This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Examples Of Business Personal Property In Washington

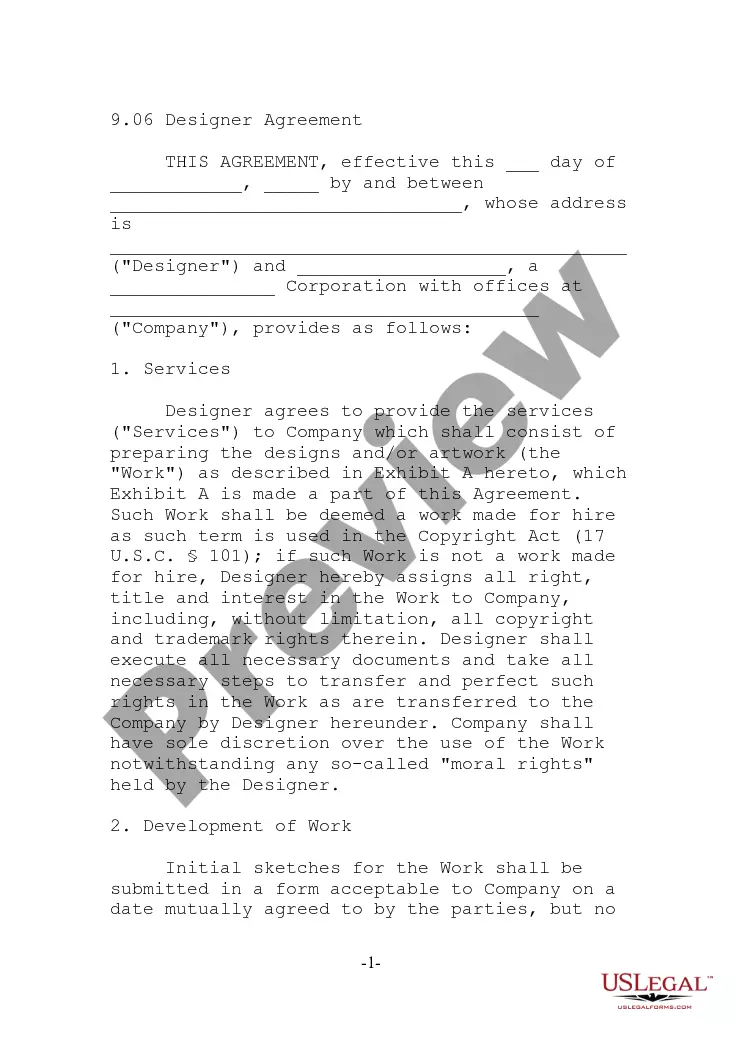

Description

Form popularity

FAQ

Personal property includes machinery, equipment, furniture, and supplies of businesses and farmers. It also includes any improvements made to land leased from the government (leasehold improvements).

BPP insurance covers the contents of your business's building, including moveable property the business owner owns. It also covers property that is in the open, or contained inside of a vehicle, within 100 feet of the building or 100 feet of the premises (whichever is greater).

Business personal property (BPP) insurance covers the equipment, furniture, fixtures and inventory that you own, use or rent inside your workspace. Basically, it covers almost everything except the building itself.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property.

In general, business personal property is all property owned, possessed, controlled, or leased by a business except real property and inventory items. Business personal property includes, but is not limited to: Machinery. Computers. Equipment (e.g. FAX machines, photocopiers)

A BOP also includes general liability coverage. Business personal property insurance just covers the contents of your business space — equipment, inventory, furniture and upgrades you made to the space.