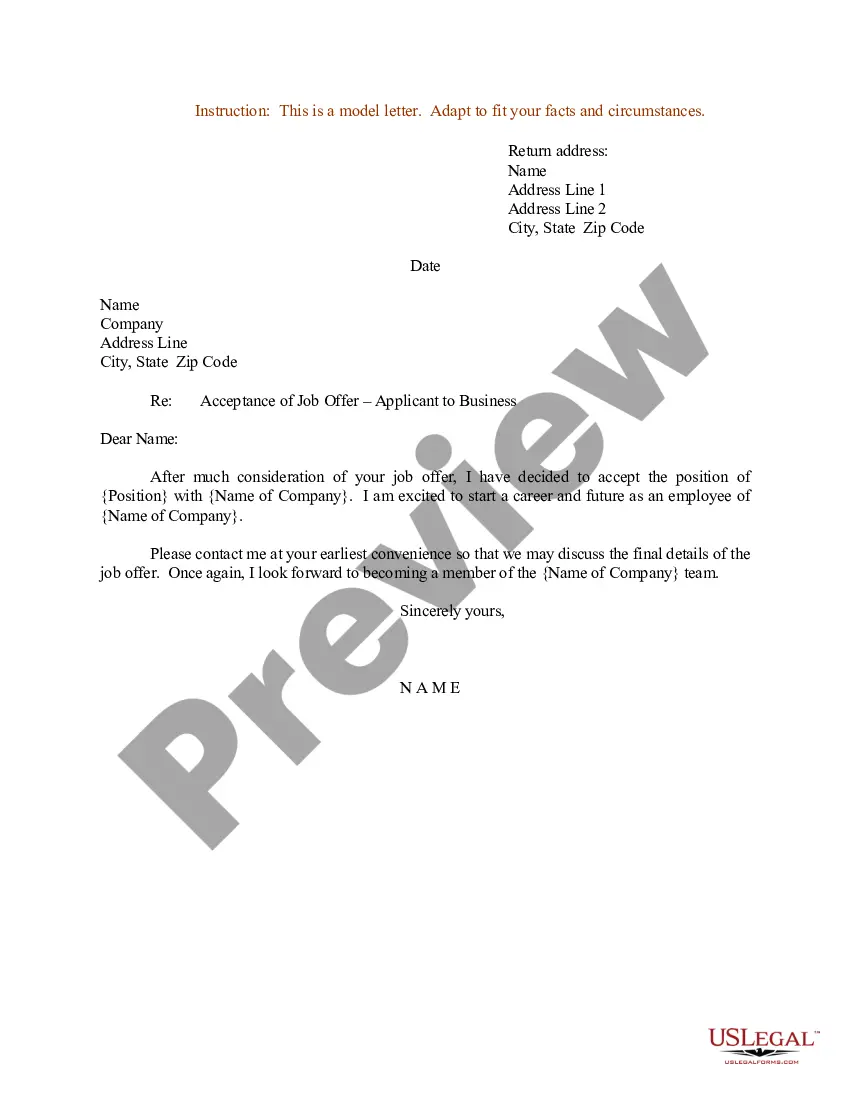

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Money Order With Chime In Washington

Description

Form popularity

FAQ

When you first get access to Mobile Check Deposit, you can deposit up to $2,000 in individual checks, and up to $10,000 in total checks each month.

With Chime, you can deposit up to $2,000 per check up to 10 times a month. Chime has a total check deposit limit of $10,000 per month. Some members may be able to access higher limits.

There's no universal maximum amount for a cashier's check. The limit depends on the issuing bank's policies and the funds you have available.

Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check. The payee typically has quicker access to a larger amount of the funds with a cashier's check.

Digital banks offer cashier's checks to account holders through streamlined online notarization platforms. These banks, such as Chime and Ally, focus exclusively on online services and typically don't have physical branches.

Chime doesn't offer physical checkbooks or allow third-party checks with your account. However, you can use the mail-a-check feature in the Chime app for things like rent, credit cards, and student loans.

Chime doesn't do cashier's checks. Just checks. And they take like a week. Preplan for rent day.

Go to your bank or credit union, or contact it online. Bring a government-issued ID with you to the bank, such as a driver's license or passport. Tell the bank the amount of the cashier's check and the recipient's name. Both will be printed on the check.

Checks deposited through the Chime mobile app typically post up to five business days from the date of the deposit.