This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With No Maturity Date In Dallas

Description

Form popularity

FAQ

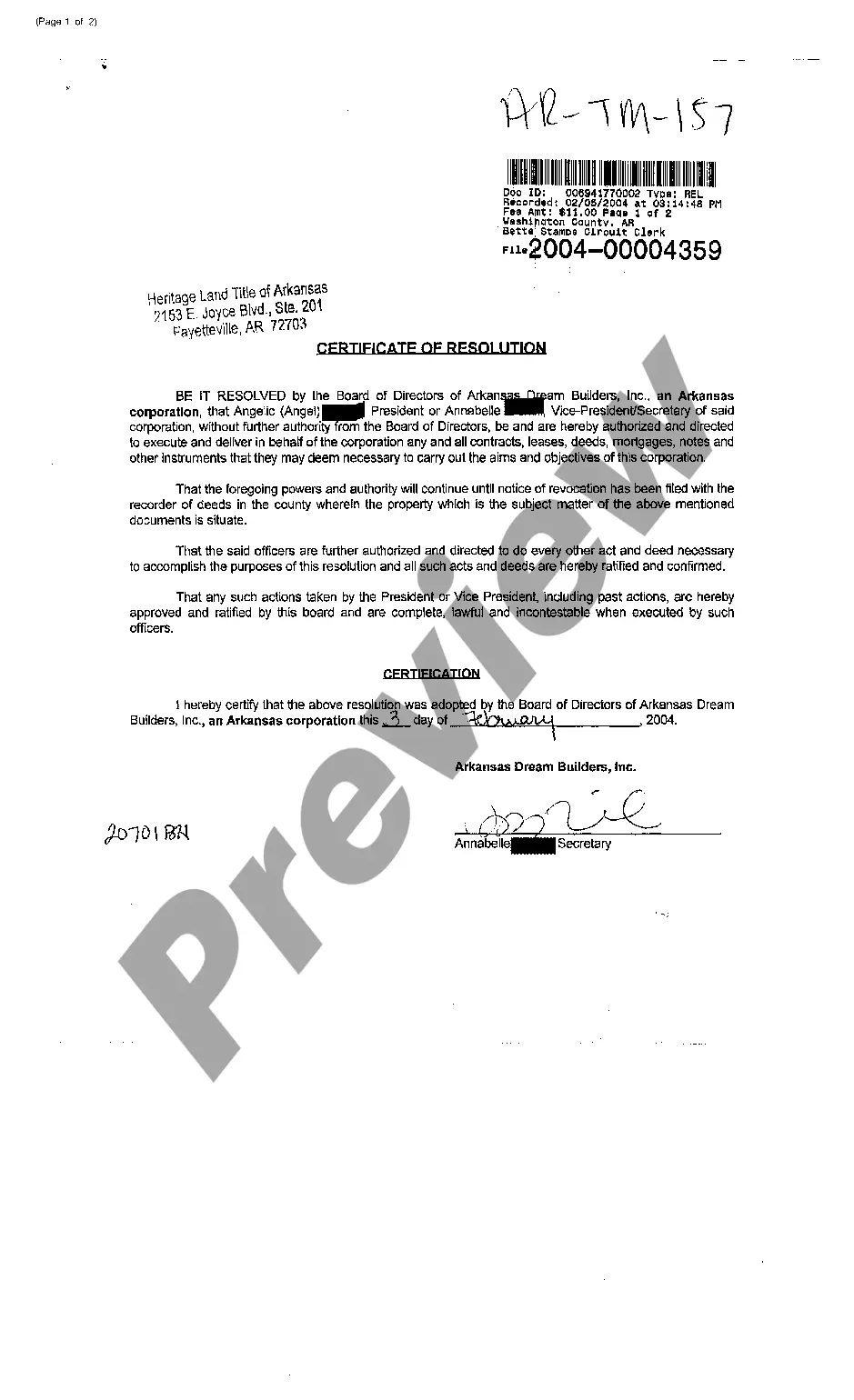

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

If a deed of trust recorded in California does not contain a maturity date, then the lender has up to 60, and possibly even 64 years to foreclose non-judicially, but the longer the lender waits, the more likely it is that a borrower could successfully raise a defense of equitable estoppel or laches.

You do not have to record the deed to make the transfer valid between the parties. However, as described above, the grantee will want to record the deed as soon as possible after receiving delivery.

Texas doesn't require you to record your trust. As long as it's signed, notarized, and properly funded, it's valid.

So, put simply, if your deed was not recorded or you have discovered unrecorded deeds in your chain of title, there is no need to worry. The deeds themselves will still be valid and you can file correction instruments to correct any mistakes.

A trust deed expires and is extinguished from the record: 10 years after the entire debt becomes due; or. 60 years after the trust deed is recorded if the due date cannot be ascertained by records of the transaction.

A trust deed remains on your credit file for six years, a timescale that exceeds the term of most trust deeds which are generally completed in three or four years.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

(b) A sale of real property under a power of sale in a mortgage or deed of trust that creates a real property lien must be made not later than four years after the day the cause of action accrues.