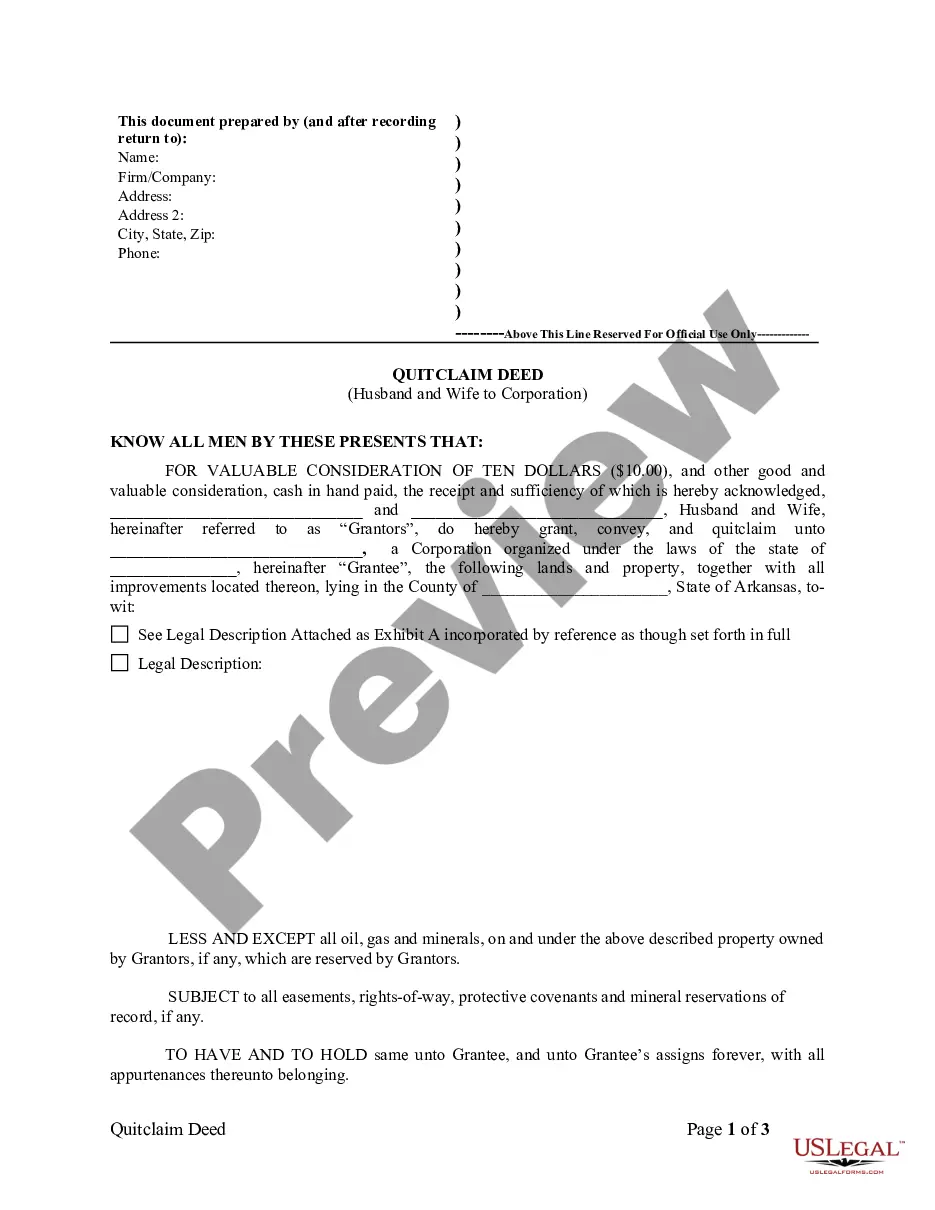

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Bad Credit In San Bernardino

Description

Form popularity

FAQ

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

To qualify for Chapter 7 bankruptcy in California, your income must be below the state's median income for your household size. For example, as of 2024, the monthly income limit is $5,030 for a single-person household and $8,620 for a four-person household.

Who Can File for Chapter 7? You are an individual, married couple, or small business owner. You must pass the Means Test to show you do not have enough income to repay debts. You must not have filed a previous Chapter 7 in the past 8 years, or a previous Chapter 13 in the past 6 years.

Highlights: Most negative information generally stays on credit reports for 7 years.

Secured debts are written off very differently than unsecured debts. The reason for this is because they have collateral against them. If you stop paying them, as per the original terms the creditor will have the right to seize the asset.

Strategies like debt management plans, alternative consolidation loans and even debt settlement programs provide relief tailored to those with low credit scores. While each option has its pros and cons, the key is to choose the one that aligns with your financial situation and long-term goals.

If your credit score is lower than 670, debt consolidation may not be a good option for you. Consolidating debt when you have bad credit can be challenging.

Chapter 13 Eligibility Any individual, even if self-employed or operating an unincorporated business, is eligible for chapter 13 relief as long as the individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief.