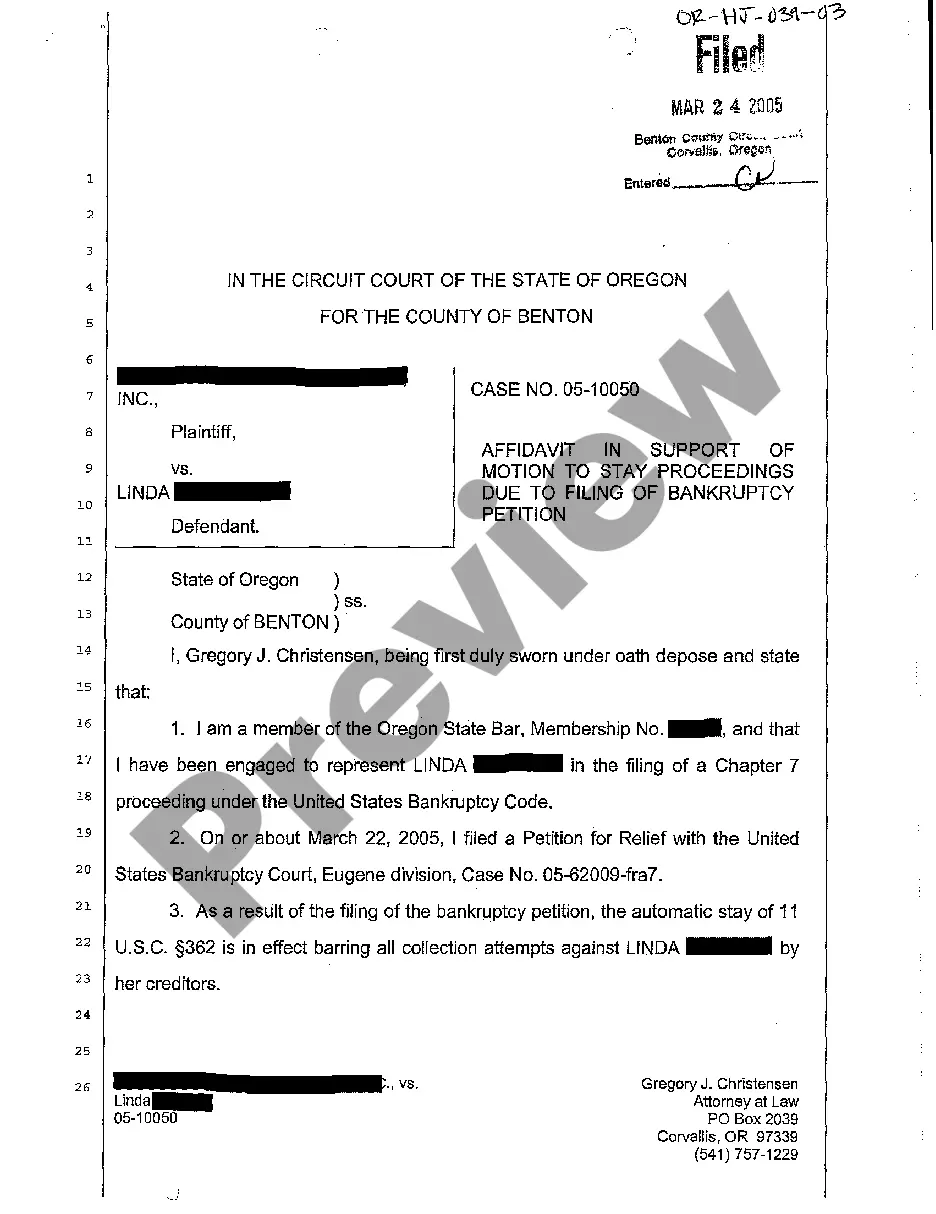

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secure Debt Shall With No Interest In Palm Beach

Description

Form popularity

FAQ

In most states, the statute of limitations for collecting on credit card debt is between three and 10 years, but a few states allow for longer periods, extending up to 15 years.

The statute of limitations in Florida on debt is five years. This means that once the five-year timeline has expired, creditors can no longer file a lawsuit against the borrower to try and recover the debt. This is only true of debts that include a written agreement, though.

The statute of limitations in Florida on debt is five years. This means that once the five-year timeline has expired, creditors can no longer file a lawsuit against the borrower to try and recover the debt. This is only true of debts that include a written agreement, though.

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.

For instance, a collector may not use threats of violence against the person, property or reputation; use obscene or profane language; advertise the debt; or repeatedly or continuously make telephone calls with the intent to harass or abuse the person at the called number.

Debt forgiveness is when a lender or creditor agrees to wipe out all or part of a debt. You may be able to apply if you have unsecured debts like credit cards, student loans or tax debt. Medical debts and mortgages may also qualify for some types of relief.

Debt relief plans can help make your payments more manageable, but they're not right for everyone. It's important for you to understand how each plan or program works and how debt relief can affect your finances.

Which debt solutions write off debts? Bankruptcy: Writes off unsecured debts if you cannot repay them. Any assets like a house or car may be sold. Debt relief order (DRO): Writes off debts if you have a relatively low level of debt. Must also have few assets. Individual voluntary arrangement (IVA): A formal agreement.

You cannot legally go to jail over debt. This is referred to as a ``debtor's prison'' and is not a legally acceptable practice.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.