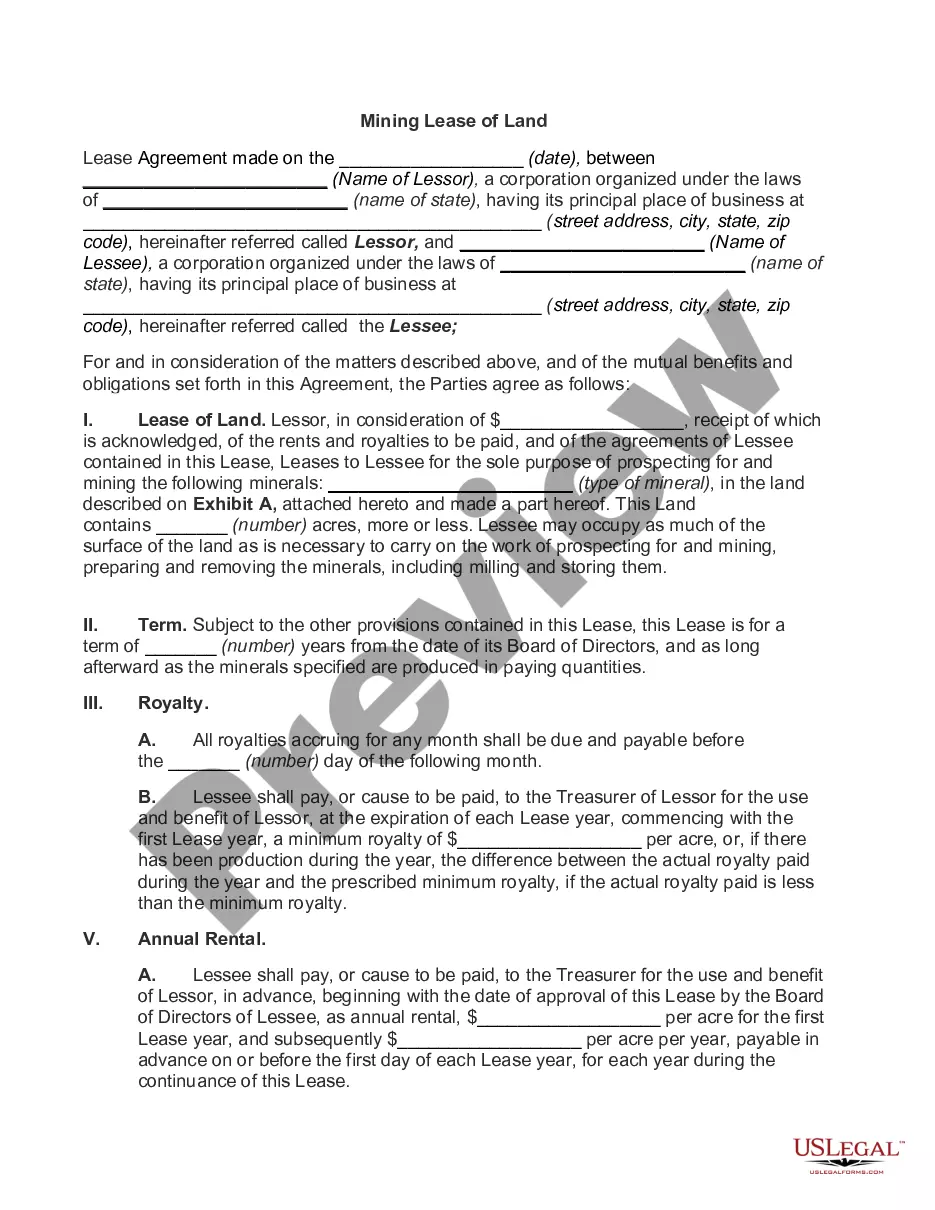

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Loan In Sacramento

Description

Form popularity

FAQ

Compare the Best Secured Personal Loans for February 2025 Best ForAPR Range Patelco Credit Union Best Overall, Best Credit Union 9.30% - 17.90% Upgrade Best for Fair or Bad Credit 7.99% - 35.99% OneMain Financial Best for Range of Vehicles 18.00% - 35.99% Best Egg Best for Homeowners 6.99% - 35.99%1 more row

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Certain actions, like making a payment, can reset the clock on old debts and give your creditors more time to take legal action against you. Most consumer debts will “expire” after three to six years, meaning a creditor or debt collector can no longer sue you for them.

California's statute of limitations for most unsecured debts, including credit card debt, is four years. This means creditors or debt collectors have four years from the date of your last payment to file a lawsuit against you to recover the debt.

Yes. This is known as the statute of limitations, and it is based on the date when you first stopped paying the original debt. Each state has it's own statute of limitations, ranging from as little as 3 or 4 years, to as much as 7 or 10 years (or even longer).

Why is a Mortgage Secured Debt? A mortgage is what's called a secured debt because it is backed up by collateral. In this case, the collateral is your home.

Key Takeaways A secured line of credit is guaranteed by collateral, such as a home. An unsecured line of credit is not guaranteed by any asset; one example is a credit card. Unsecured credit always comes with higher interest rates because it is riskier for lenders.