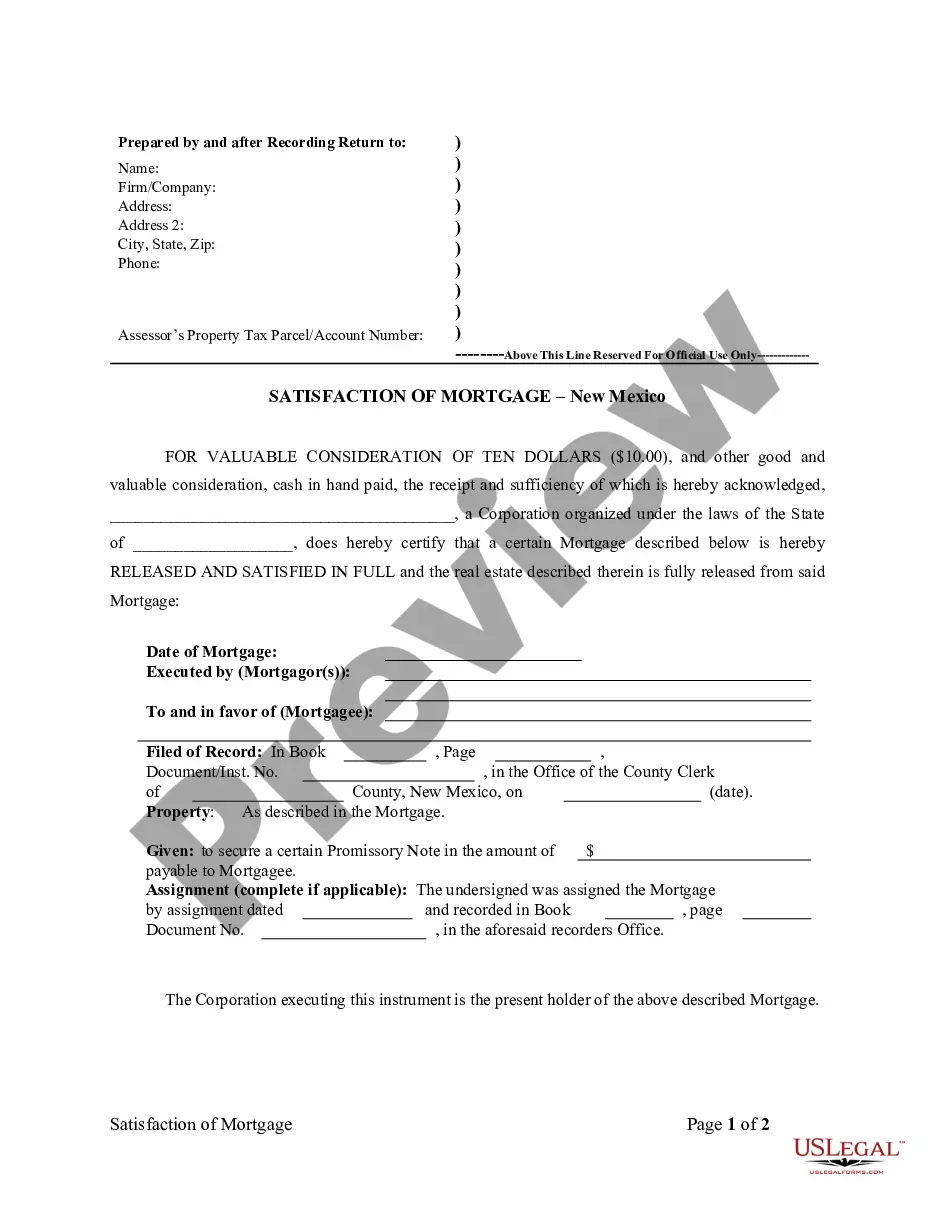

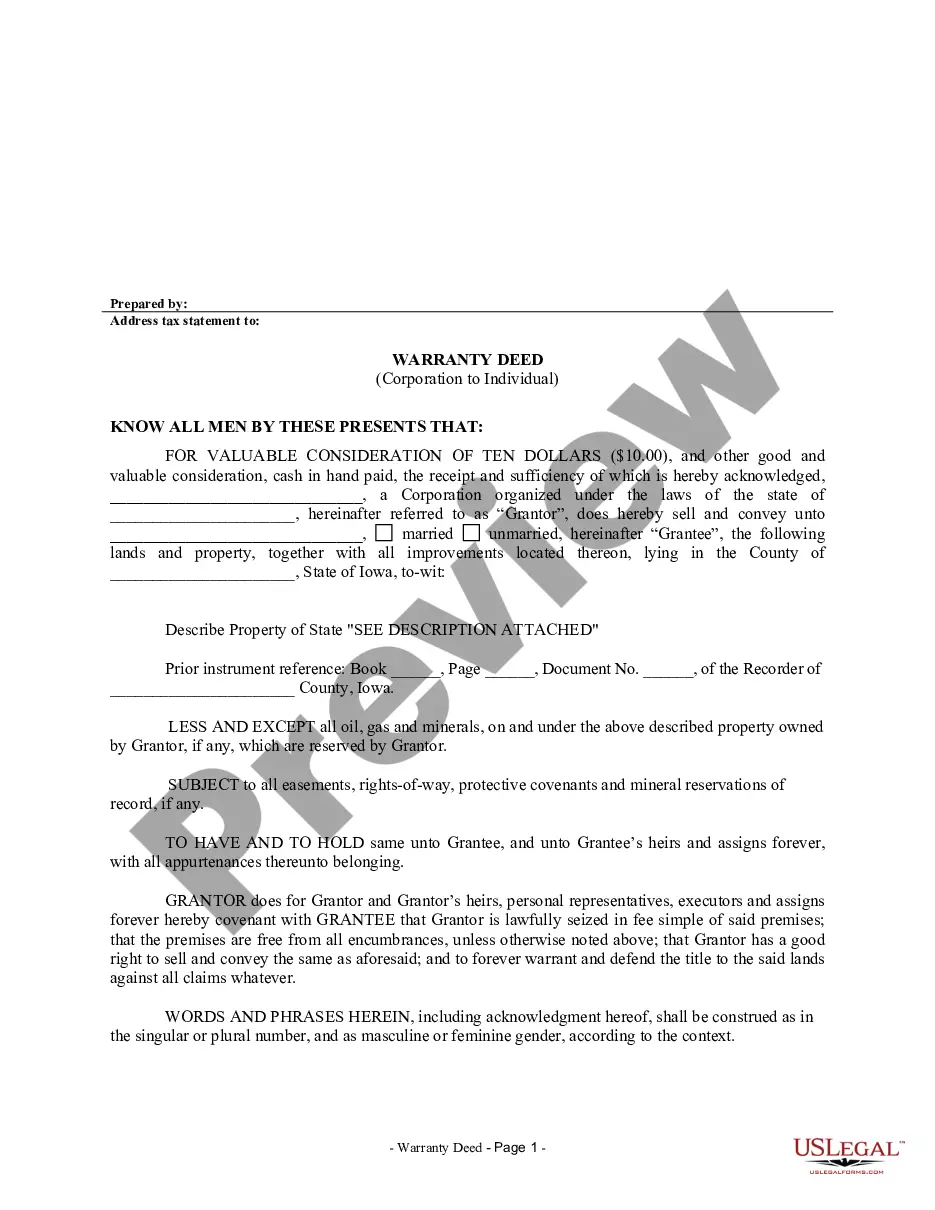

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Bad Credit In Virginia

Description

Form popularity

FAQ

Virginia does not have a state-sponsored debt relief program. However, there are accredited organizations and programs available to help residents tackle their debt.

Strategies like debt management plans, alternative consolidation loans and even debt settlement programs provide relief tailored to those with low credit scores. While each option has its pros and cons, the key is to choose the one that aligns with your financial situation and long-term goals.

If your credit score is lower than 670, debt consolidation may not be a good option for you. Consolidating debt when you have bad credit can be challenging.

Lenders apply debt forgiveness in several ways, including through directly negotiated settlements or government programs. You can also approach industry professionals such as debt counselors to assist with repayment plans. However, it's important to keep in mind that debt forgiveness is relatively rare.

Virginia's fair debt collection law makes it a crime for debt collectors to send documents simulating legal process. The federal Fair Debt Collection Practices Act (FDCPA) (15 U.S.C. § 1692 and following) regulates debt collectors. The FDCPA protects consumers from unfair and deceptive debt collection practices.

National Debt Relief is generally able to negotiate a settlement for 46% of an average client's starting debt, ing to the company, dropping down to 25% after the company takes its fees. However, NDR doesn't provide any information about how many people drop out before they reach the end.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.