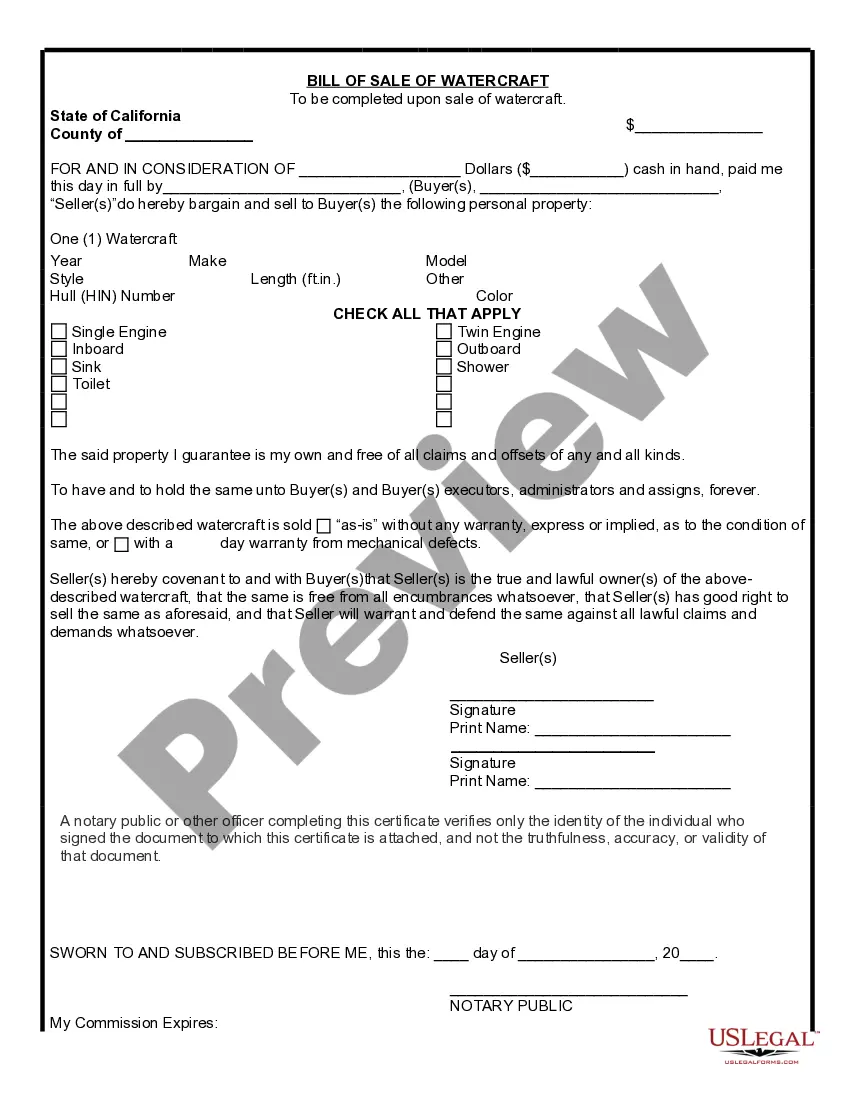

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sale Our For Nri In San Bernardino

Description

Form popularity

FAQ

Buying property overseas doesn't automatically trigger a US tax reporting requirement. Selling foreign property will result in a capital gain or loss that is reportable on your US tax return. Buying or selling foreign property may create tax obligations in your country of residence.

What happens if NRI sells property in India? You can sell your residential or commercial properties in India. The sale proceeds attract TDS, and capital gains attract short or long-term capital gains, depending on your holding period. Also, you can repatriate these proceeds to your home country.

Form 8949. Form 8949 is used to report sales and exchanges of capital assets, ing to the IRS. This form helps consolidate all capital gains and losses from the sale you've made, both short-term and long-term (less than 12 months after becoming the property owner or more, respectively).

You can either sell your property in India while staying abroad (through POA) or when you visit India.

Foreign nationals of non Indian origin resident outside India are not permitted to acquire any immovable property in India unless such property is acquired by way of inheritance from a person who was resident in India.