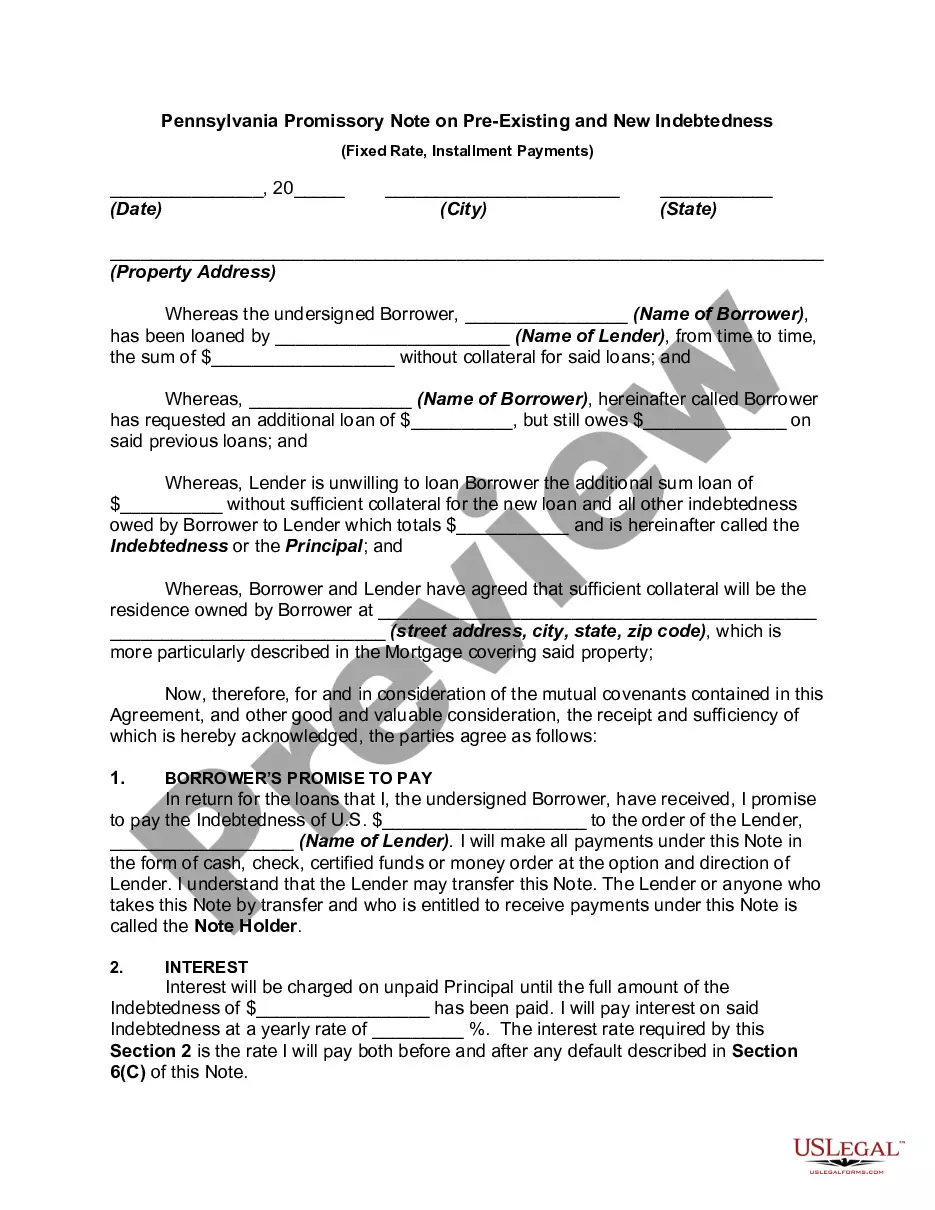

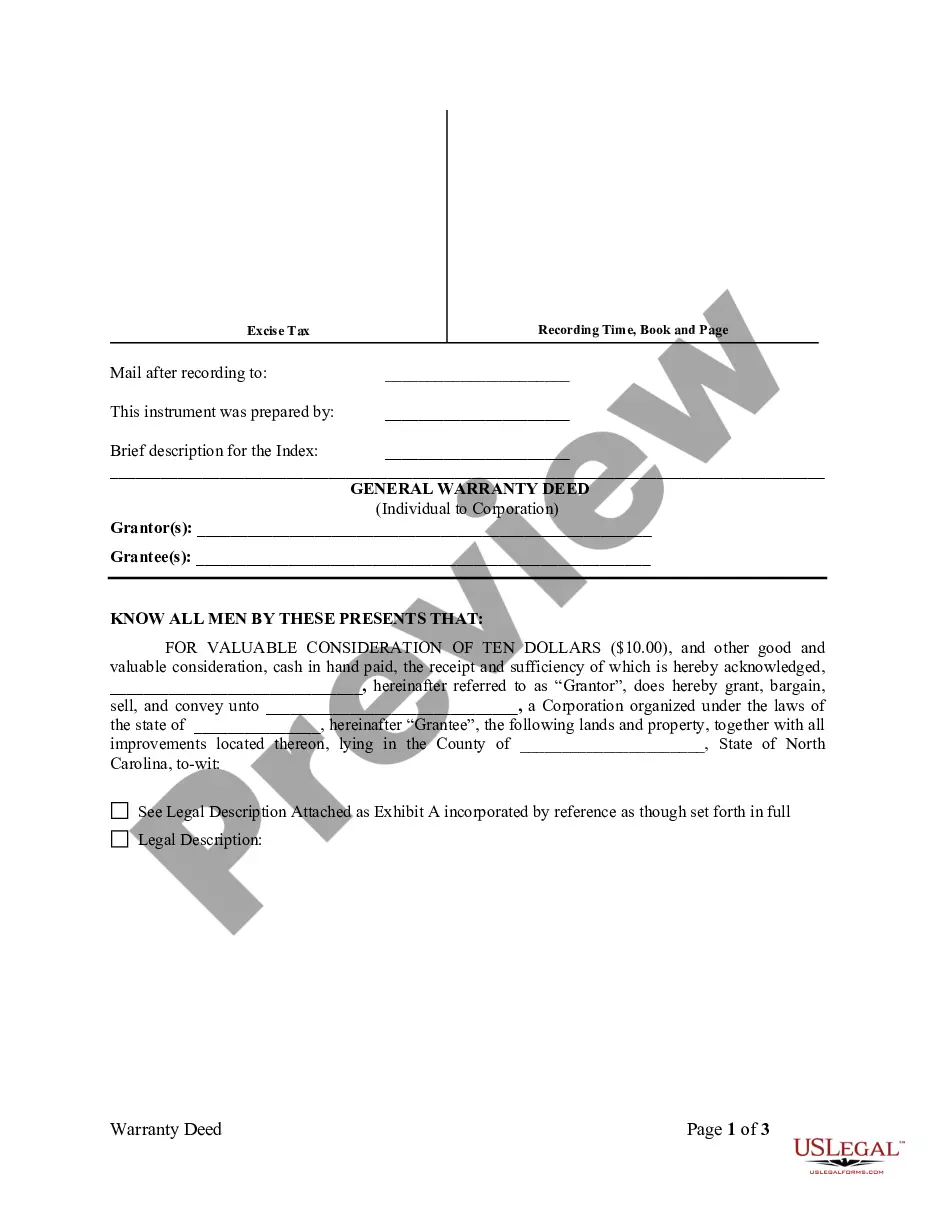

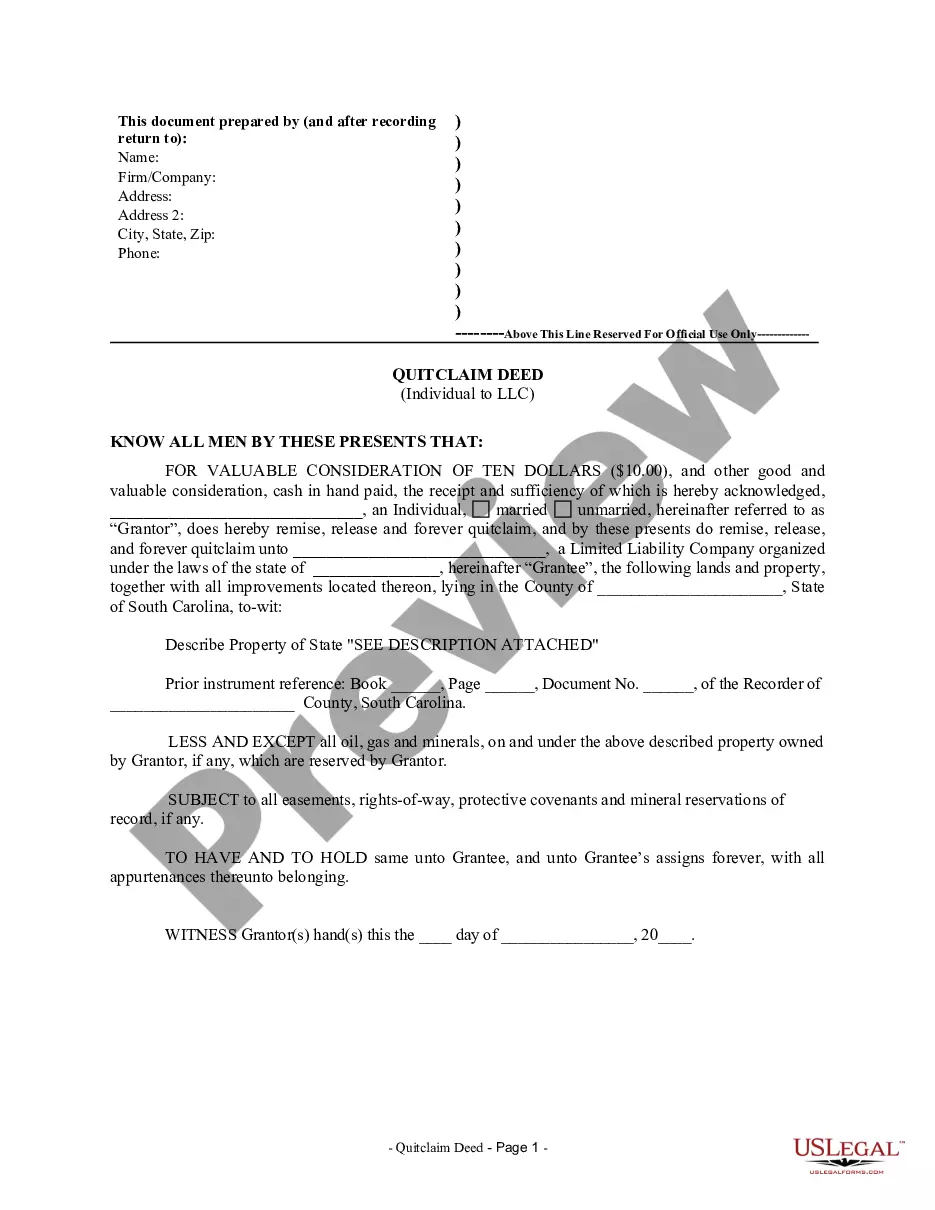

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Security Debt Any For Dummies In Pennsylvania

Description

Form popularity

FAQ

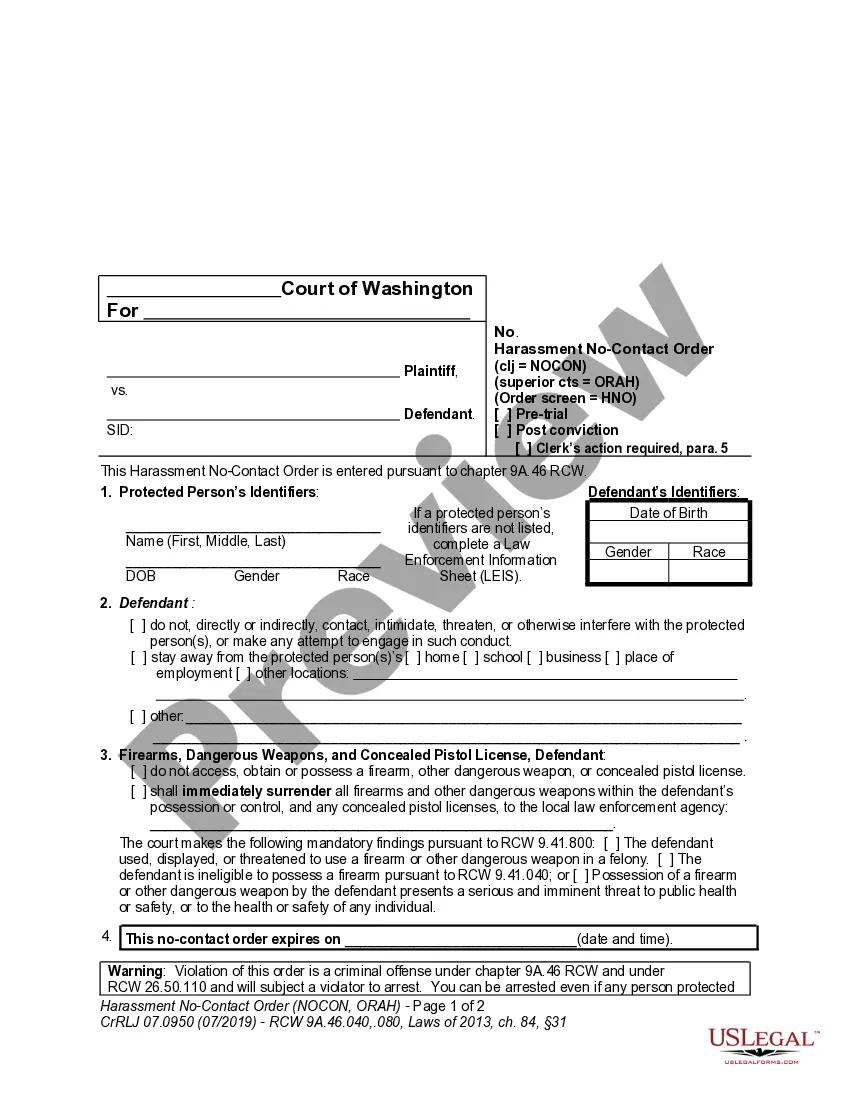

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

Pennsylvania exempts from execution on judgment on a contract all wearing apparel of the debtor and his family, bibles and school books in use in the family, as well as $300 worth of any property owned or in pos- session of the debtor.

The phrase in question is: “Please cease and desist all calls and contact with me, immediately.” These 11 words, when used correctly, can provide significant protection against aggressive debt collection practices.

If you file for a Chapter 7 bankruptcy, your secured debt may be discharged, but the lender is also able to repossess the property that secured the debt. In other words, if you have a mortgage on your home and file a Chapter 7 bankruptcy, the mortgage debt may be discharged but the lender can take back your home.

Criminal statute of limitations is capped at the age of adulthood plus 32 years, ie age 50 for most. Criminal statute of limitations for adults is capped at 12 years after the offense was committed. Civil statute of limitations for adults is capped at 2 years after the offense was committed.

In most states, the statute of limitations for collecting on credit card debt is between three and 10 years, but a few states allow for longer periods, extending up to 15 years.