This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Money Order Form For Lending In North Carolina

Category:

State:

Multi-State

Control #:

US-0016LTR

Format:

Word;

Rich Text

Instant download

Description

Form popularity

FAQ

North Carolina interest rate laws set the maximum rate at 8 percent, but explicitly allow consumers and creditors to "contract for a higher rate." State law also exempts mortgage loans, equity lines of credit, and some other types of credit from the statutory limit.

A family agreement should include everyone's contributions, what they expect in return, and what should happen if the agreement ends.

More info

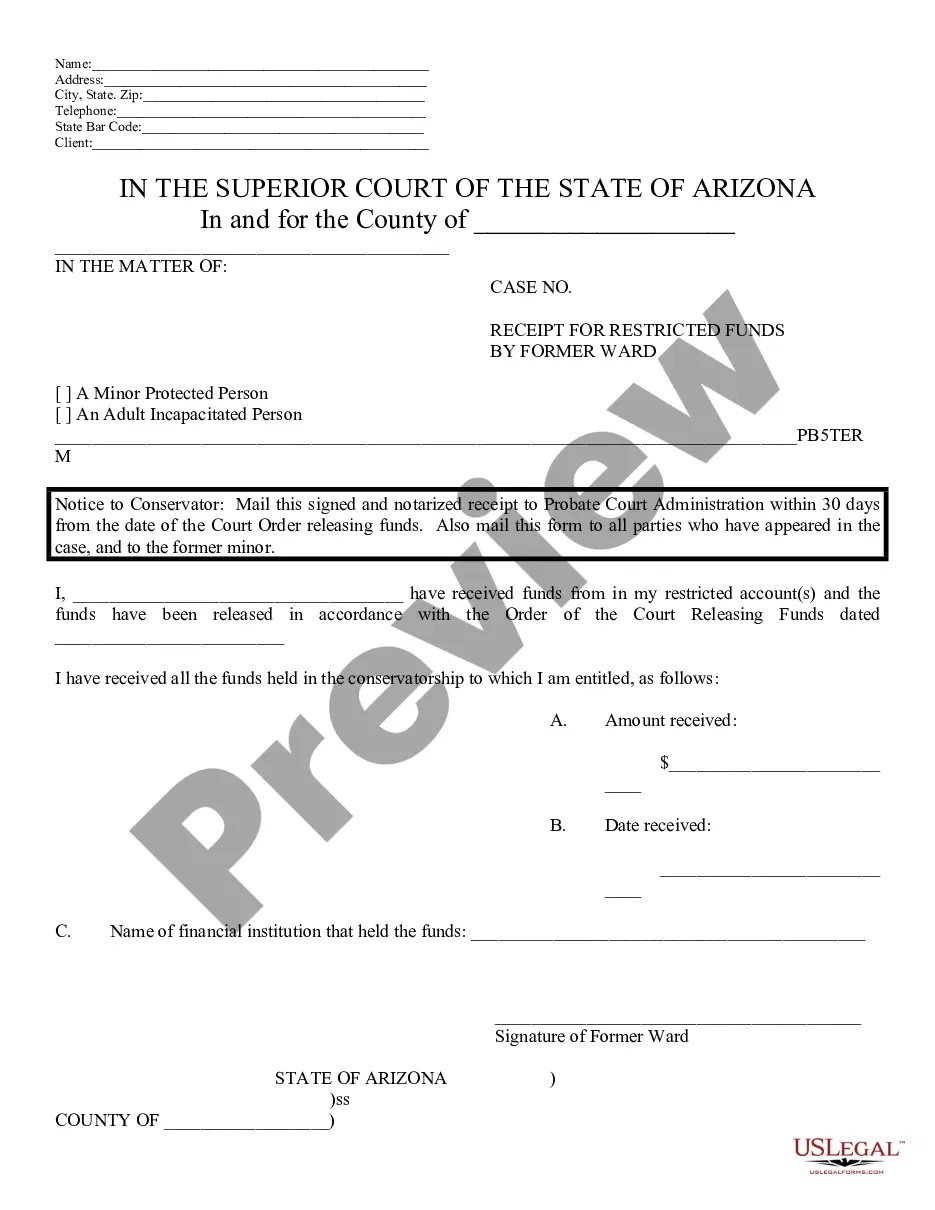

The below deposit form must accompany your money order. A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule.Are you looking for a loan agreement form in North Carolina? A personal loan agreement can protect both you and the borrower when you lend money. Use our step-by-step guide for how to write a personal loan agreement. The North Carolina Unsecured Promissory Note Template is a legal form that establishes the various terms of a loan agreement. Download a loan agreement template to establish a borrower-lender relationship and ensure both parties meet their obligations. If interest is charged, the rate should be included with a repayment schedule. Many documents, including filings made with our Uniform Commercial Code Section, may be viewed on our website. North Carolina specific forms are available below.