Deed Of Trust For Form 17 In Clark

Description

Form popularity

FAQ

Sellers must fill out either an unimproved or improved residential real estate disclosure form, which covers various topics about the property's condition. This comprehensive form asks about the state of the home's electrical, plumbing, heating and other systems.

What You Need to Know about the Washington State Seller Property Disclosure – Form 17. Washington State requires sellers of residential real property to thoroughly disclose material facts on a form called the Residential Real Property Disclosure Statement (often referred to as Form 17).

In most states, by law, you have to disclose any issues with the property. By not disclosing, you open yourself up to lawsuit.

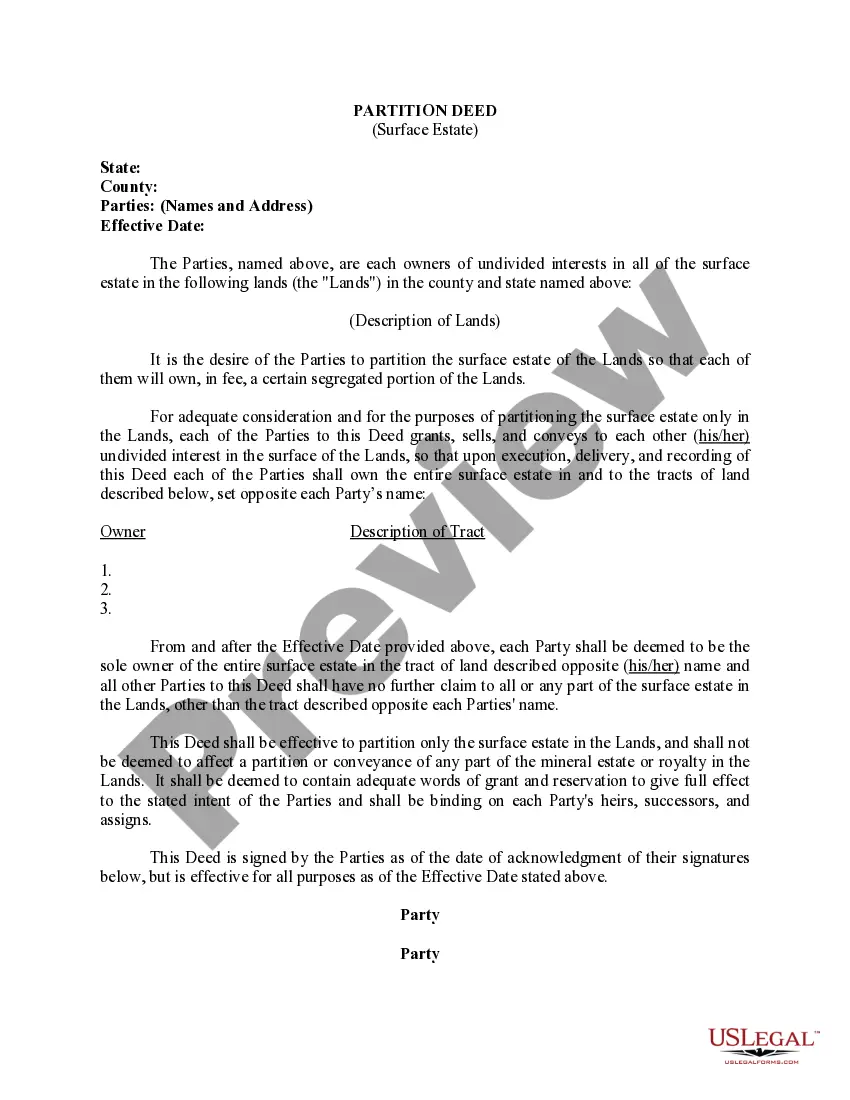

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

Assignments of a beneficial interest must be in writing and signed by the person assigning the beneficial interest i.e. Assignor. No consideration is necessary for an assignment of the beneficial interest, but if no consideration is payable then the assignment should be documented by a deed.

The seller disclosure statement, also known as a seller disclosure form or Form-17 is a crucial document that sellers must complete when selling their home. Its purpose is to provide potential buyers with information about the condition of the property and any known issues or defects.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Can I prepare my own beneficiary deed in Missouri? A Beneficiary Deed must be signed by the Grantor in the presence of a Notary Public and then properly recorded with the local County Recorder of Deeds office (where the real property is located).