This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form Withholding In Los Angeles

Description

Form popularity

FAQ

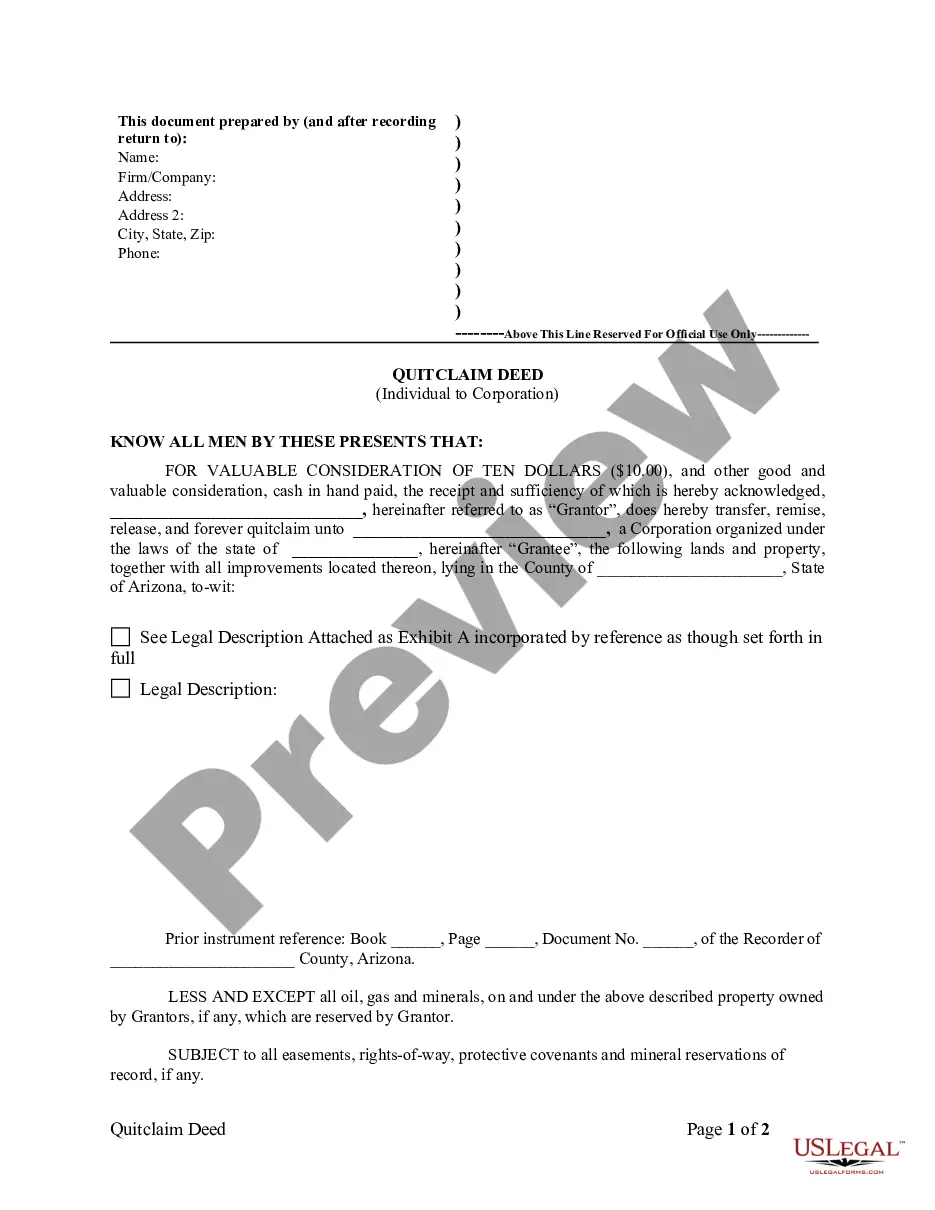

The seller/transferor must complete and sign this form and return it to your REEP or remitter by the close of the real estate transaction for it to be valid. The buyer/transferee is not required to sign Form 593 when no exemptions apply.

The California Constitution states in part that, "Unless otherwise provided by this Constitution or the laws of the US, (a) All property is taxable". That is, unless otherwise exempted, all forms of tangible property are taxable in California and the Assessor is required to assess business personal property.

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

WHICH STATES DO NOT TAX BUSINESS PERSONAL PROPERTY? North Dakota. South Dakota. Ohio. Pennsylvania. New Jersey. New York. New Hampshire. Hawaii.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st.

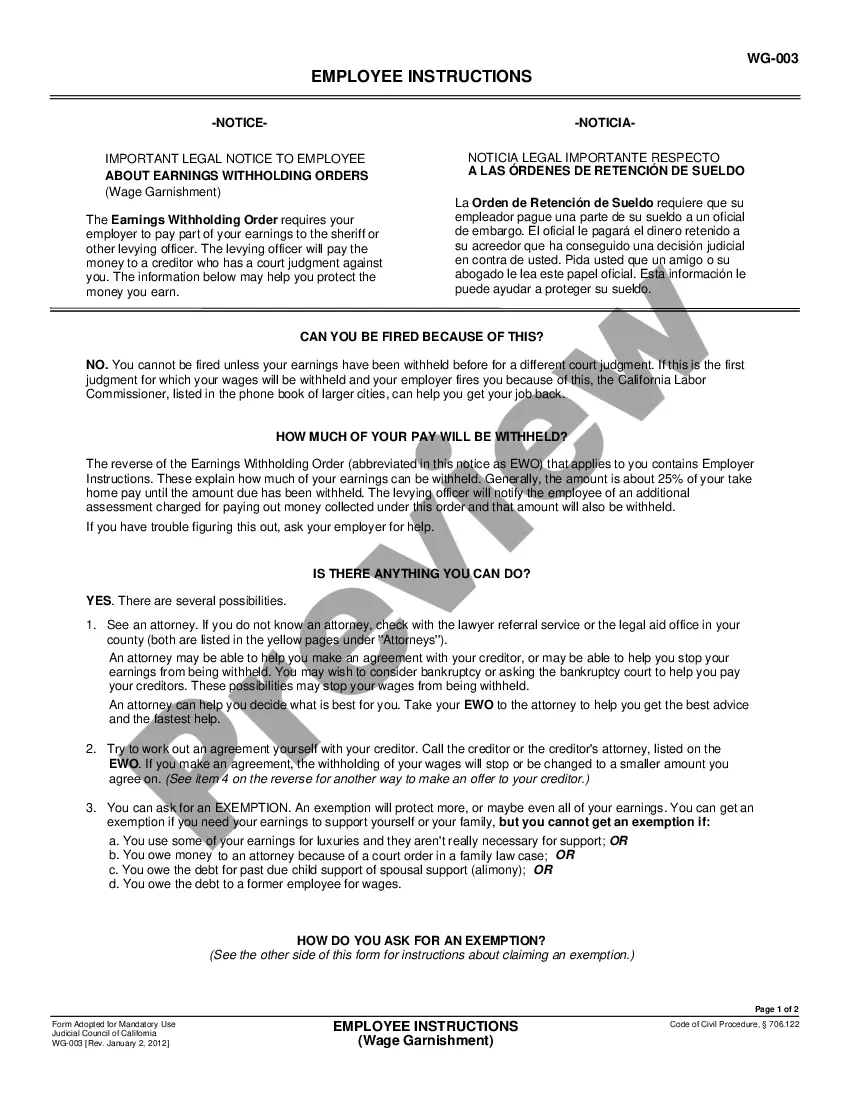

You must file the state form DE 4 to determine the appropriate California PIT withholding. If you do not provide your employer a completed DE 4, your employer must use Single with Zero withholding allowance.

Unsecured (Personal) Property Taxes are ad-valorem (value based) property taxes that the Office of the Los Angeles County Assessor assesses to the owner of record as of January 1 of each year. Because the taxes are not secured by real property such as land, these taxes are called “Unsecured.”

Seller/Transferor and Buyer/Transferee must complete the perjury statement, sign and date on Side 3 of Form 593 when the initial sale occurs. For the remaining installment payments, the Buyer/Transferee must sign all subsequent Form 593s.