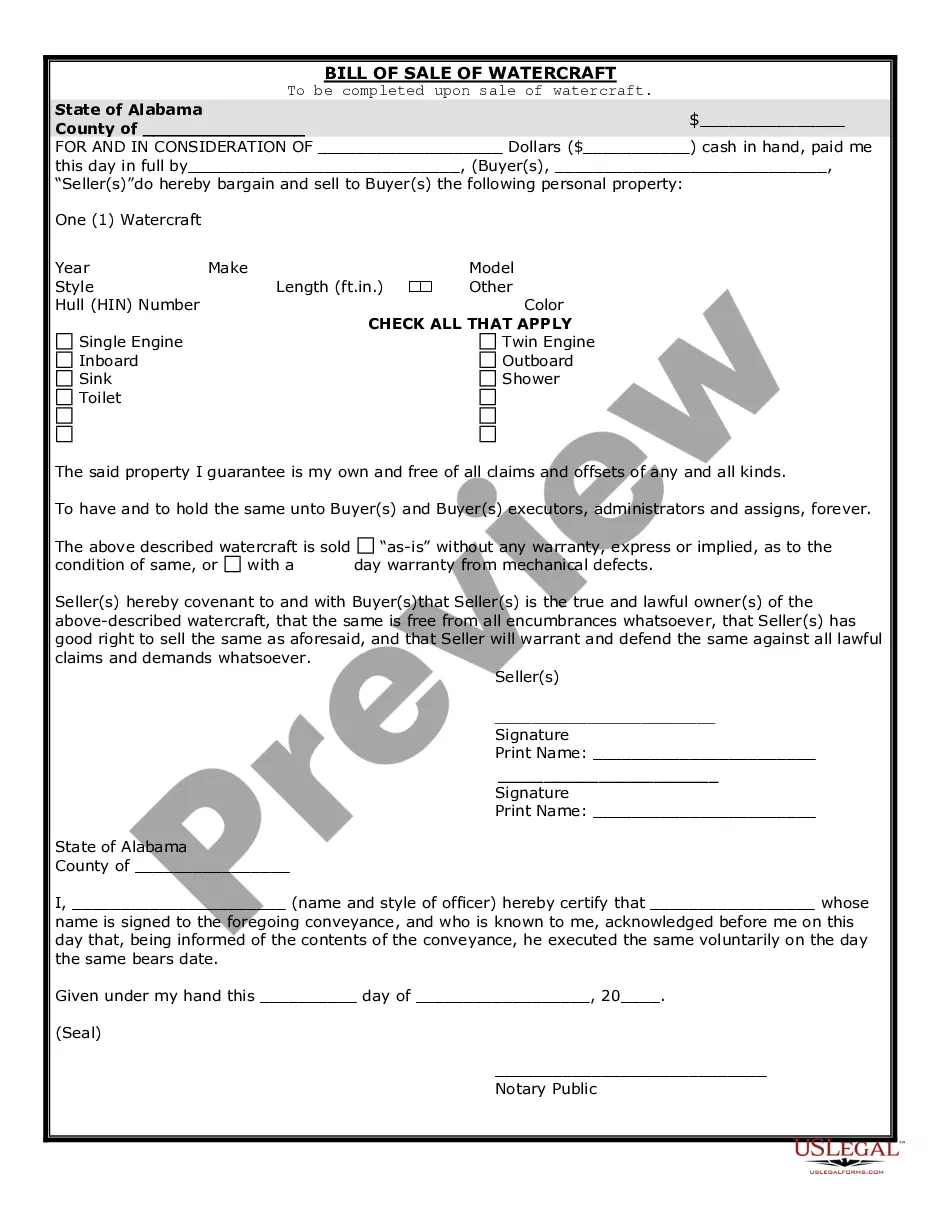

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sale Our For Capital Gains In Wake

Description

Form popularity

FAQ

Who qualifies for 0% capital gains in 2025. Starting in 2025, single filers can qualify for the 0% long-term capital gains rate with taxable income of $48,350 or less, and married couples filing jointly are eligible with $96,700 or less. However, taxable income is significantly lower than your gross earnings.

Inheriting property in California comes with financial opportunities and responsibilities. By leveraging the stepped-up basis, selling strategically, or using tax-saving tools like the principal residence exclusion or a 1031 exchange, you can minimize or avoid capital gains taxes.

Inheriting property in California comes with financial opportunities and responsibilities. By leveraging the stepped-up basis, selling strategically, or using tax-saving tools like the principal residence exclusion or a 1031 exchange, you can minimize or avoid capital gains taxes.

The $250,000/$500,000 home sale tax exclusion - If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.

If you used and owned the property as your principal residence for an aggregated 2 years out of the 5-year period ending on the date of sale, you have met the ownership and use tests for the exclusion. This is true even though the property was used as rental property for the 3 years before the date of the sale.

Sale of your principal residence. We conform to the IRS rules and allow you to exclude, up to a certain amount, the gain you make on the sale of your home. You may take an exclusion if you owned and used the home for at least 2 out of 5 years. In addition, you may only have one home at a time.

Capital gains tax rate 2025 Tax rateSingleMarried filing jointly 0% $0 to $48,350 $0 to $96,700 15% $48,351 to $533,400 $96,701 to $600,050 20% $533,401 or more $600,051 or more Short-term capital gains are taxed as ordinary income ing to federal income tax brackets.

Section 121(a) generally provides, with certain limitations and exceptions, that gross income does not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange, the taxpayer has owned and Page 8 8 used the property as the taxpayer's principal residence ...

What are the two rules of the exclusion on capital gains for homeowners? That the exclusion can be used once every two years and that the house was occupied by the seller two of the last five years.