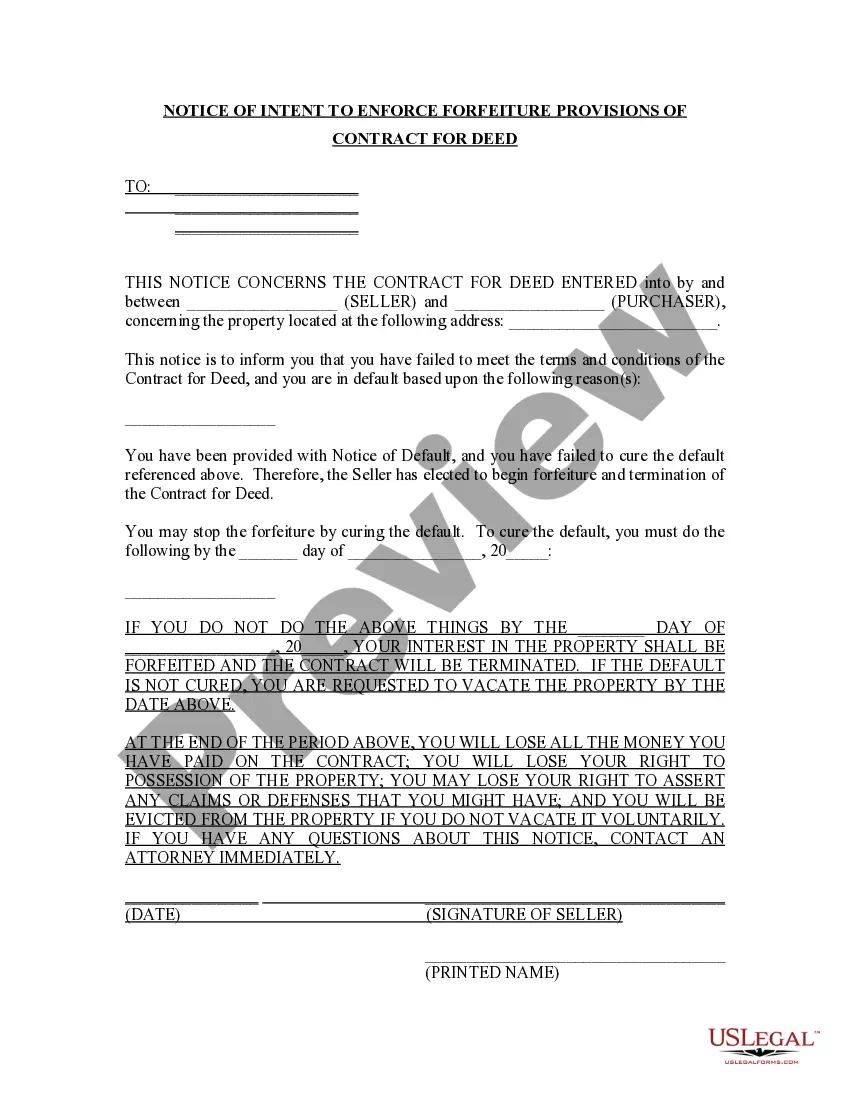

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secure Debt Shall Withhold In Ohio

Description

Form popularity

FAQ

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In Ohio, a judgment lien can be attached to real estate only (such as a house, land, or similar property interest).

Exemptions to Bank Garnishment Ohio and federal law provide for certain exemptions to garnishment. Those include, but are not limited to: An automatic $400 exemption applies to a debtor's bank account, so only funds in excess of that amount may be garnished.

Section 901.51 | Injuring vines, bushes, trees, or crops on land of another. No person, without privilege to do so, shall recklessly cut down, destroy, girdle, or otherwise injure a vine, bush, shrub, sapling, tree, or crop standing or growing on the land of another or upon public land.

Chapter 1312 of the Ohio Revised Code became effective in 2005 and embodies Ohio's Right to Cure Statute. It sets forth the procedure under which a residential contractor may cure a defect prior to an Owner commencing arbitration proceedings or a civil action.

If your state tax refund is being intercepted, you will receive a Notice of Ohio Income Tax Refund Offset for Overdue Support. This notice provides instructions on how to request a tax offset review, if you want to dispute the offset.

If a taxpayer has been assessed and either fails to timely appeal a decision of the commissioner or the taxpayer's appeal is ultimately unsuccessful, any unpaid assessment is certified by the Ohio Department of Taxation to the Attorney General's Collection Enforcement Section.

Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be: Over $0 but not over $5,000 0.501% Over $5,000 but not over $10,000 $25.05 plus 1.001% of excess over $5,000 Over $10,000 but not over $15,000 $75.10 plus 2.005% of excess over $10,0003 more rows •

Line 1: If you can be claimed on someone else's Ohio income tax return as a dependent, then you are to enter “0” on this line. Everyone else may enter “1”.

It just depends on your situation. If you are single, have one job, and have no dependents, claiming 1 may be a good option. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other.