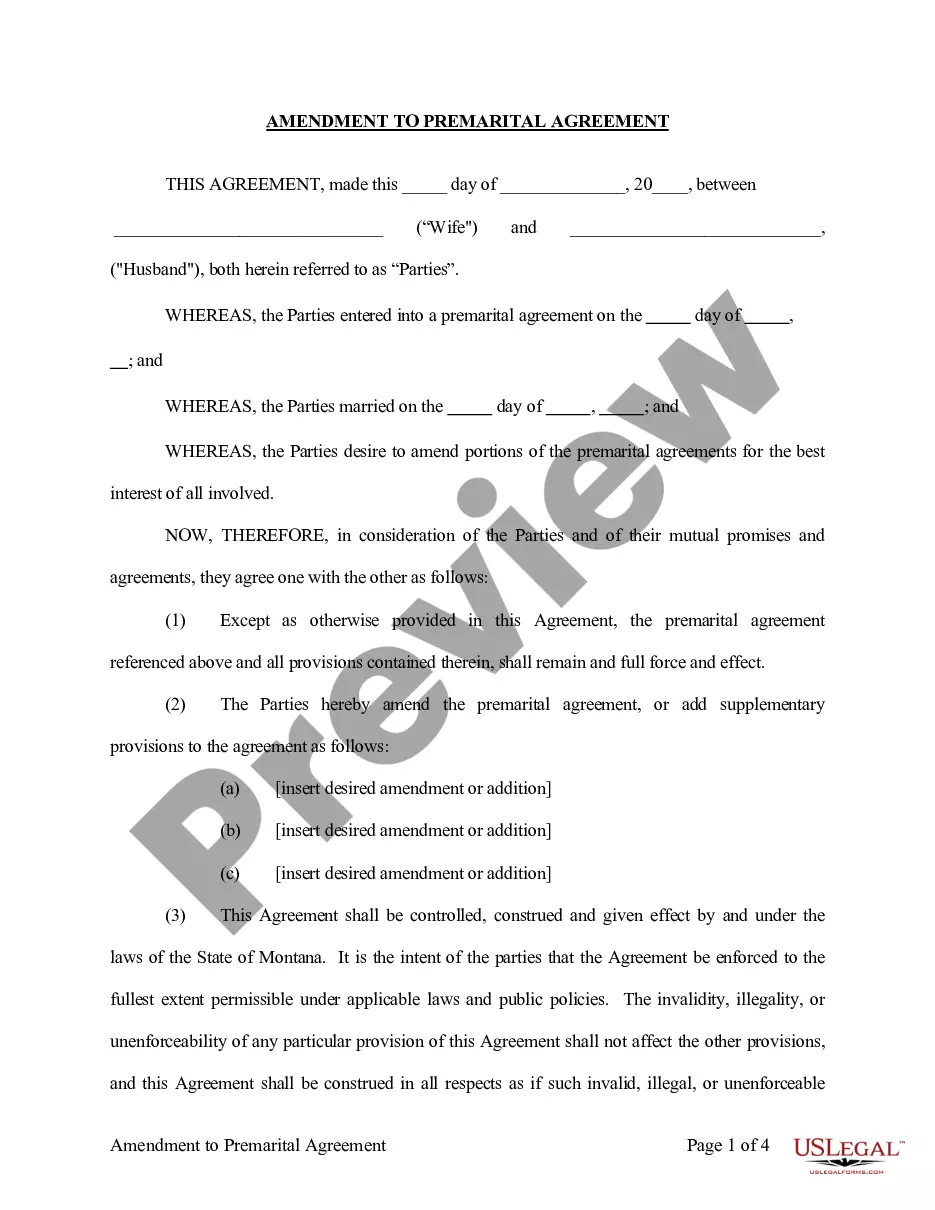

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Someone You Hurt In Chicago

Description

Form popularity

FAQ

You must file either (1) Form PTAX-203 and any required documents with the deed or trust document or (2) an exemption notation on the original deed or trust document at the County Recorder's office within the county where the property is located.

Amending a trust deed is process that should be treated as requiring careful planning, consideration and intentionality. Indeed, unintended (and undesirable) consequences can flow from a purported trust amendment that has been undertaken with such consideration, such as a resettlement of the trust.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another.

In California, you can modify your living trust to reflect changes in your life circumstances or wishes. To amend a living trust in California, you'll need to create a written amendment document that clearly states the changes you want to make to your trust.

All beneficiaries must sign a written consent form to transfer assets from a trust that does not allow modifications. You will need to create the new trust first, then request the court to allow the asset transfer and the termination of the old trust.

There are many good reasons why trustees might transfer assets from one trust to another of the family's trusts. They might want to separate the diverging interests of different family members.

Beneficiaries can make changes without heading to court in some situations. If the beneficiaries consent, then the trust can be modified or terminated. However, all beneficiaries must agree to this course of action. If there are disputes, the Illinois courts may need to become involved.