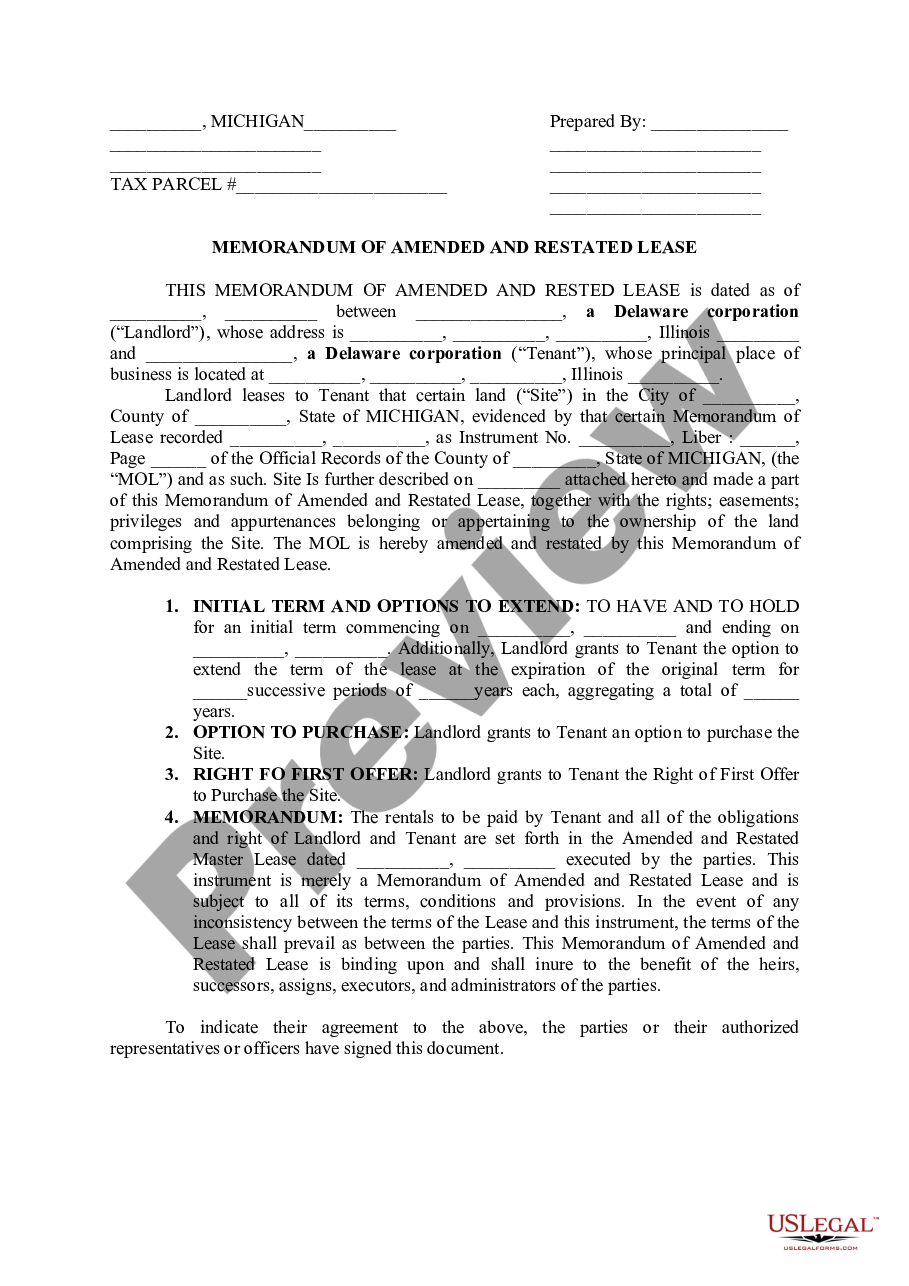

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deeds Of Trust In Arizona In Chicago

Description

Form popularity

FAQ

The grantor, or the current property owner, must sign the deed in the presence of a notary public. The grantor must also formally transfer the property from their name to the trust's name. This step solidifies the legal transfer and ensures that the living trust holds the property.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Arizona is a Mortgage state and Deed of Trust state.

In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

The grantor, or the current property owner, must sign the deed in the presence of a notary public. The grantor must also formally transfer the property from their name to the trust's name. This step solidifies the legal transfer and ensures that the living trust holds the property.