Deed Of Trust Without Promissory Note In Bronx

Description

Form popularity

FAQ

Both a deed of trust and a promissory note might outline similar information, but they are separate documents that are signed for the benefit of different parties. In a deed of trust, there are three parties involved: the lender, the borrower, and the third-party trustee.

In a deed of trust, the borrower (trustor) transfers the Property, in trust, to an independent third party (trustee) who holds conditional title on behalf of the lender or note holder (beneficiary) for the purpose of exercising the following powers: (1) to reconvey the deed of trust once the borrower satisfies all ...

Who holds the mortgage note? As the borrower, you'll receive a copy of your mortgage note at closing, not the original. The original mortgage note is held by your mortgage lender or servicer until (or unless) the lender sells it on the secondary market. Most lenders do this relatively quickly after closing.

Example: When used in a real estate transaction, the promissory note covers the promise to repay the amount owed, interest, and maturity date — while the deed of trust or mortgage outlines the other responsibilities of the parties involved more precisely.

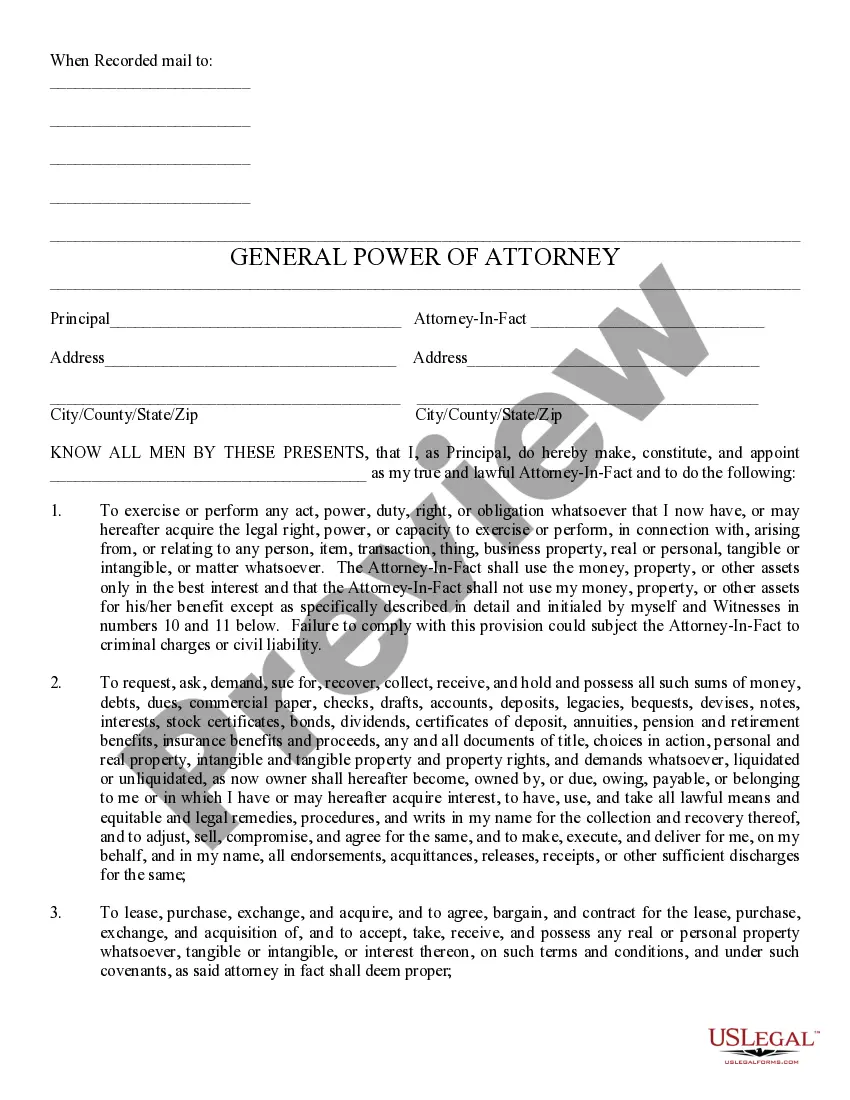

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Yes, you can make your own Grant Deed. A lawyer is not required to prepare a valid and enforceable deed.

How To Get a Property Deed – Step by Step Step 1: Get a Deed Form. Obtain a property deed form at the recorder office of your local county, a law library, or an office supply store. Step 2: Legally Describe the Property. Step 3: Identify the Parties Involved. Step 4: Date and Signature. Step 5: File the Property Deed.

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

May I make out my own deed? Yes you may, however, we always recommend consulting an attorney regarding property transfers and changes, because minor changes in the wording of the document can completely change the legal meaning of the document.