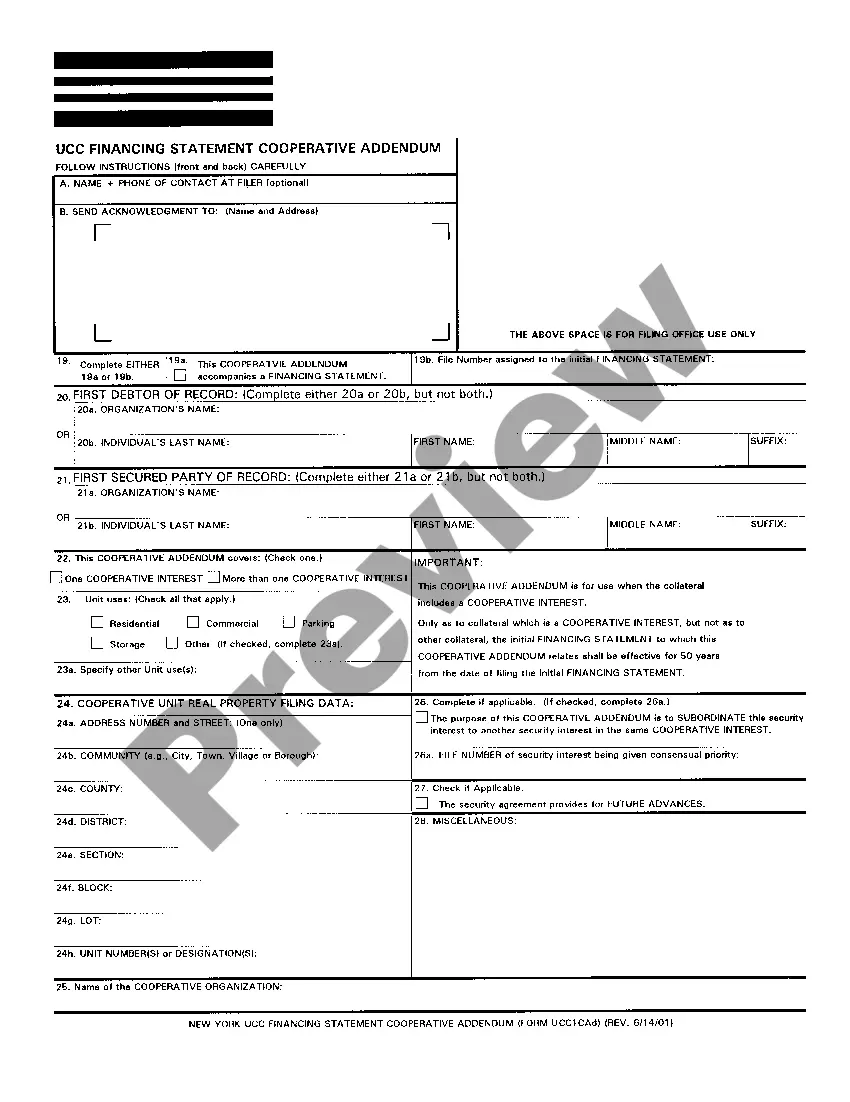

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Bad Credit In Georgia

Description

Form popularity

FAQ

In Georgia, the statute of limitations for filing a lawsuit to collect credit card debt is 6 years.

You may be denied a secured credit card for various reasons, including a lack of credit history, low credit score or no verifiable income. If you've been denied a secured credit card, working toward increasing your credit score can help improve your chances of approval if and when you decide to reapply.

Be sure to have your bank routing number and account number handy when you apply. There's no credit score required to apply for a Discover it®️ Secured Credit Card.

A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more time passes. Unpaid debts and debts in collections also generally come off your credit reports after seven years.

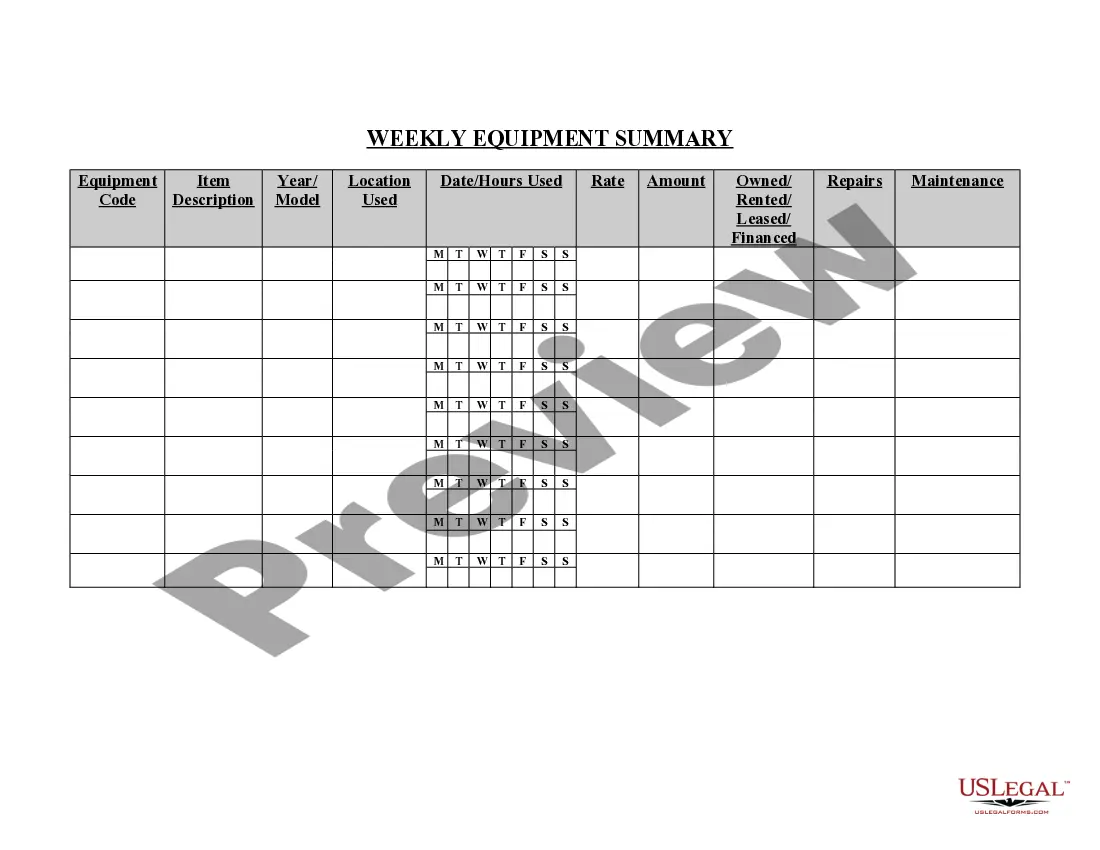

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOpen-ended accounts (including credit cards) Georgia 6 6 Hawaii 6 6 Idaho 5 4 Illinois 10 547 more rows

In Georgia, a lawsuit based on a contract (like a credit card contract) must be filed within six years from the date of default to avoid a statute of limitations defense.

DEBT COLLECTORS CANNOT: contact you at unreasonable places or times (such as before AM or after PM local time); use or threaten to use violence or criminal means to harm you, your reputation or your property; use obscene or profane language;

Without your express permission or permission granted through a court order, a debt collector may not: contact you at unreasonable places or times (such as before a.m. or after p.m. local time); contact you at work if they know your employer disapproves of personal calls; or.

The FCRA protects consumers from inaccurate credit reporting that causes damages and does this by providing a private right of action, which means the right to sue, if creditors and the CRAs don't comply.