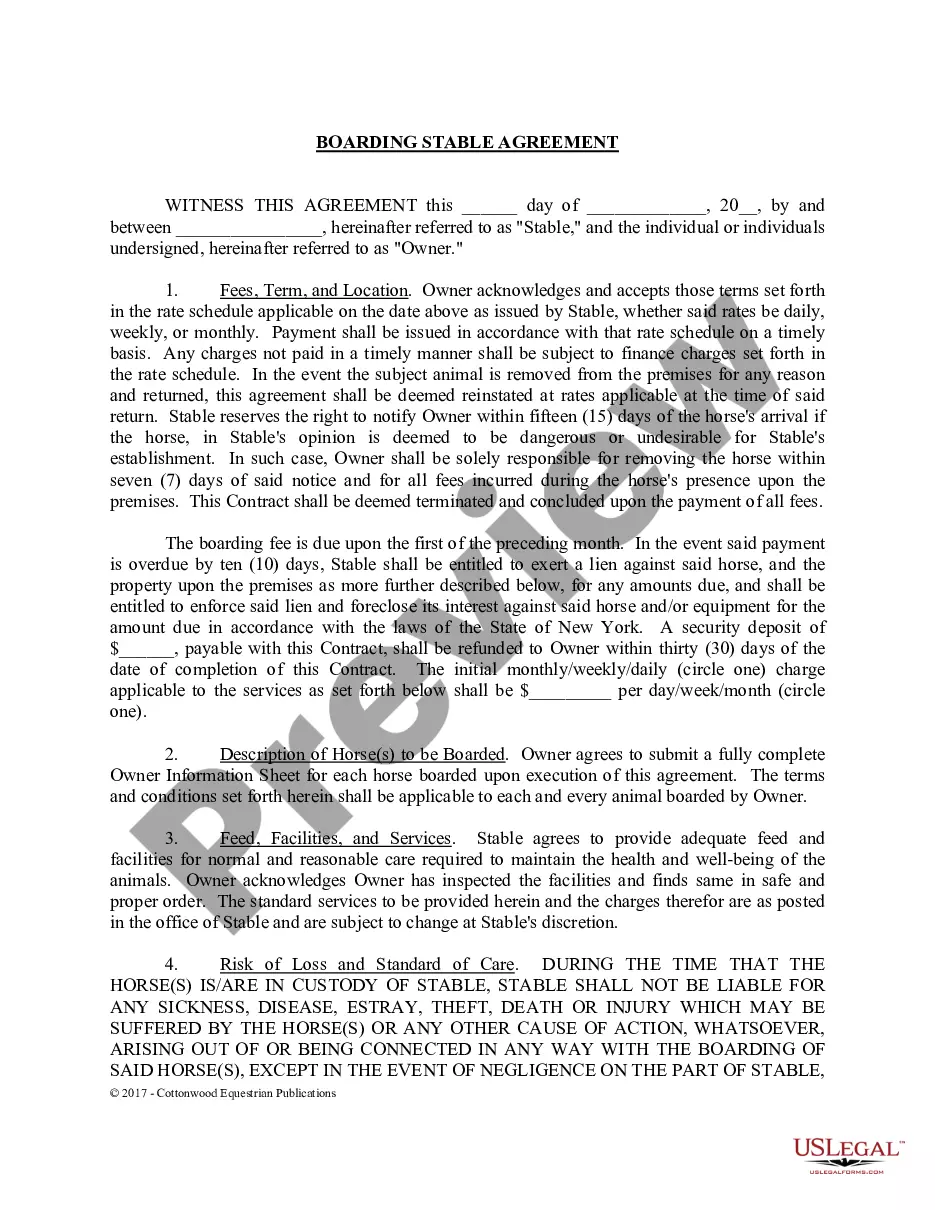

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Shall Formula In San Diego

Description

Form popularity

FAQ

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Secured debt is backed by collateral, whereas unsecured debt doesn't require you to put any assets on the line to get approved. Because lenders take on more risk, unsecured debts tend to have higher interest rates and stricter eligibility requirements than secured debt.

What Are the Current Chapter 13 Debt Limits? The debt limitations set for cases filed between April 1, 2022, and March 31, 2025, are $1,395,875 of secured debt, and $465,275 of unsecured debt.

Key takeaways. Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

From the lender's point of view, secured debt can be better because it is less risky. From the borrower's point of view, secured debt carries the risk that they'll have to forfeit their collateral if they can't repay. On the plus side, however, it is more likely to come with a lower interest rate than unsecured debt.

Ing to the bankruptcy code, unpaid credit card, medical, rent, or utility bills would likely be forgiven. Depending on the specifics of each case, personal loans from friends or family and unsecured debts, in general, could also be discharged after bankruptcy.

Chapter 7 bankruptcy is generally more damaging to credit initially because it involves liquidating assets and stays on your credit report for 10 years, whereas Chapter 13 stays for 7 years and demonstrates an effort to repay debts through a structured plan, which may soften the impact over time.