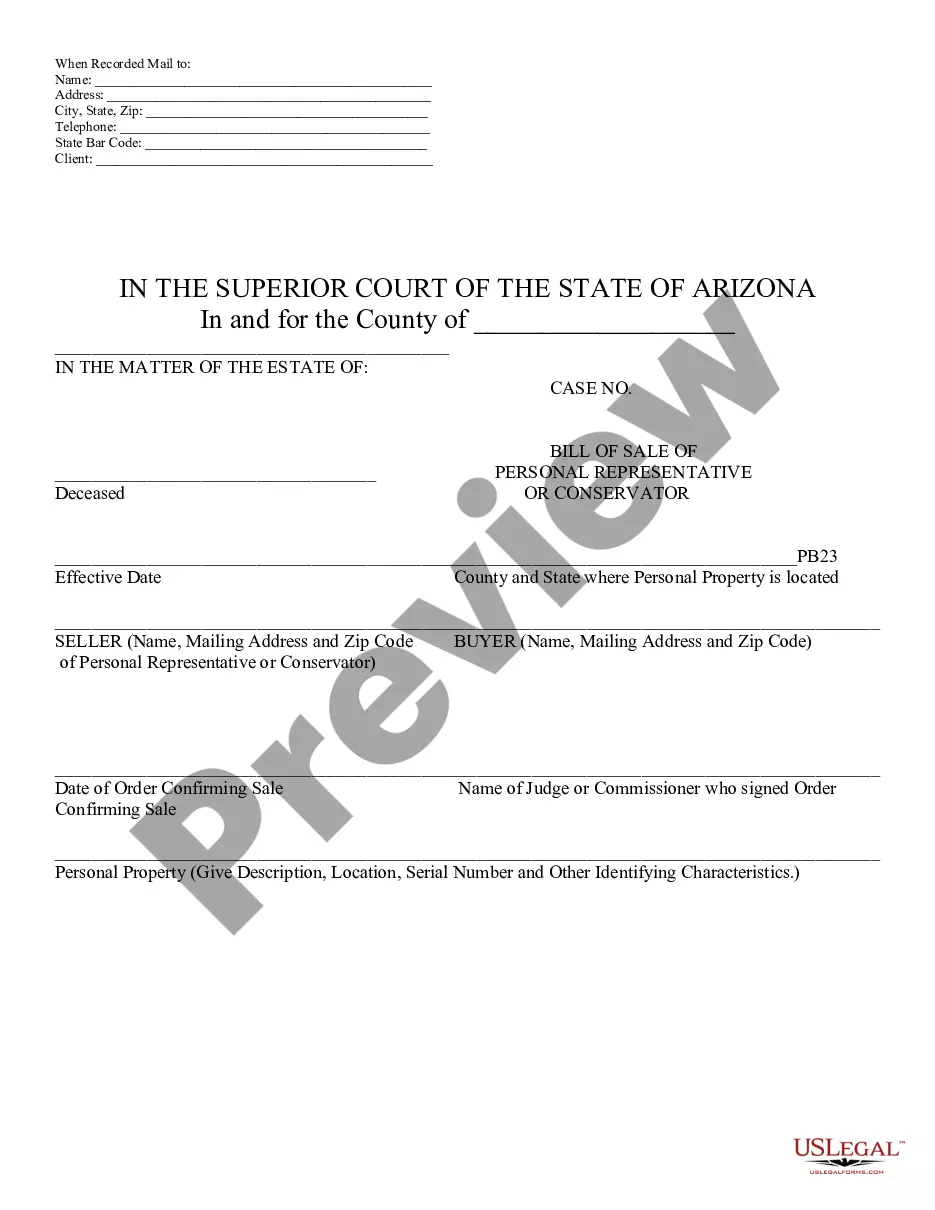

Debtor is obligated to pay the secured party attorneys fees. In consideration of the indebtedness, debtor conveys and warrants to trustee certain property described in the land deed of trust.

Secured Debt Any For Bad Credit In Wake

Description

Form popularity

FAQ

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit score may rise. However, your score may start rebounding sooner if you are otherwise using credit responsibly.

Be sure to have your bank routing number and account number handy when you apply. There's no credit score required to apply for a Discover it®️ Secured Credit Card.

You may be denied a secured credit card for various reasons, including a lack of credit history, low credit score or no verifiable income. If you've been denied a secured credit card, working toward increasing your credit score can help improve your chances of approval if and when you decide to reapply.

If you can't or don't want to keep paying the secured debt, you have the option to surrender the collateral. This means you give the property back to the lender, and you're no longer responsible for the debt.

Take Inventory of What You Owe. Make a Budget. Avoid New Debt. Use a Debt Repayment Strategy. Reach Out to a Credit Counselor. Consider Debt Relief. Look Into Other Financial Assistance Programs.

In short, no. The 7-year rule means that each negative remark remains on your report for 7 years (possibly more depending on the remark). However, after that period has ended, a remark will most probably fall off of your report.

Although the unpaid debt will go on your credit report and have a negative impact on your score, the good news is that it won't last forever. After seven years, unpaid credit card debt falls off your credit report. The debt doesn't vanish completely, but it'll no longer impact your credit score.