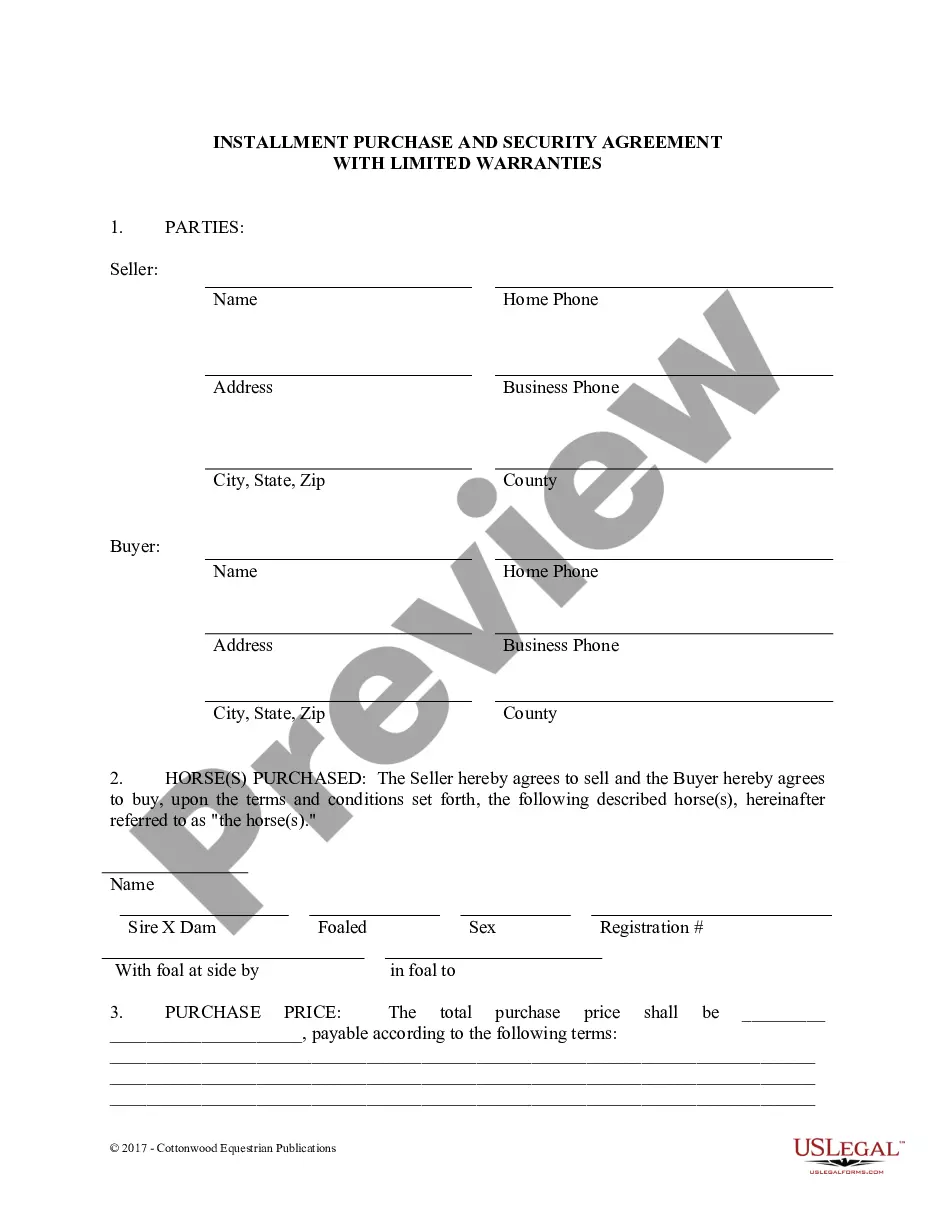

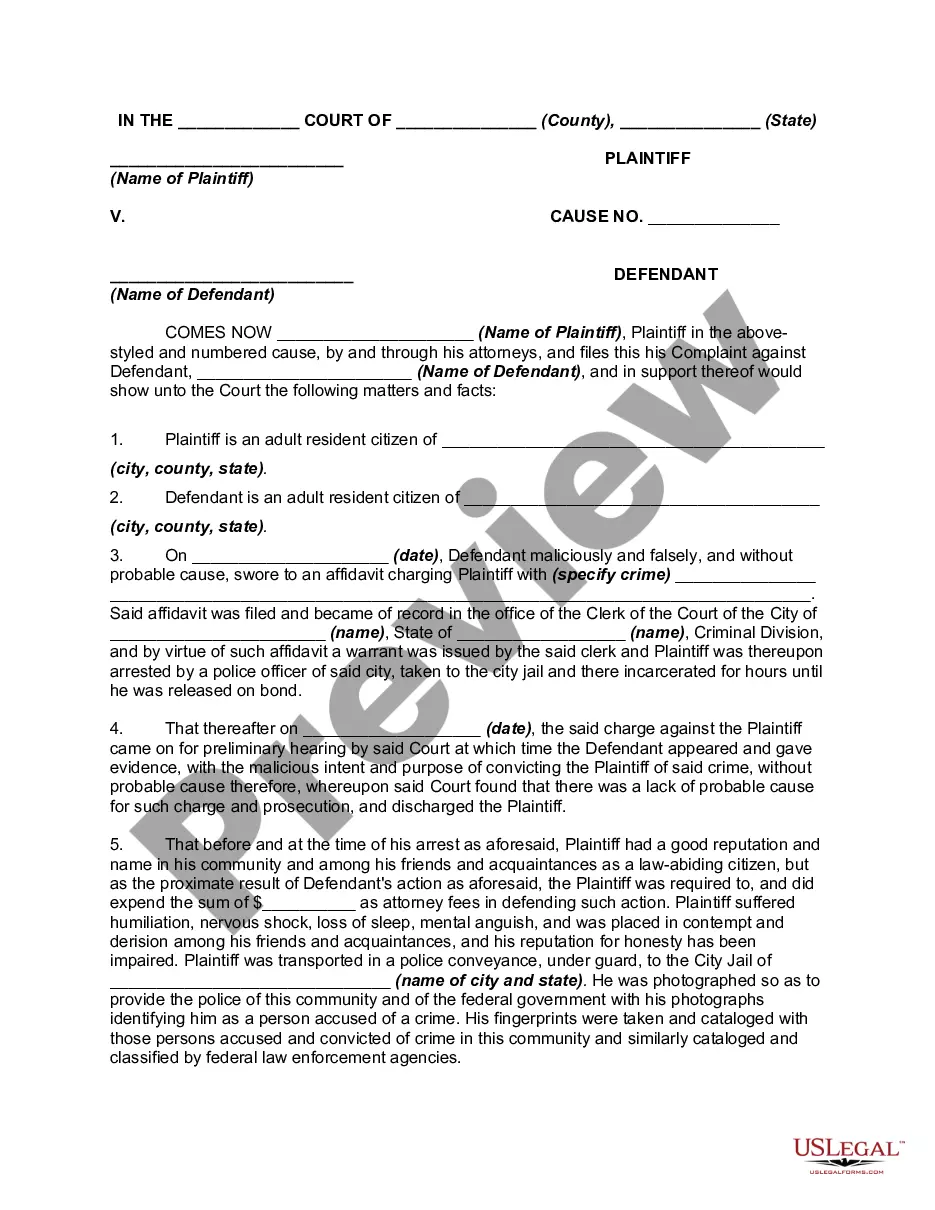

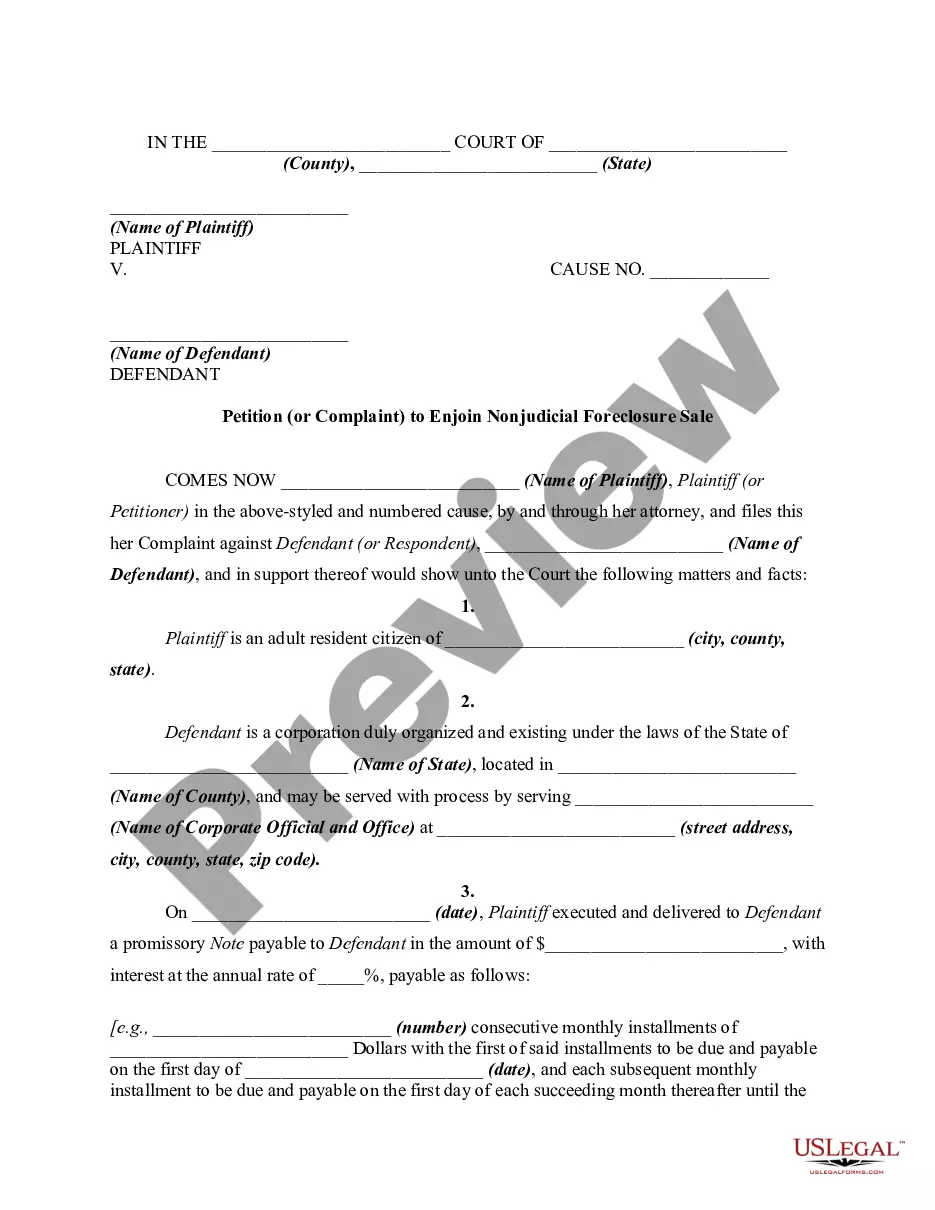

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed To Trust In Cook

Description

Form popularity

FAQ

What Are the Disadvantages of Putting Your House in a Trust in California? Putting a home, or any real estate, into a trust can be costly. The process can also take time, even with the help of an experienced attorney. If the home is in a trust, it can also make refinancing and changing your mortgage much harder.

Trust Information Form. This document includes the desired name of the trust, settlor and trust beneficiaries. Deed of Indemnity. Nearly 100% of people who set up Cook Islands Trusts are either in lawsuits or anticipate them. Letter of Wishes. Sworn Affidavit of Solvency. Other Documents Needed. Trust + LLC.

Parents and other family members who want to pass on assets during their lifetimes may be tempted to gift the assets. Although setting up an irrevocable trust lacks the simplicity of giving a gift, it may be a better way to preserve assets for the future.

Rich people frequently place their homes and other financial assets in trusts to reduce taxes and give their wealth to their beneficiaries. They may also do this to protect their property from divorce proceedings and frivolous lawsuits.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Five Reasons To Establish A Cook Islands Trust Foreign judgements are not recognized in Cook Islands courts. Succession planning advantages. Tax benefits. Protection for a variety of asset classes. Exposure to global financial centers.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

A Cook Islands International Trust is tax neutral in that it is not subject to any form of Cook Islands taxation.

Legitimate Uses in Asset Protection and Wealth Management Cook Islands Trusts are reputable financial vehicles for preserving and growing wealth for high-net-worth individuals and those working in high-risk professions, like business owners, real estate investors, or doctors.