Secure Debt Shall Forget The Day In San Antonio

Description

Form popularity

FAQ

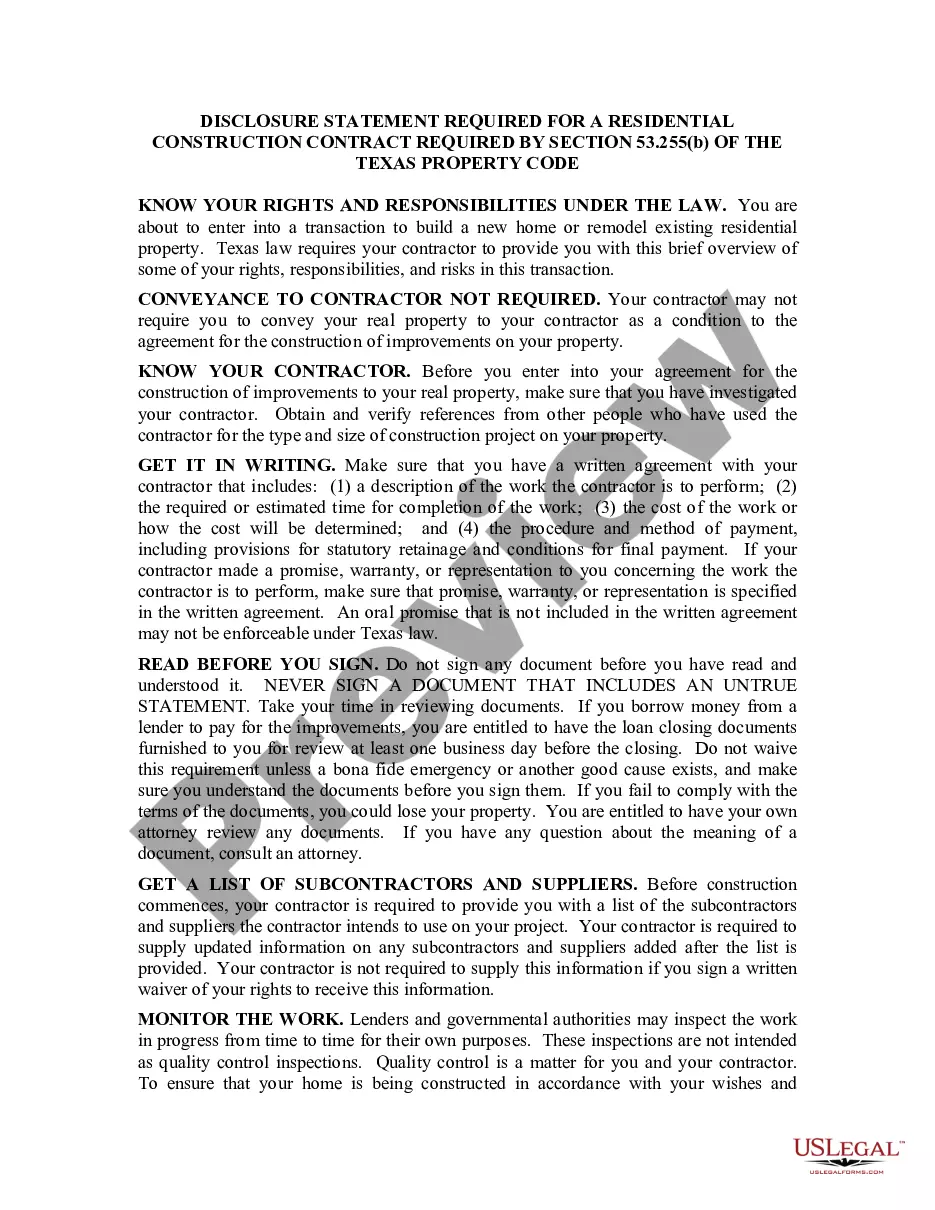

The new Texas debt collection laws require debt collectors to offer additional information about the debt they're attempting to collect. This includes a breakdown of the original amount owed, any added interest or fees, and the name of the original creditor.

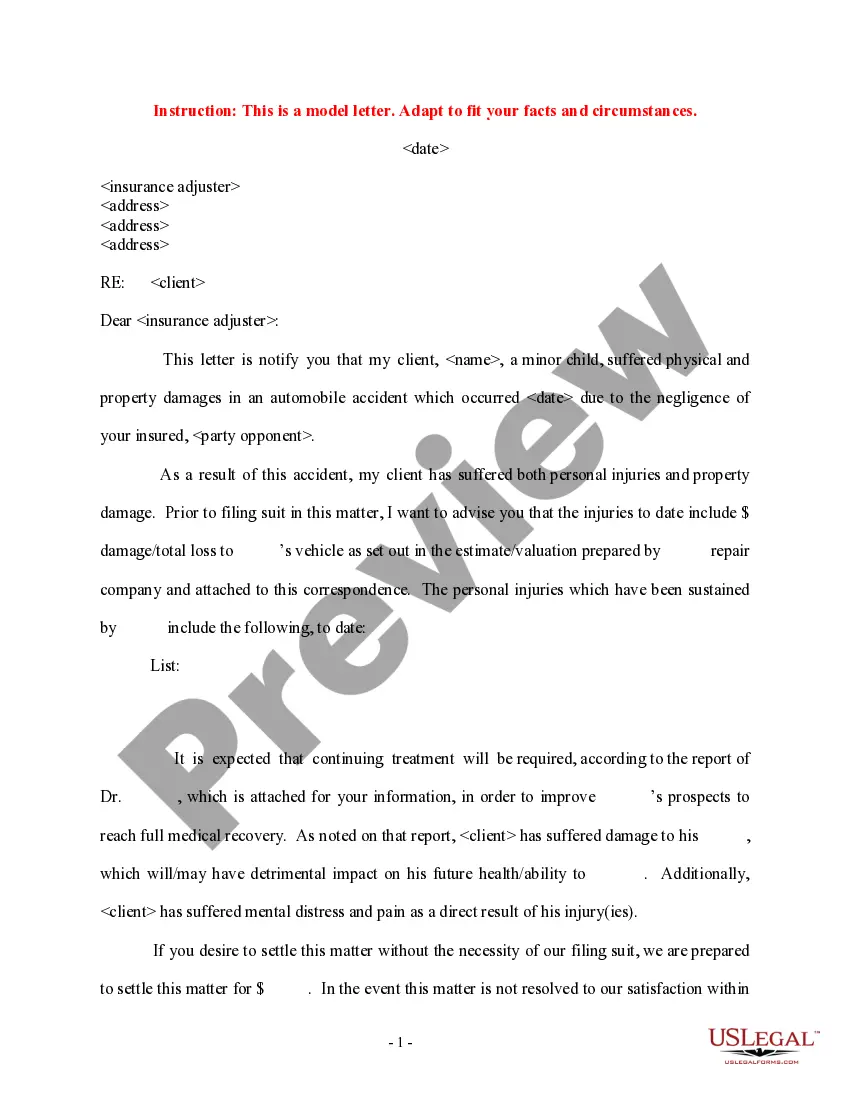

Ignoring debt collectors might cause further issues. It might make your financial burden larger. You may get served a lawsuit if your creditor believes you owe them a significant debt.

Debt Collection Statute of Limitations by State StateWritten ContractPromissory Notes Alaska 3 years 3 years Arizona 6 years 6 years Arkansas 5 years 5 years California 4 years 4 years47 more rows •

A debt collector cannot lie or use deceptive practices to collect a debt. They cannot falsely claim to be attorneys or government representatives, misrepresent the amount you owe, falsely claim you've committed a crime or threaten legal action they cannot or do not intend to take.

Settling is always better than going to court. A court-ordered judgment is SERIOUSLY life-affecting. Your wages could be garnished and the judgment will forever be on your record. You may even find the court case in various places on the internet.

Texas law gives someone 4 years to bring a lawsuit for unpaid debt. This time period is commonly referred to as the statute of limitations. Once the time period is up, a person is prohibited from filing suit to recover the debt. This means the debt is time-barred.

Settling is always better than going to court. A court-ordered judgment is SERIOUSLY life-affecting. Your wages could be garnished and the judgment will forever be on your record. You may even find the court case in various places on the internet.

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.