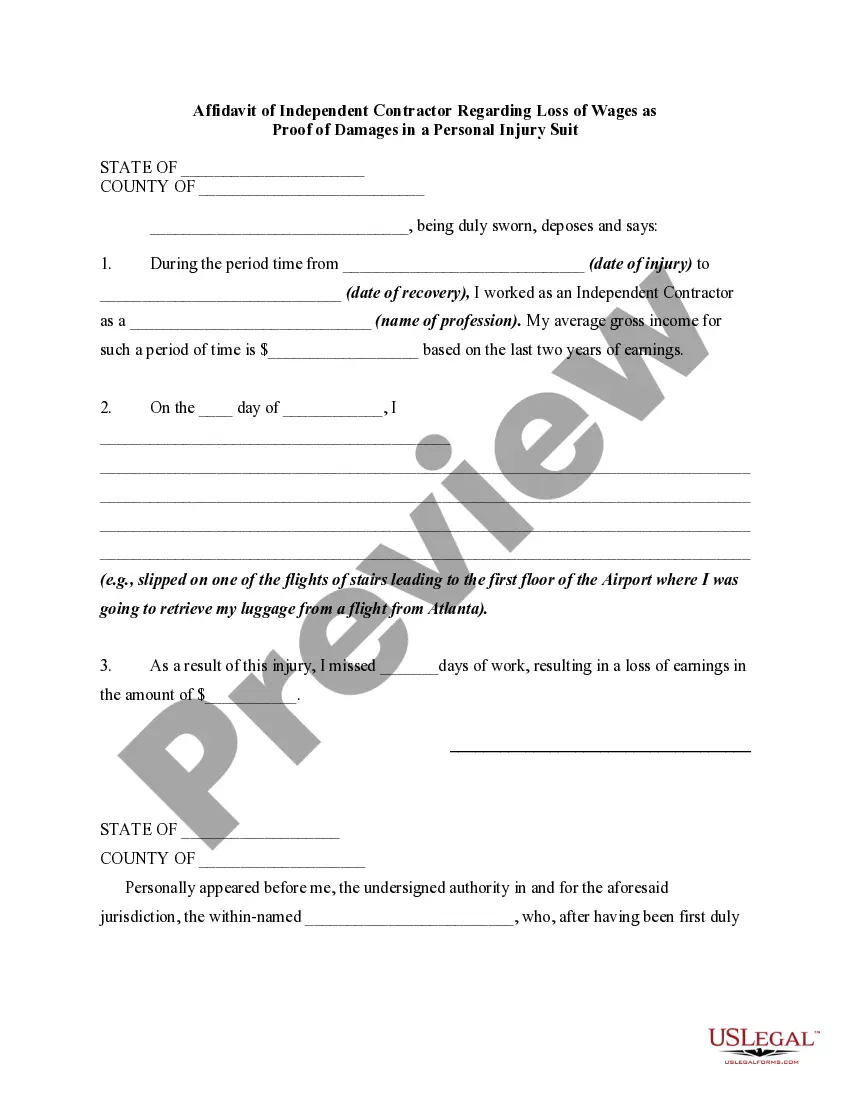

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed In Trust Vs Deed Of Trust In Arizona

Description

Form popularity

FAQ

One disadvantage of placing your house in a trust is the loss of direct ownership. Transferring your property to a revocable living trust makes the trust the legal owner. While you retain control as the trustee, this change in ownership may affect your ability to mortgage or refinance the property.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Assets can be transferred to a trust through methods like a deed of grantor(s) to trustee(s), title transfer, assignment of ownership, opening new accounts, naming the trust as a beneficiary, and more. Putting property in a trust can be done through various legal means, providing flexibility to the grantor.

In general, Arizona property will involve three types of deeds: 1) a warranty deed, 2) a special warranty deed, and 3) a quit claim deed.? The main differences between them are the guarantees made by the seller regarding the title to the property.

"Trust deed" or "deed of trust" means a deed executed in conformity with this chapter and conveying trust property to a trustee or trustees qualified under section 33-803 to secure the performance of a contract or contracts, other than a trust deed which encumbers in whole or in part trust property located in Arizona ...

In many states, lenders use conventional mortgages as the primary security document for the underlying property during a real estate transaction. However, if you are buying a home in Arizona, you are likely to use a Deed of Trust as security for the property.

A deed of trust is drawn up by joint buyers if they want to divide the ownership of a property in a way that is not a simple 50/50 split. It is a legal agreement that reflects each owner's financial contribution, and offers security to joint owners of a property if their circumstances change.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.