Deed Of Trust Without Promissory Note In California

Description

Form popularity

FAQ

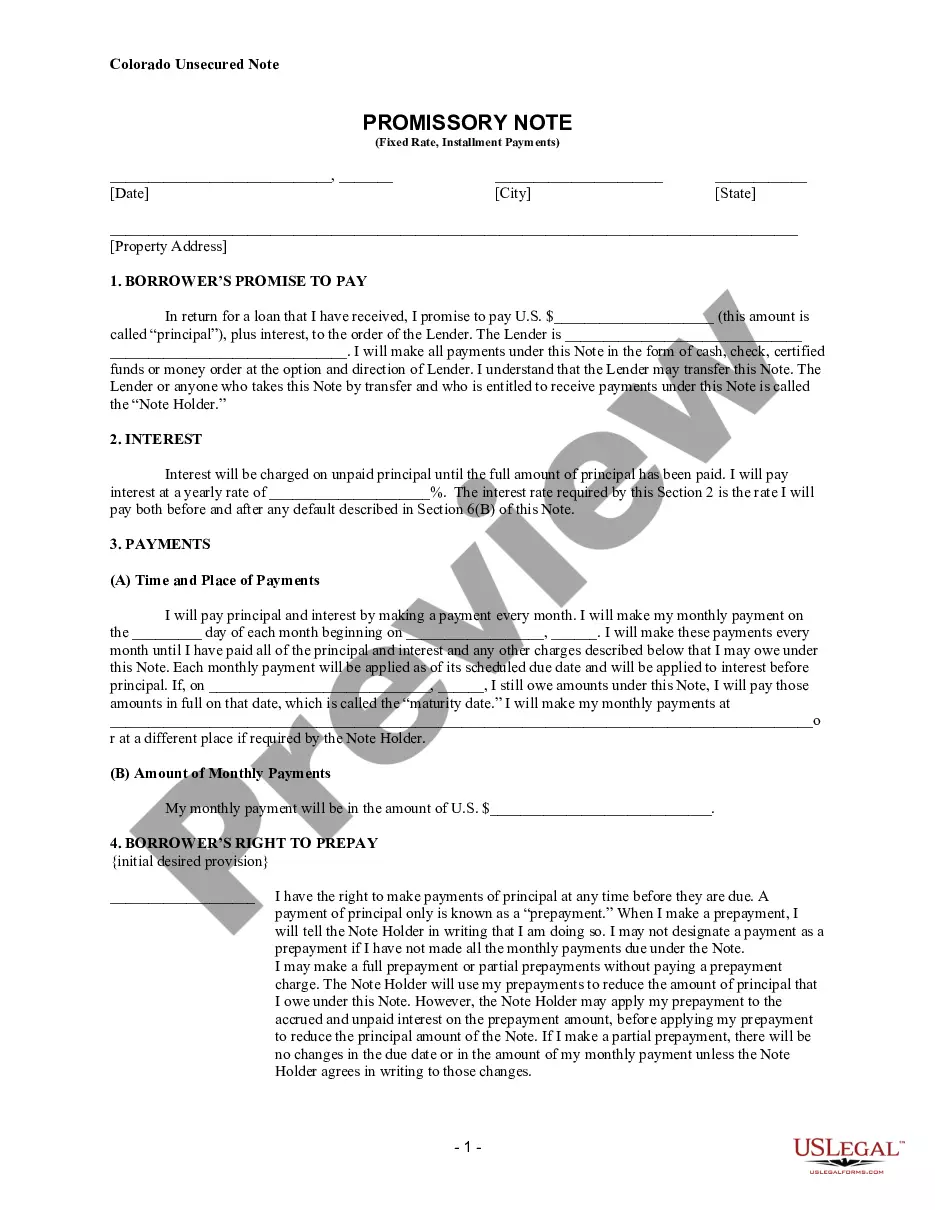

Example: When used in a real estate transaction, the promissory note covers the promise to repay the amount owed, interest, and maturity date — while the deed of trust or mortgage outlines the other responsibilities of the parties involved more precisely.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

At its most basic, a promissory note is simply a contract. As such, it needs to have certain sections to ensure all parties are fully protected and treated fairly. Common sections of a promissory note include: Contact information for the borrower and the lender.

Record the Signed Documents at the County Recorder's Office Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder's Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864.

It must: Be in writing. Have an amount which matches the amount on the Note(s) Have a date which matches the date on the Note(s) Have a complete legal description of the property(s) being encumbered (street address only is not sufficient)

You can cancel your deed of trust by getting a deed of surrender in place. This is a legal document which can be used to waive a previous deed or contract between multiple parties. You can't cancel a deed of trust without the consent of all parties named within the deed.

Basic Requirements of a Trust California statutes dictate a set criterion for valid trusts. Breaching any of the following can lead to the trust being deemed invalid: Intent. Mental capacity, meaning they should be legally sane and over 18.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.