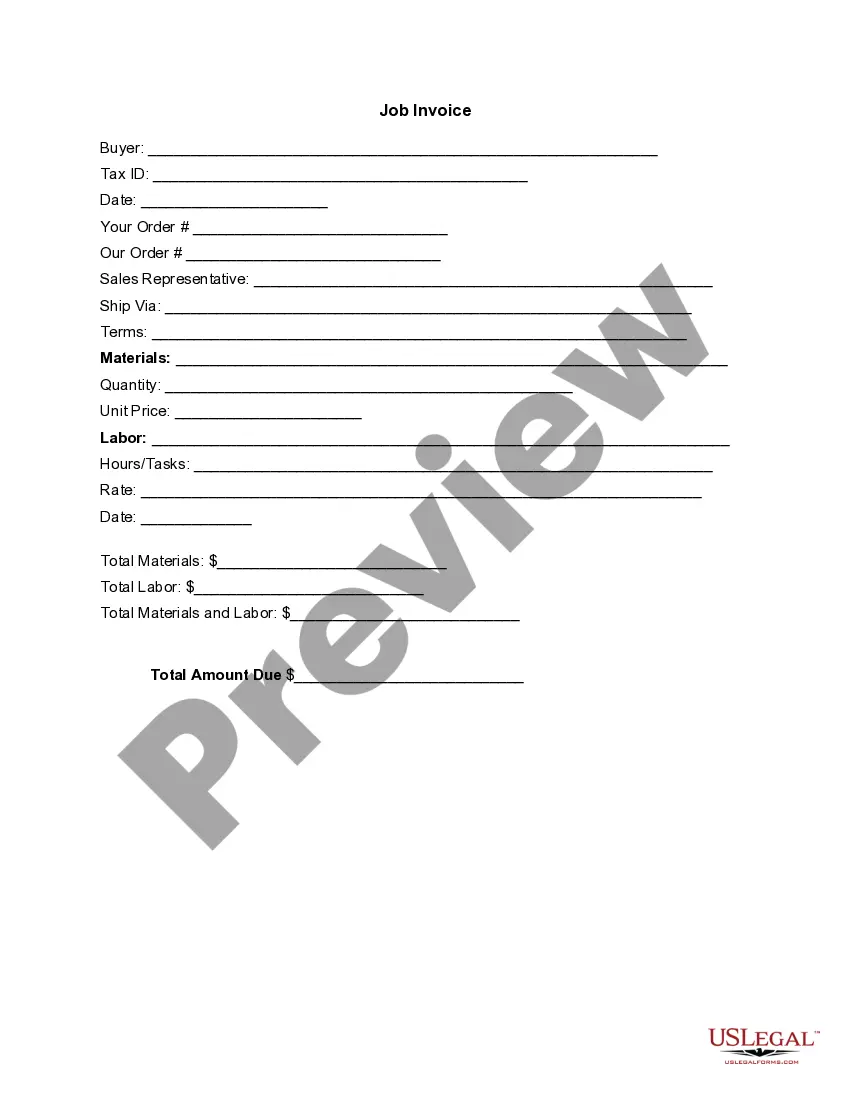

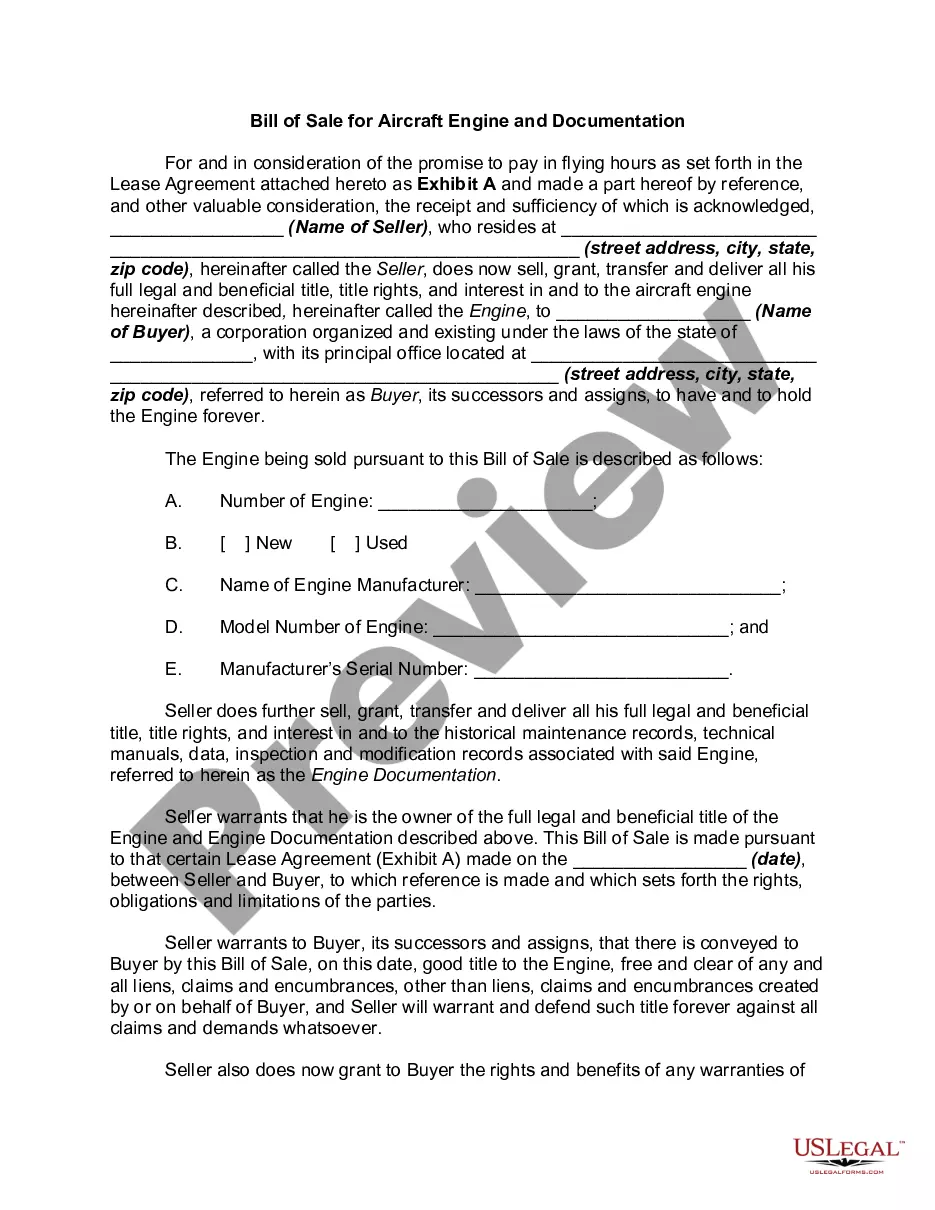

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Business Tangible Personal Property Form With Two Points In Minnesota

Description

Form popularity

FAQ

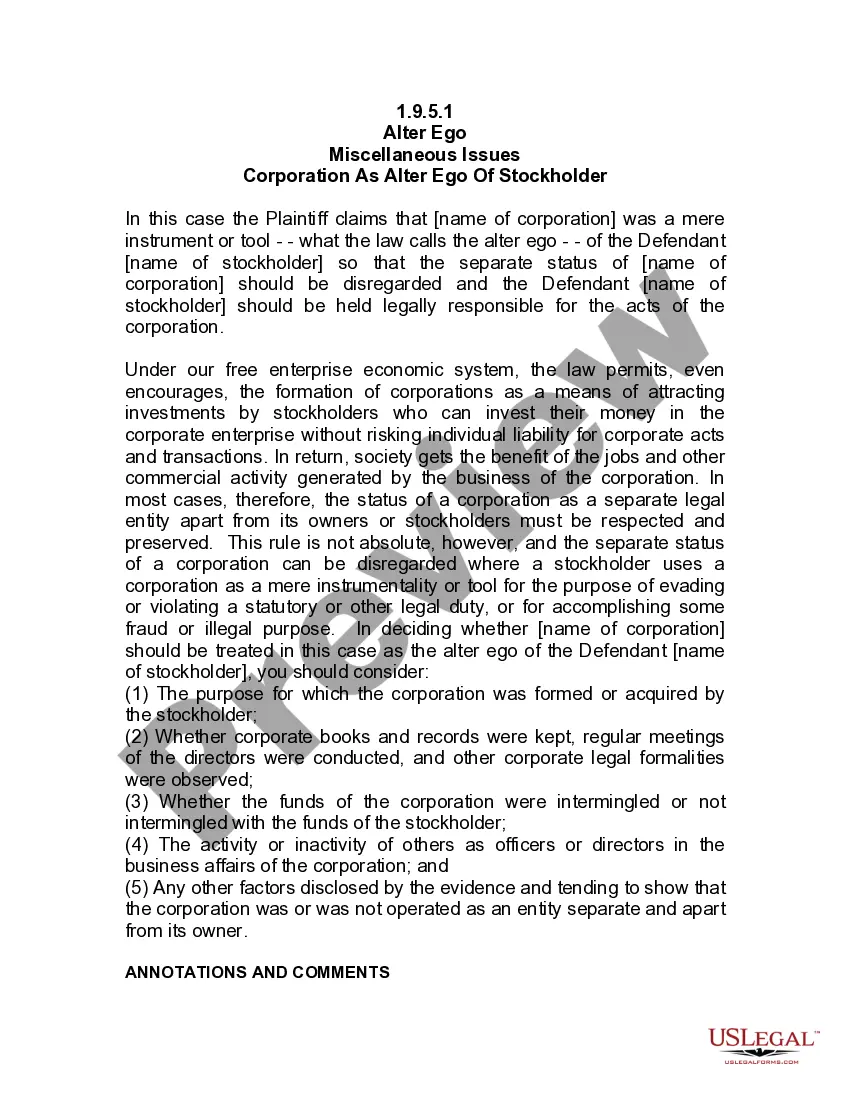

You can touch tangible personal property with your hands, so things like jewelry, your wedding ring, and the rugs in your home are tangible personal property. Intangible personal property can't be physically touched, but it is often a source of contention between divorcing couples.

6016. "Tangible personal property." "Tangible personal property" means personal property which may be seen, weighed, measured, felt, or touched, or which is in any other manner perceptible to the senses.

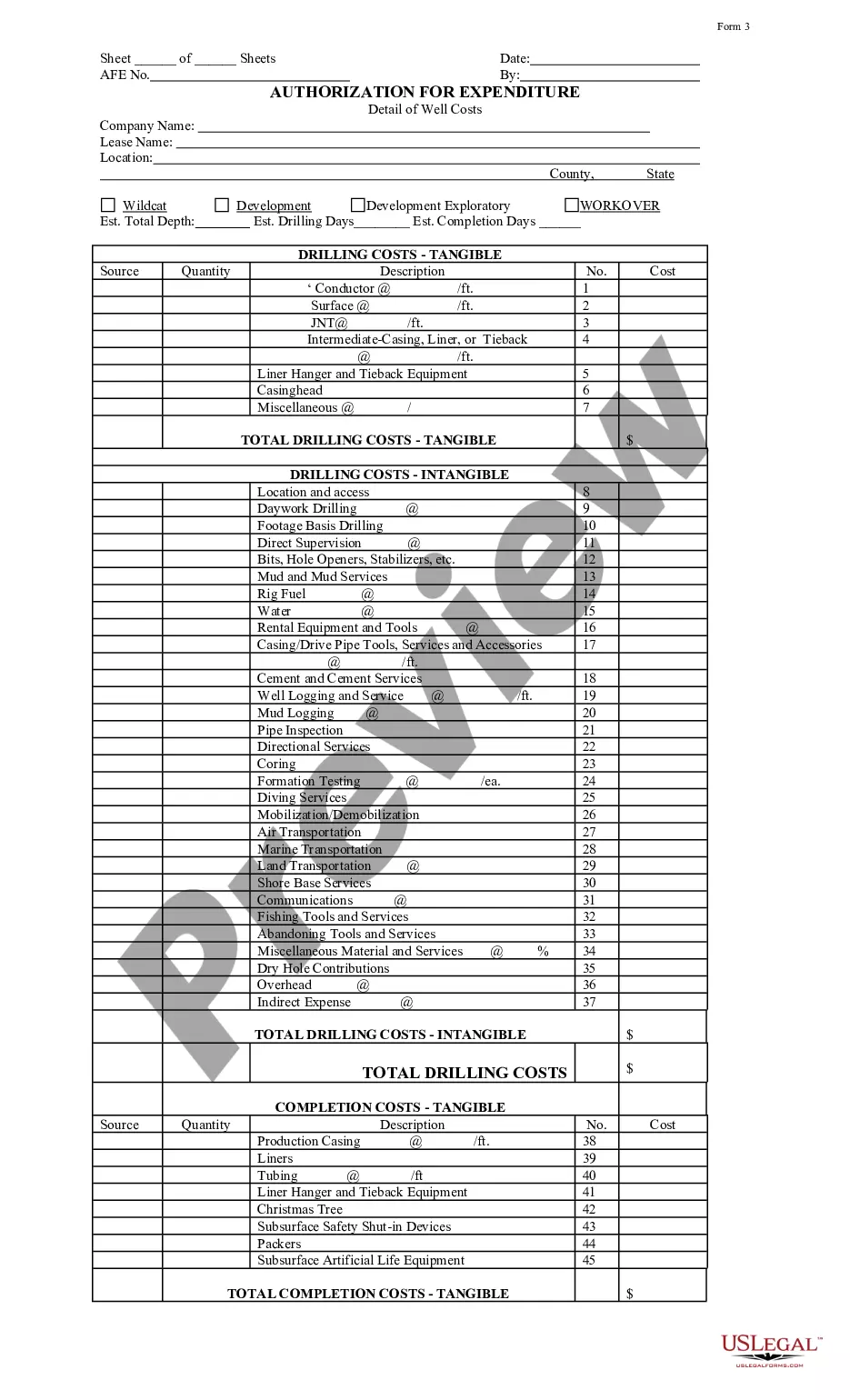

Subd. (a) Tangible property includes land, buildings, machinery and equipment, inventories, and other tangible personal property actually used by the taxpayer during the taxable year in carrying on the business activities of the taxpayer.

Commercial & Industrial Property Tax Minnesota exempts personal property, including machinery and inventory, from the property tax, which lowers the effective tax rate for real and personal property.

Personal property is movable property that is not attached to land. Tangible - movable equipment and machinery, furniture, cars, trade fixtures, etc. Intangible – goodwill, non-compete clauses, patents, copyrights, etc.

Tangible Personal Property includes all furniture, fixtures, tools, machinery, equipment, signs, leasehold improvements, leased equipment, supplies and any other equipment that may be used as part of the ordinary course of business or included inside a rental property.

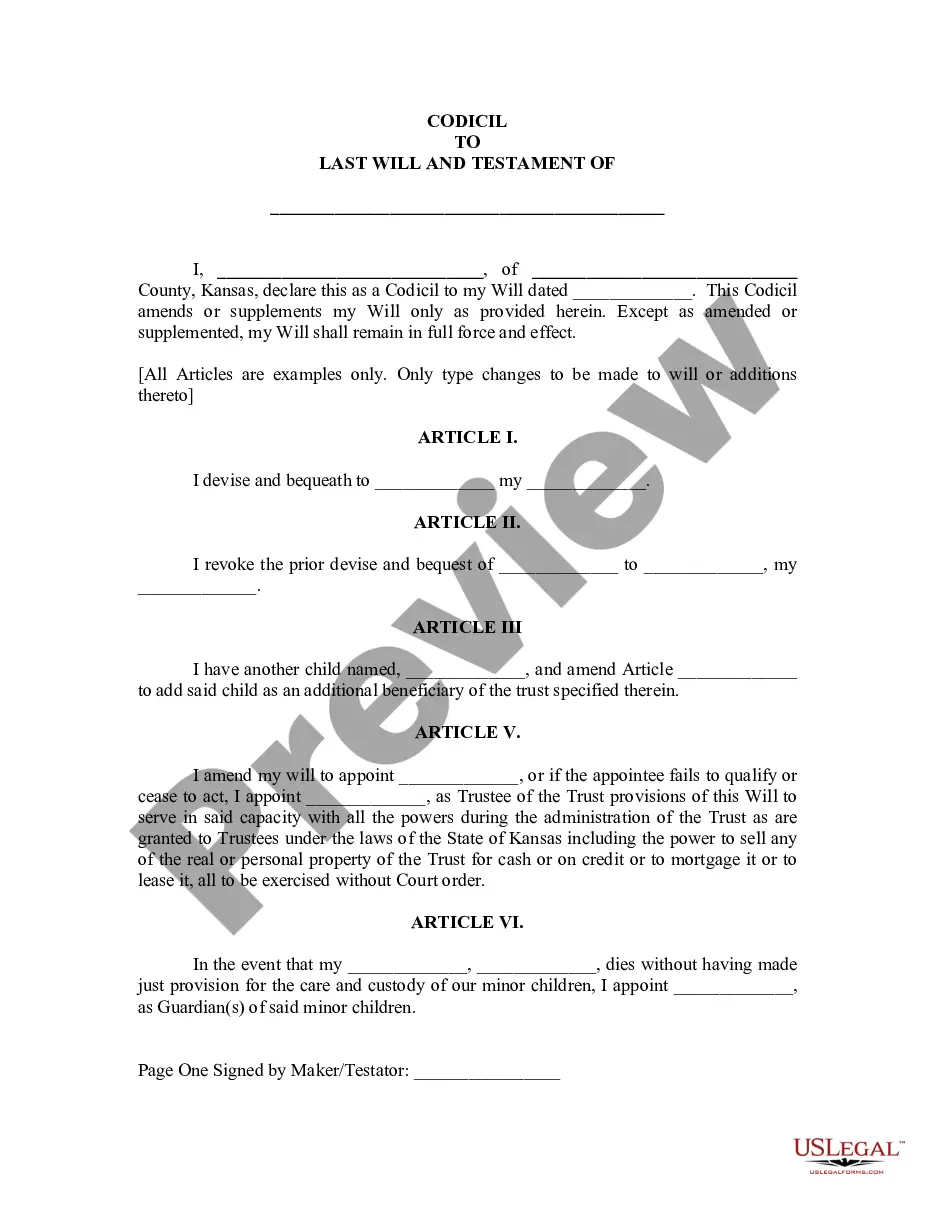

Form M2, regardless if it is consid- ered a resident. When required, the trustee of a trust or the personal representative of an estate is responsible for filing the Minnesota Form M2, Income Tax Return for Estates and Trusts (Fiduciaries) and for paying the tax. Bankruptcy estates.