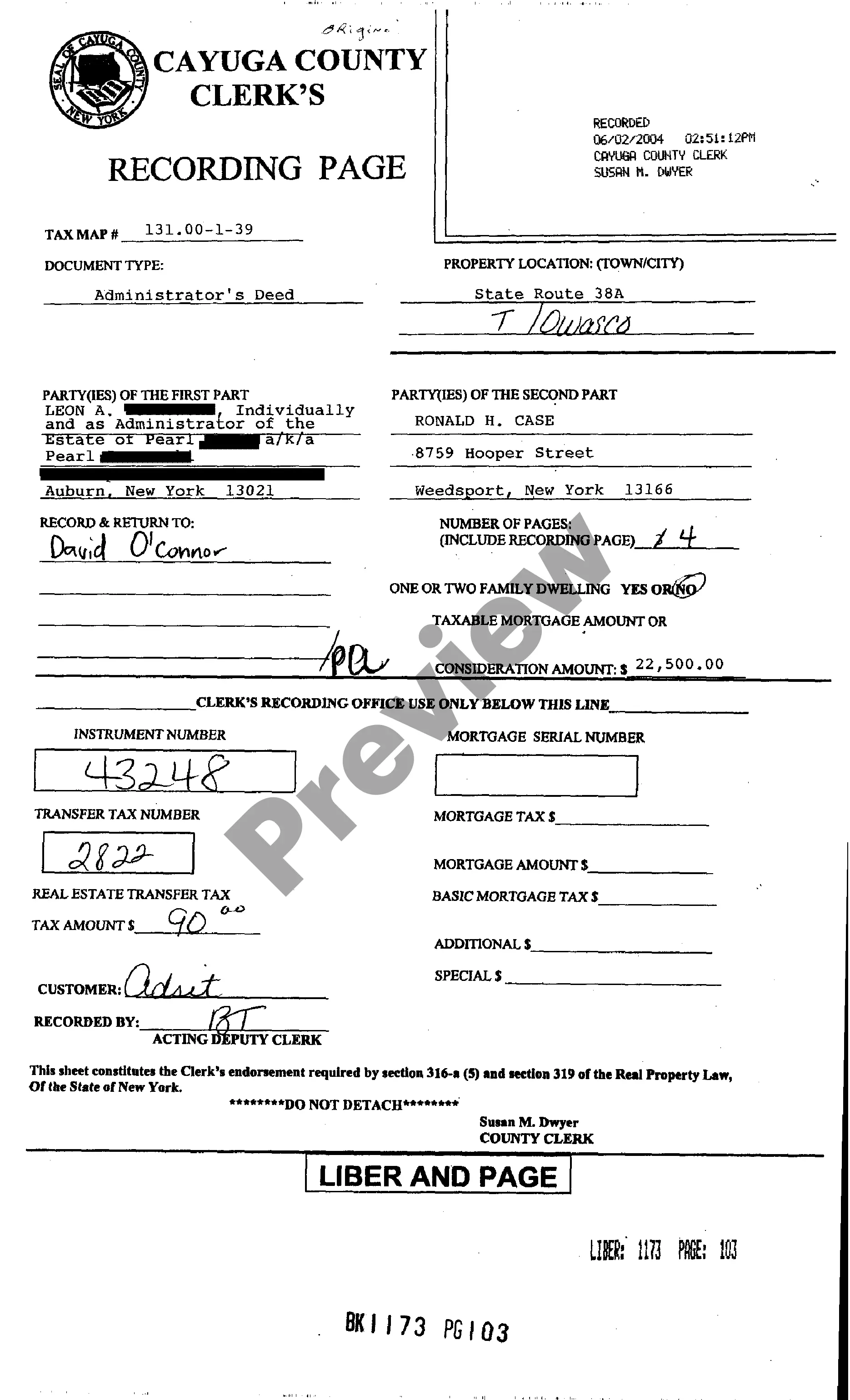

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secure Debt Shall Forget The Day Lyrics In Texas

Description

Form popularity

FAQ

Credit attorney here. As long as it's 7 years or less since you went delinquent on the original debt, and amount you owe is correctly listed, it's legal for the debt to appear on credit report. The negative impact will fade over time.

Texas law gives someone 4 years to bring a lawsuit for unpaid debt. This time period is commonly referred to as the statute of limitations. Once the time period is up, a person is prohibited from filing suit to recover the debt. This means the debt is time-barred.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The 11-word phrase often cited to stop debt collectors is: ``I do not acknowledge this debt and request verification of it.'' This phrase requests that the debt collector provide verification of the debt, which they are legally obligated to do under the Fair Debt Collection Practices Act (FDCPA) in the United States.

The statute of limitations on debt in Texas is four years.

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

A debt collector cannot lie or use deceptive practices to collect a debt. They cannot falsely claim to be attorneys or government representatives, misrepresent the amount you owe, falsely claim you've committed a crime or threaten legal action they cannot or do not intend to take.

Once wages are deposited into a bank account, the funds can be frozen and possibly seized. In order to do this, a debt collector must have won the lawsuit and had an order issued by the court. This can be confusing because the order is called a "writ of garnishment" but it still cannot be used to take incoming wages.

8 things debt collectors can't do Contacting you at inconvenient times. Harassing or abusing you. Making false or misleading statements. Contacting you after you've requested they stop. Discussing your debt with third parties. Threatening illegal actions. Failing to provide debt verification.

The statute of limitations on debt in Texas is four years.