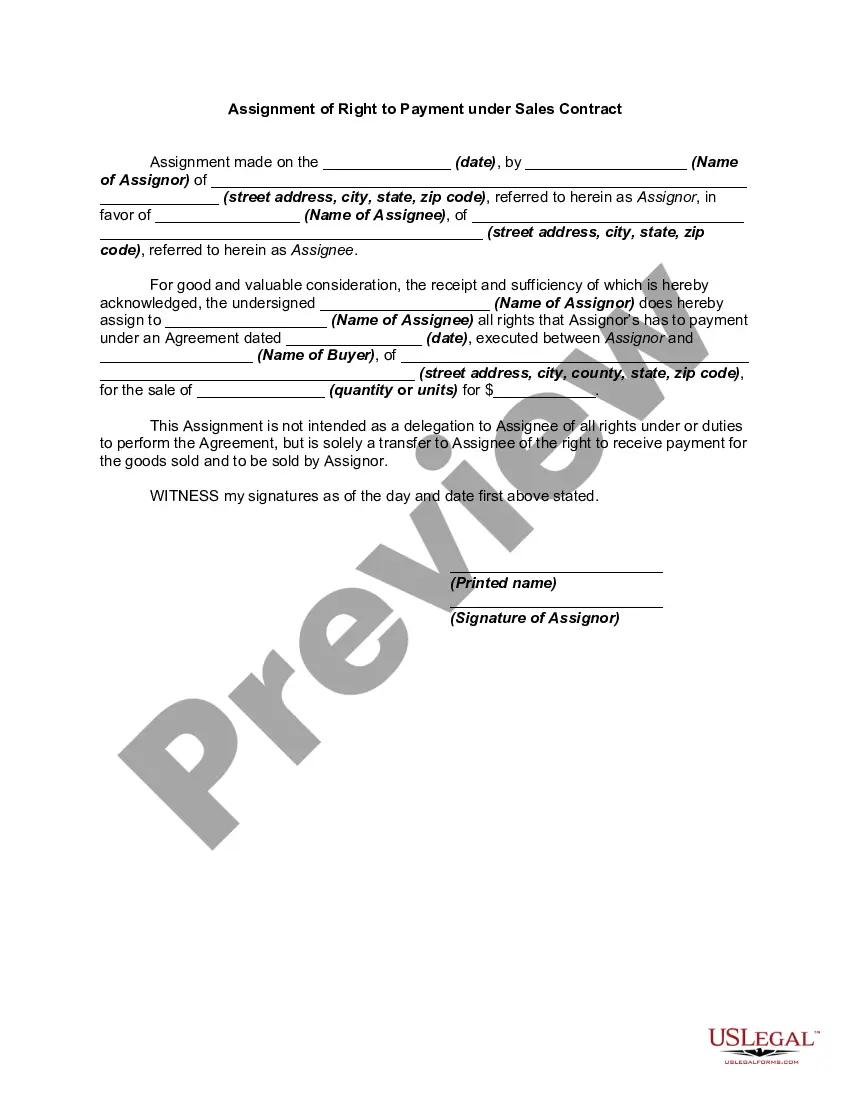

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sale Our For Capital Gains In Houston

Description

Form popularity

FAQ

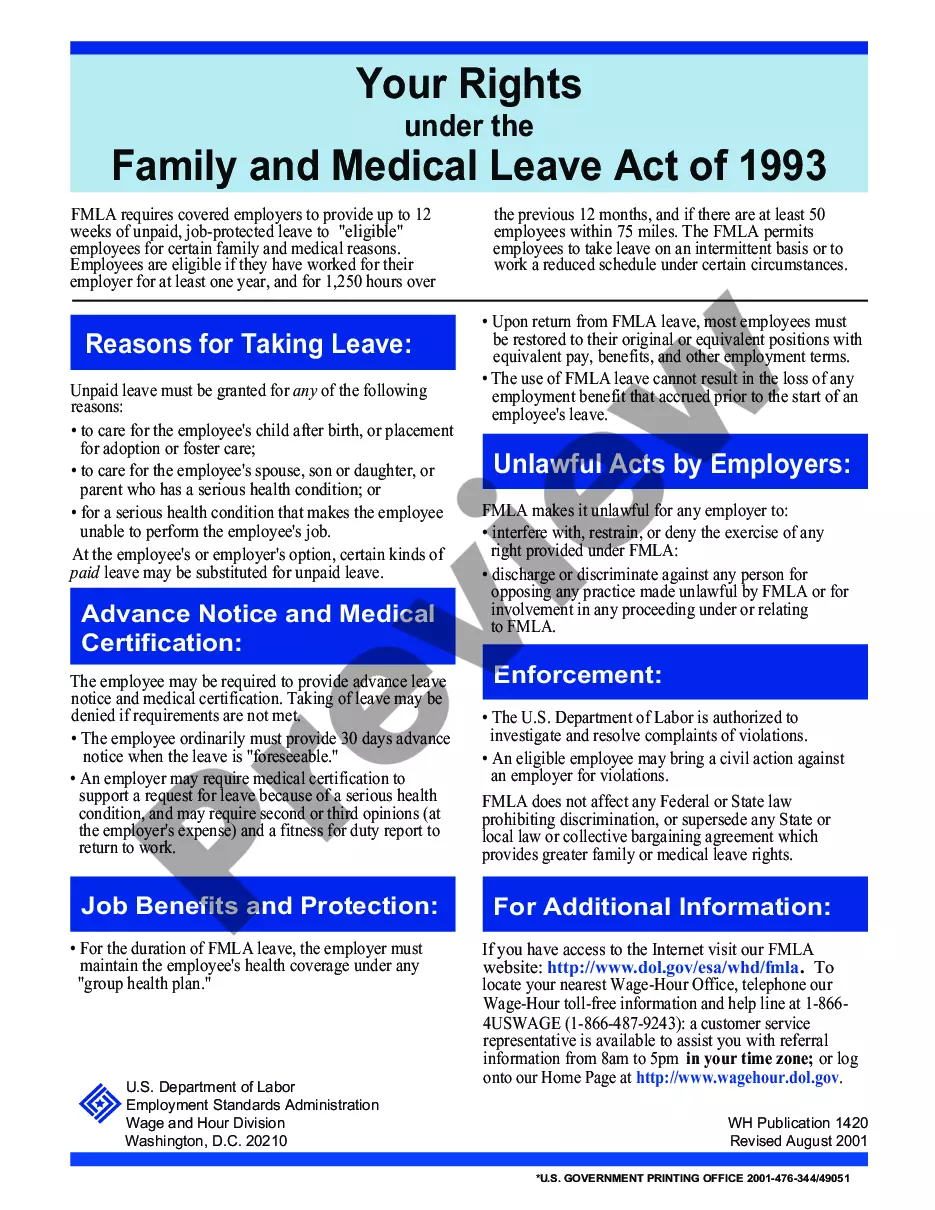

Including real estate primary residence exemption. One of the most significant strategies to avoidMoreIncluding real estate primary residence exemption. One of the most significant strategies to avoid capital gains tax is the primary residence exemption to qualify you must have owned.

Ways to avoid or minimize capital gains tax on inherited property Sell the property immediately after inheritance. Utilize the 1031 exchange for investment properties. Set up a trust. Stepped-up basis considerations.

Texas residents selling their primary residence can potentially exempt up to $250,000 (or $500,000 for married couples) in profits from capital gains tax if certain conditions are met.

The Capital Gains Exclusion If you profit from the sale of your home, you can exclude the first $250,000 of that profit from taxes, if you're single. For married couples filing jointly, that number increases to $500,000. Critically, this exclusion applies to your gains, not the total sale.

This includes significant improvements like extensions, renovations, or the fees involved in purchasing and selling the property, such as estate agent commissions, legal fees, and stamp duty. These expenses are directly linked to the property's value and can be deducted from your gains when calculating CGT.

Inheritance tax doesn't apply to Texas. Capital Gains Tax: The IRS applies capital gains tax based on a stepped-up basis. This tax applies only to the property's appreciation after inheritance.

How to show capital gains in ITR? Choose "Taxable income is more than the basic exemption limit" as the reason for filing your ITR. Select "General" and click on "Income Schedule." Next, tap on "Schedule Capital Gains" and select the type of capital assets from the list. Finally, enter the capital gains details.

Unlike federal capital gains taxes, there is no capital gains tax in Texas. In other words, there is not a state-level tax imposed on capital gains earned by individuals, businesses, or other legal entities.

How to avoid capital gains tax in Texas Holding on to the asset. Holding on to an asset for a longer period is an effective strategy to minimize or avoid federal capital gains tax. Primary residence exemption. Section 1031 exchange. Income-based exemptions. Use tax-advantaged accounts.

A capital gains exemption allows homeowners who have owned the property for at least two years to avoid paying capital gains. Learn everything you need to know about the two-year ownership rule and how to calculate capital gains taxes. We'll also review a few alternatives to minimize tax penalties.