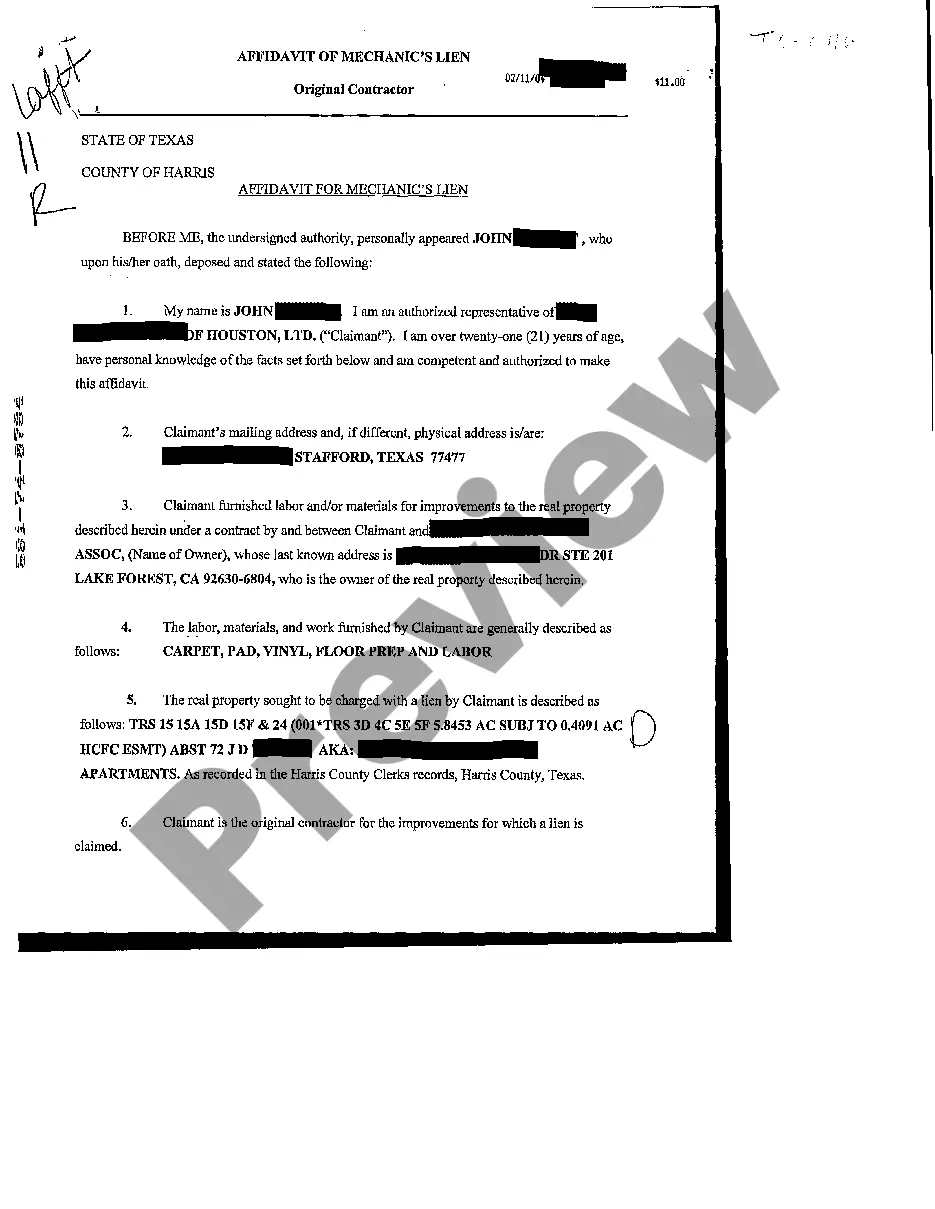

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Bad Credit In Texas

Description

Form popularity

FAQ

You enroll through a credit counseling agency. The agency will work with your creditors to reduce or eliminate interest and work out a payment schedule. Qualifying Texans can get out of debt in 36-60 payments, on average. Another option for Texas residents is debt settlement.

Debt settlement programs are a type of debt relief service. At the start of the program, a debt relief expert will typically analyze your debts and financial position. Using this information, the expert will create an affordable, effective payment plan.

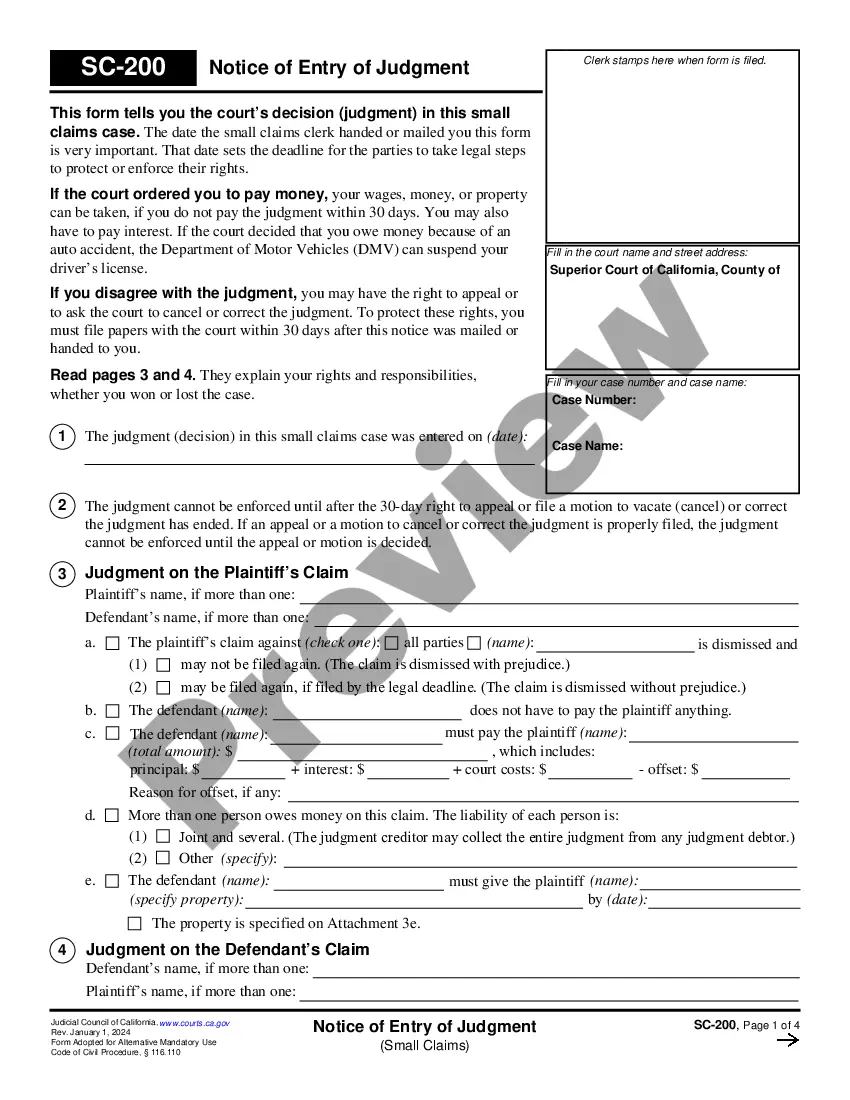

Texas law gives someone 4 years to bring a lawsuit for unpaid debt. This time period is commonly referred to as the statute of limitations. Once the time period is up, a person is prohibited from filing suit to recover the debt. This means the debt is time-barred.

Texas does not have a state-sponsored debt relief program. However, there are accredited organizations and programs available to help residents tackle their debt.

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

Unsecured debt can take the form of things like traditional credit cards, personal loans, student loans and medical bills.

Secured debt - A debt that is backed by real or personal property is a “secured” debt. A creditor whose debt is “secured” has a legal right to take the property as full or partial satisfaction of the debt. For example, most homes are burdened by a “secured debt”.

Texas law gives someone 4 years to bring a lawsuit for unpaid debt.