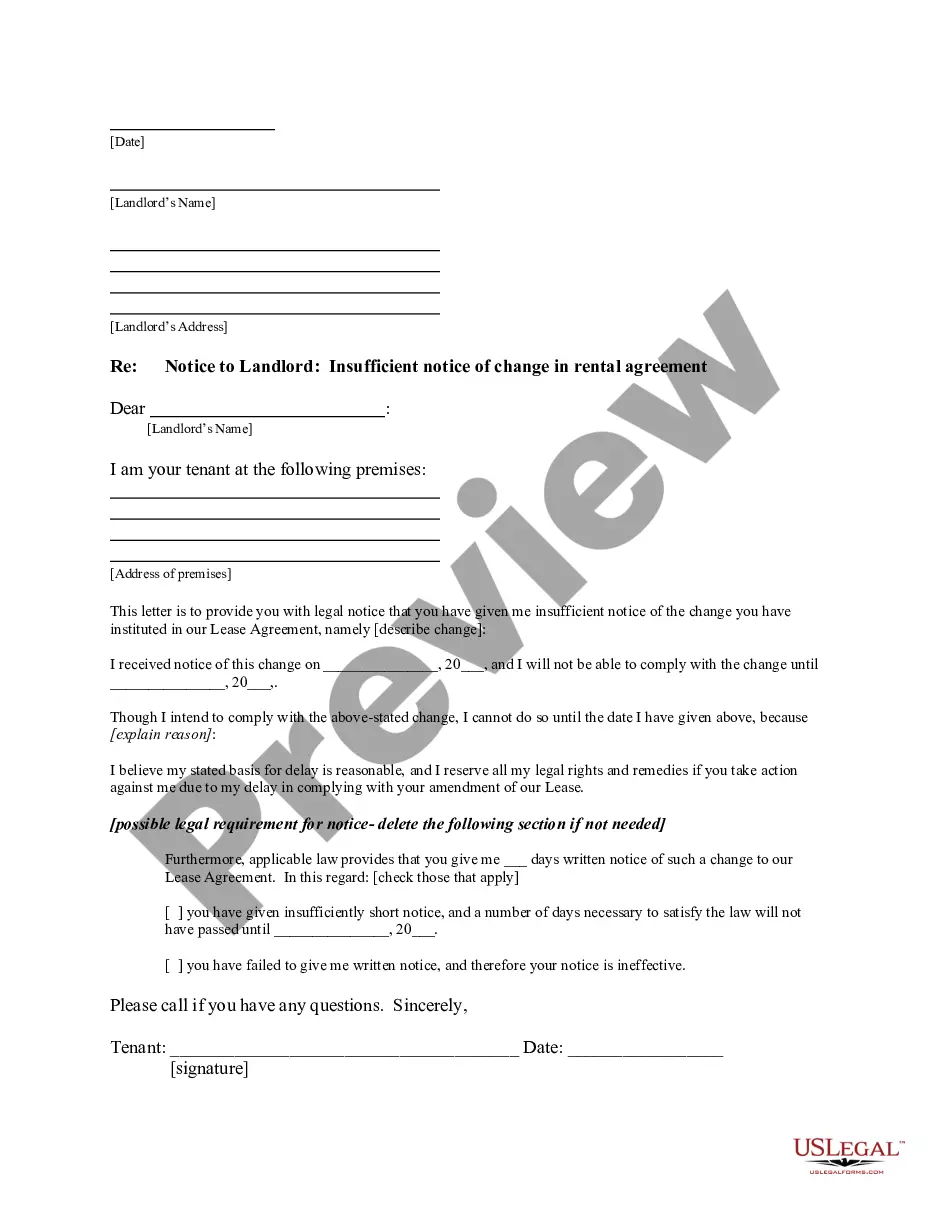

This form is a sample letter in Word format covering the subject matter of the title of the form.

Attorney For The Insurance Company In Nevada

Description

Form popularity

FAQ

Steps to Appeal a Health Insurance Claim Denial Step 1: Find Out Why Your Claim Was Denied. Step 2: Call Your Insurance Provider. Step 3: Call Your Doctor's Office. Step 4: Collect the Right Paperwork. Step 5: Submit an Internal Appeal. Step 6: Wait For An Answer. Step 7: Submit an External Review. Review Your Plan Coverage.

The statistic is particularly alarming when one considers that the overwhelming majority of appeals—83.2%—resulted in the insurance company either partially or fully overturning the initial prior authorization denial in 2022. That figure is similar to what the overturn rate was between 2019 and 2021.

The Nevada Division of Insurance, a division of the Nevada Department of Business and Industry, regulates Nevada's $22 billion insurance industry. It regulates and licenses insurance producers, brokers, and other professionals; sets ethical and financial standards for insurance companies; and reviews rates.

File a Complaint with Your State's Insurance Department: If your insurer continues to be uncooperative, you can file a formal complaint with your state's Department of Insurance. They will investigate whether the insurance company is handling your claim fairly and within legal guidelines.

You may be able to sue your insurance company for bad faith if they intentionally neglect to perform the duties necessary ing to your policy. If the insurance company knows that the claim is valid but they deny it anyway, you may be able to sue for bad faith.

To file a complaint about Allstate, go online and submit your issue to the Better Business Bureau as well as your state's insurance regulator, then write a review of Allstate on WalletHub. This will either allow Allstate to fix their mistake or it will warn other consumers of potential problems with Allstate's service.

After completing an investigation, an insurance company is required to settle a claim within a set period of time. This period varies by state and type of claim, but typically ranges from 30-60 days.

How do you file an insurance claim? Document what happened. Create a full incident report, including how, when, who, and where. Get the contact information of everyone who was there including witnesses. Take photos of the scene, surroundings, and damages. Contact your insurance company to notify it of the situation.

Nevada insurance companies have just under three months—or 80 working days—to settle a car accident claim once it has been filed. Along with this timeline, Nevada insurance companies are also held to strict time frames involving acknowledgment and acceptance of the claim.

What can you do if an insurance company is taking too long? Call your insurance company. First and foremost you should give the insurance company every opportunity to fulfill your claim. Review your policy with a different agent. Request a formal denial letter. Call an experienced lawyer to sue the insurance company.