Deed Of Trust Records With Alcohol In Cook

Description

Form popularity

FAQ

Office this office keeps public records of real estate transactions. You can visit the countyMoreOffice this office keeps public records of real estate transactions. You can visit the county recorder's office in person provide the property address and the owner's name to request the document.

You'll find most California property deeds at the County Clerk's office, also called the Registrar/Recorder office. Some of them provide online searches. Others require visiting their offices. For example, the San Diego County Clerk's Office provides online searches.

In a deed of trust, the borrower (trustor) transfers the Property, in trust, to an independent third party (trustee) who holds conditional title on behalf of the lender or note holder (beneficiary) for the purpose of exercising the following powers: (1) to reconvey the deed of trust once the borrower satisfies all ...

Record the Signed Documents at the County Recorder's Office Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder's Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864.

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or “Zero Stamps” if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known ...

So, who is responsible for recording a property deed? This responsibility typically lies with your title or escrow agent. They will “record” the deed by filling out and filing your original deed in the appropriate government office in your local county.

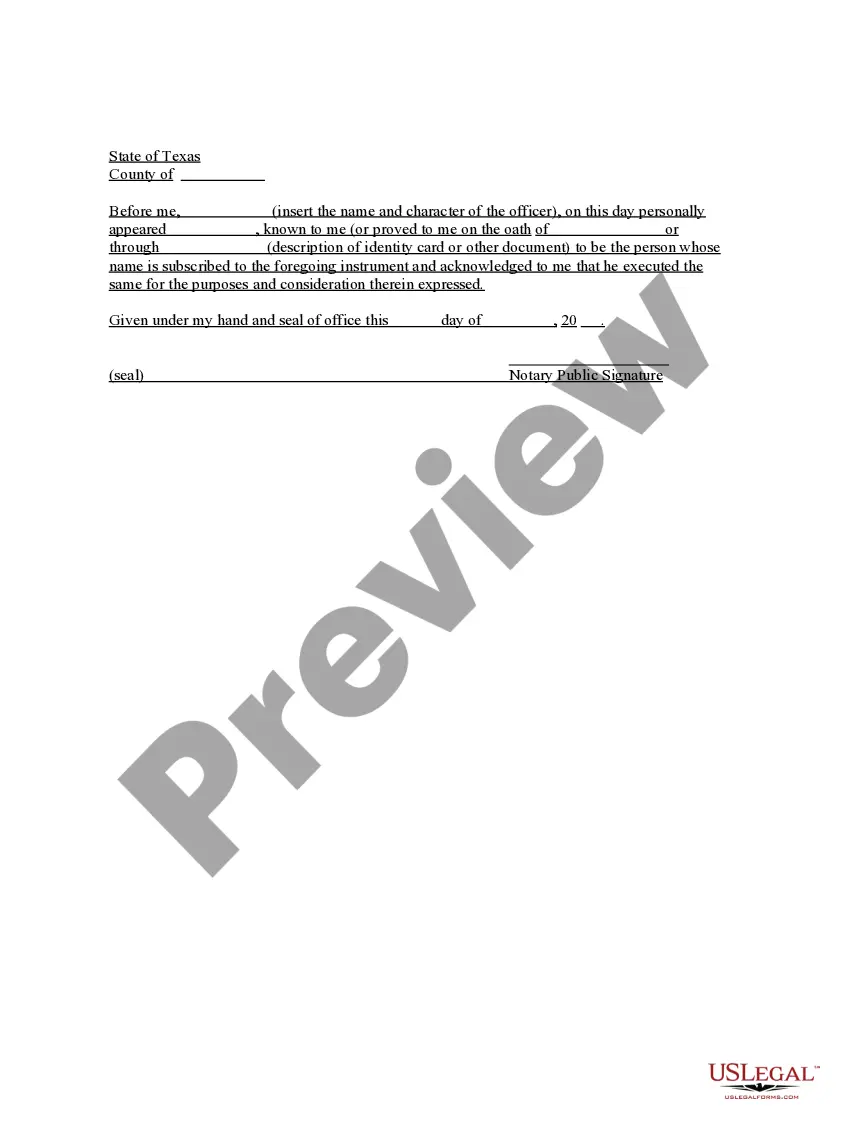

The County Clerk as Recorder of Deeds/Official Public Records: Texas Government Code, Local Government Code, Property Code, Uniform Commercial Code, Civil Practice and Remedies Code, Business and Commercial Code.

In California: “An unrecorded instrument is valid as between the parties thereto and those who have notice thereof.”

The answer is the buyer. Who typically pays for recording fees to record the deed and deed of trust? The answer is the buyer.